this should help

this should be clear

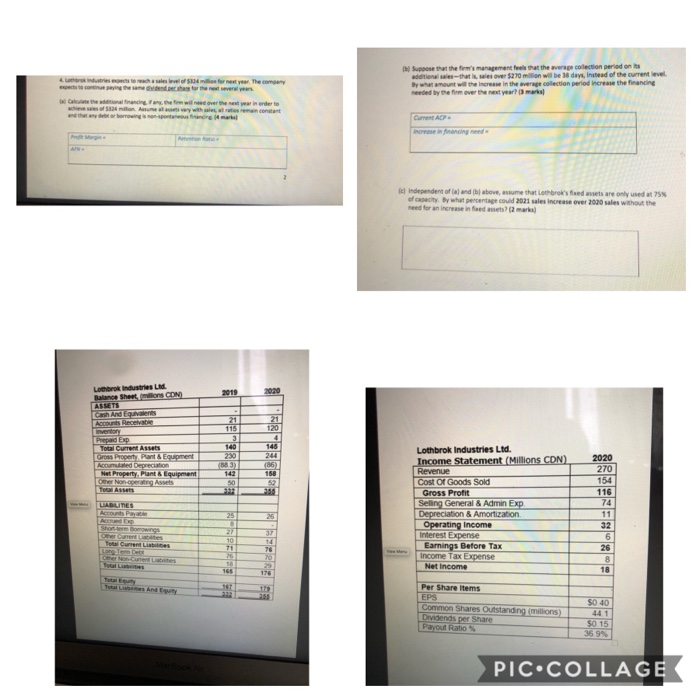

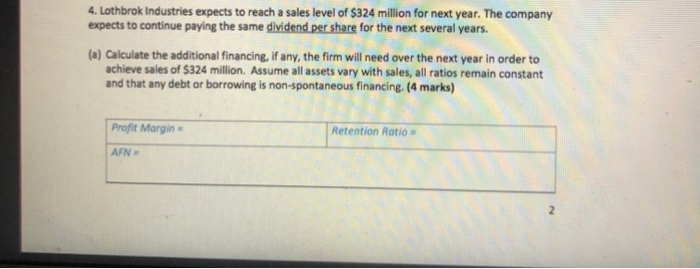

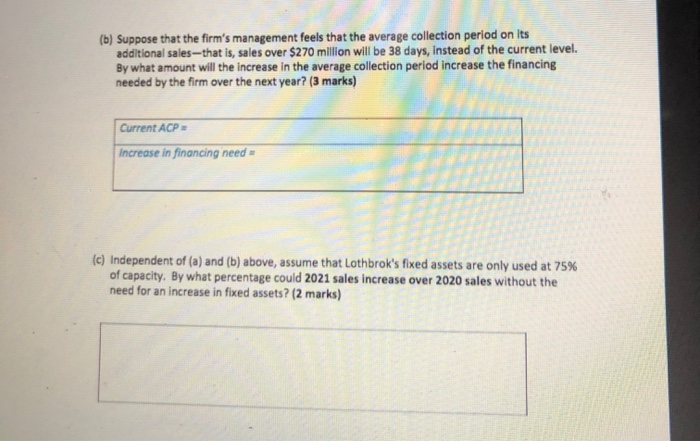

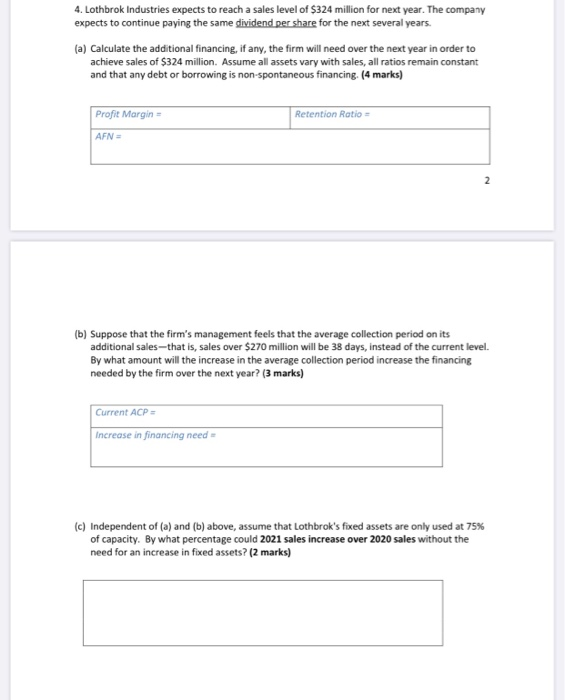

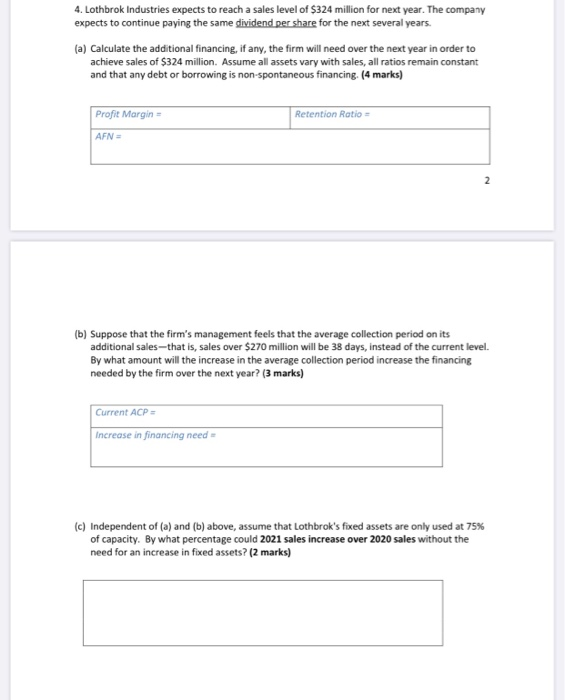

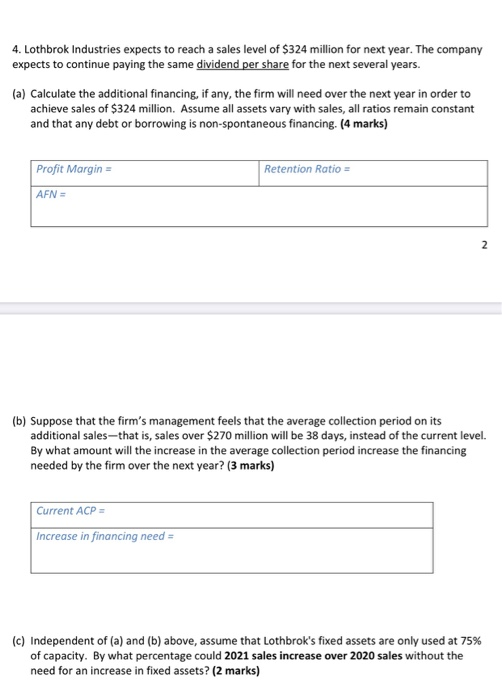

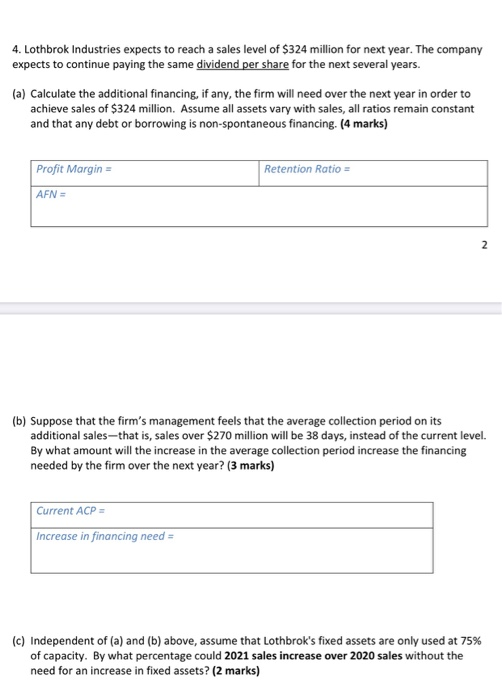

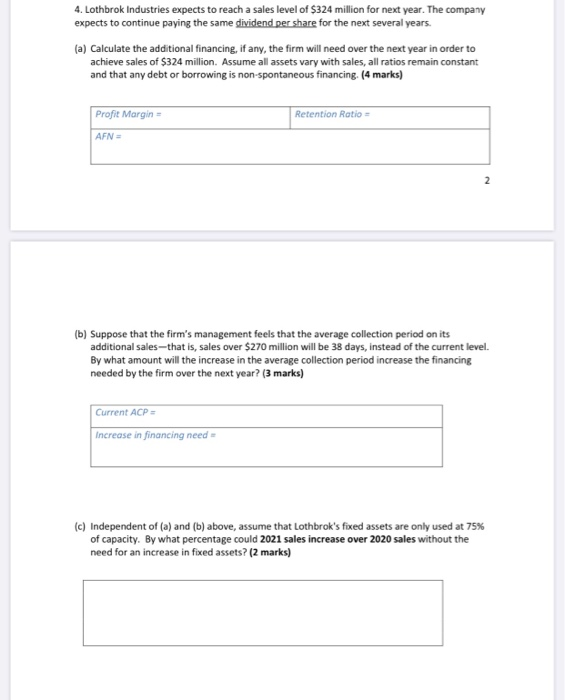

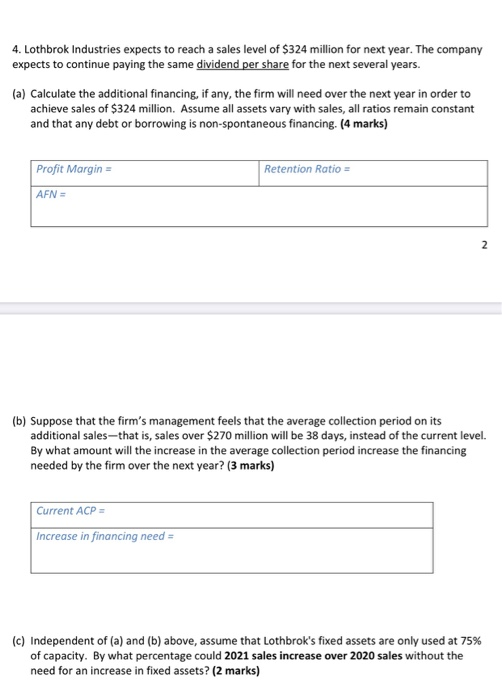

4. tracheomis for next year. The company IN Spoone that the tow's management fees that the average collection perioden additional that is, sales over 5270 milion will be 38 days, instead of the current level by what amount with increase in the werage collection period whereas the financing needed by the form over the next year? Giorning will read over the next year in order to che mit Kuume way the resean constart and that any doborowing Sports and marks Current ACP- Increase infringed Id independent of land above me that Lothbrok's feeds are only used of capacity by what percentage could 2021 sales increase over 2020 sales without the need for an increase in faedast2 marks 2010 2020 Lombok Industries Lid. Balance Sheets CON METS Cash And Equivalent 21 115 3 Inventory Prepaid Exp Total Current Assets Gross PropertPart & Equipment Acumulated Depreciation Net Property. Plant & Equipment Other Non-cer Assets To sets 21 120 4 146 244 (86) 158 (683) 142 50 LIABILITIES Lothbrok Industries Ltd. Income Statement (Millions CDN) Revenue Cost Of Goods Sold Gross Profit Selling General & Admin Exp Depreciation & Amortization Operating Income Interest Expense Earnings Before Tax Income Tax Expense Net Income 25 2020 270 154 116 74 11 32 6 26 8 18 De Current 10 71 37 14 78 165 176 167 Per Share Items EPS Common Shares Outstanding millions Dividends per Share Payout Ratio $0 40 44.1 $0.15 PIC.COLLAGE 4. Lothbrok Industries expects to reach a sales level of $324 million for next year. The company expects to continue paying the same dividend per share for the next several years. (a) Calculate the additional financing, if any, the firm will need over the next year in order to achieve sales of $324 million. Assume all assets vary with sales, all ratios remain constant and that any debt or borrowing is non-spontaneous financing. (4 marks) Profit Margin- Retention Ratio - AFN 2 (b) Suppose that the firm's management feels that the average collection period on its additional sales-that