Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This suggests that it will take 38 days for Rocky Mountain Bikes's raw materials inventory to be used in production. Assuming production needs can be

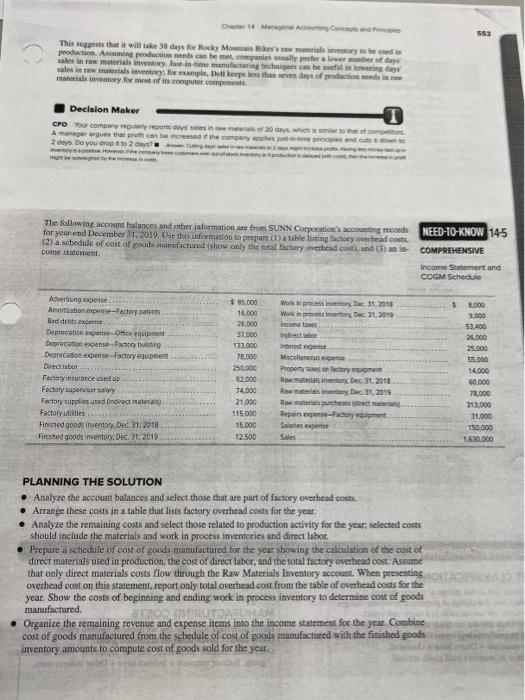

This suggests that it will take 38 days for Rocky Mountain Bikes's raw materials inventory to be used in production. Assuming production needs can be met, companies usually prefer a lower number of days' sales in raw materials inventory. Just-in-time manufacturing techniques can be useful in lowering days' sales in raw materials inventory; for example, Dell keeps less than seven days of production needs in raw materials inventory for most of its computer components. Chapter 14 Managerial Accounting Concepts and Principles Decision Maker CFO Your company regularly reports days' sales in raw materials of 20 days, which is similar to that of competitors. A manager argues that profit can be increased if the company applies just-in-time principles and cuts it down to 2 days. Do you drop it to 2 days? Answer: Cutting days' sales in raw materials to 2 days might increase profits. Having less money tied up in Inventory is a positive. However, if the company loses customers over out-of-stock inventory or if production is delayed (with costs), then the increase in profit might be outweighed by the increase in costs. The following account balances and other information are from SUNN Corporation's accounting records for year-end December 31, 2019. Use this information to prepare (1) a table listing factory overhead costs, (2) a schedule of cost of goods manufactured (show only the total factory overhead cost), and (3) an in- come statement. Advertising expense Amortization expense-Factory patents Bad debts expense. Depreciation expense-Office equipment Depreciation expense-Factory building Depreciation expense-Factory equipment Direct labor Factory insurance used up. Factory supervisor salary.. Factory supplies used (indirect materials). Factory utilities... Finished goods inventory, Dec. 31, 2018 Finished goods inventory, Dec. 31, 2019 $ 85,000 16,000 28,000 37,000 133,000 78,000 250,000 62,000 74,000 21,000 115,000 15,000 12,500 Work in process inventory, Dec. 31, 2018 Work in process inventory, Dec. 31, 2019 Income taxes. Indirect labor Interest expense Miscellaneous expense Property taxes on factory equipment Raw materials inventory, Dec. 31, 2018 Raw materials inventory, Dec. 31, 2019 Raw materials purchases (direct materials). Repairs expense-Factory equipment.. Salaries expense Sales NEED-TO-KNOW 14-5 COMPREHENSIVE PLANNING THE SOLUTION Analyze the account balances and select those that are part of factory overhead costs. Arrange these costs in a table that lists factory overhead costs for the year. Analyze the remaining costs and select those related to production activity for the year; selected costs should include the materials and work in process inventories and direct labor. Income Statement and COGM Schedule Prepare a schedule of cost of goods manufactured for the year showing the calculation of the cost of direct materials used in production, the cost of direct labor, and the total factory overhead cost. Assume that only direct materials costs flow through the Raw Materials Inventory account. When presenting overhead cost on this statement, report only total overhead cost from the table of overhead costs for the year. Show the costs of beginning and ending work in process inventory to determine cost of goods manufactured. Hos Organize the remaining revenue and expense items into the income statement for the year. Combine cost of goods manufactured from the schedule of cost of goods manufactured with the finished goods inventory amounts to compute cost of goods sold for the year. 553 $ 8,000 9,000 53,400 26,000 25,000 55,000 14,000 60,000 78,000 313,000 31,000 150,000 1,630,000 aboos, finn heimaval 26 usth

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started