is, sales over $270 million will be 38 days, Instead of the current level. By what amount will the increase in the average collection period increase the financing needed by the firm over the next year? (3 marks) Current ACP Increase in financing need (c) Independent of (a) and (b) above, assume that Lothbrok's fixed assets are only used at 75% of capacity. By what percentage could 2021 sales increase over 2020 sales without the need for an increase in fixed assets? (2 marks) 4. Lothbrok Industries expects to reach a sales level of $324 million for next year. The company expects to continue paying the same dividend per share for the next several years. (a) Calculate the additional financing, if any, the firm will need over the next year in order to achieve sales of $324 million. Assume all assets vary with sales, all ratios remain constant and that any debt or borrowing is non-spontaneous financing. (4 marks) Retention Ratio - Profit Margin- AFN (b) Suppose that the firm's management feels that the average collection period on its additional sales-that is, sales over $270 million will be 38 days, instead of the current level. By what amount will the increase in the average collection period increase the financing needed by the firm over the next year? (3 marks) Current ACP Increase in financing need (c) Independent of (a) and (b) above, assume that Lothbrok's fixed assets are only used at 75% of capacity. By what percentage could 2021 sales increase over 2020 sales without the need for an increase in fixed assets? (2 marks) 4. Lothbrok Industries expects to reach a sales level of $324 million for next year. The company expects to continue paying the same dividend per share for the next several years. (a) Calculate the additional financing, if any, the firm will need over the next year in order to achieve sales of $324 million. Assume all assets vary with sales, all ratios remain constant and that any debt or borrowing is non-spontaneous financing. (4 marks) Profit Margin= Retention Ratio = AFN = 2 (b) Suppose that the firm's management feels that the average collection period on its additional sales-that is, sales over $270 million will be 38 days, instead of the current level. By what amount will the increase in the average collection period increase the financing needed by the firm over the next year? (3 marks) Current ACP = Increase in financing need = (c) Independent of (a) and (b) above, assume that Lothbrok's fixed assets are only used at 75% of capacity. By what percentage could 2021 sales increase over 2020 sales without the need for an increase in fixed assets? (2 marks) 4. tracheomis for next year. The company IN Spoone that the tow's management fees that the average collection perioden additional that is, sales over 5270 milion will be 38 days, instead of the current level by what amount with increase in the werage collection period whereas the financing needed by the form over the next year? Giorning will read over the next year in order to che mit Kuume way the resean constart and that any doborowing Sports and marks Current ACP- Increase infringed Id independent of land above me that Lothbrok's feeds are only used of capacity by what percentage could 2021 sales increase over 2020 sales without the need for an increase in faedast2 marks 2010 2020 Lombok Industries Lid. Balance Sheets CON METS Cash And Equivalent 21 115 3 Inventory Prepaid Exp Total Current Assets Gross PropertPart & Equipment Acumulated Depreciation Net Property. Plant & Equipment Other Non-cer Assets To sets 21 120 4 146 244 (86) 158 (683) 142 50 LIABILITIES Lothbrok Industries Ltd. Income Statement (Millions CDN) Revenue Cost Of Goods Sold Gross Profit Selling General & Admin Exp Depreciation & Amortization Operating Income Interest Expense Earnings Before Tax Income Tax Expense Net Income 25 2020 270 154 116 74 11 32 6 26 8 18 De Current 10 71 37 14 78 165 176 167 Per Share Items EPS Common Shares Outstanding millions Dividends per Share Payout Ratio $0 40 44.1 $0.15 PIC.COLLAGE 4. Lothbrok Industries expects to reach a sales level of $324 million for next year. The company expects to continue paying the same dividend per share for the next several years. (a) Calculate the additional financing, if any, the firm will need over the next year in order to achieve sales of $324 million. Assume all assets vary with sales, all ratios remain constant and that any debt or borrowing is non-spontaneous financing. (4 marks) Profit Margin- Retention Ratio - AFN 2 (b) Suppose that the firm's management feels that the average collection period on its additional sales-that is, sales over $270 million will be 38 days, Instead of the current level. By what amount will the increase in the average collection period increase the financing needed by the firm over the next year? (3 marks) Current ACP Increase in financing need (c) Independent of (a) and (b) above, assume that Lothbrok's fixed assets are only used at 75% of capacity. By what percentage could 2021 sales increase over 2020 sales without the need for an increase in fixed assets? (2 marks) 4. Lothbrok Industries expects to reach a sales level of $324 million for next year. The company expects to continue paying the same dividend per share for the next several years. (a) Calculate the additional financing, if any, the firm will need over the next year in order to achieve sales of $324 million. Assume all assets vary with sales, all ratios remain constant and that any debt or borrowing is non-spontaneous financing. (4 marks) Retention Ratio - Profit Margin- AFN (b) Suppose that the firm's management feels that the average collection period on its additional sales-that is, sales over $270 million will be 38 days, instead of the current level. By what amount will the increase in the average collection period increase the financing needed by the firm over the next year? (3 marks) Current ACP Increase in financing need (c) Independent of (a) and (b) above, assume that Lothbrok's fixed assets are only used at 75% of capacity. By what percentage could 2021 sales increase over 2020 sales without the need for an increase in fixed assets? (2 marks) 4. Lothbrok Industries expects to reach a sales level of $324 million for next year. The company expects to continue paying the same dividend per share for the next several years. (a) Calculate the additional financing, if any, the firm will need over the next year in order to achieve sales of $324 million. Assume all assets vary with sales, all ratios remain constant and that any debt or borrowing is non-spontaneous financing. (4 marks) Profit Margin= Retention Ratio = AFN = 2 (b) Suppose that the firm's management feels that the average collection period on its additional sales-that is, sales over $270 million will be 38 days, instead of the current level. By what amount will the increase in the average collection period increase the financing needed by the firm over the next year? (3 marks) Current ACP = Increase in financing need = (c) Independent of (a) and (b) above, assume that Lothbrok's fixed assets are only used at 75% of capacity. By what percentage could 2021 sales increase over 2020 sales without the need for an increase in fixed assets? (2 marks)