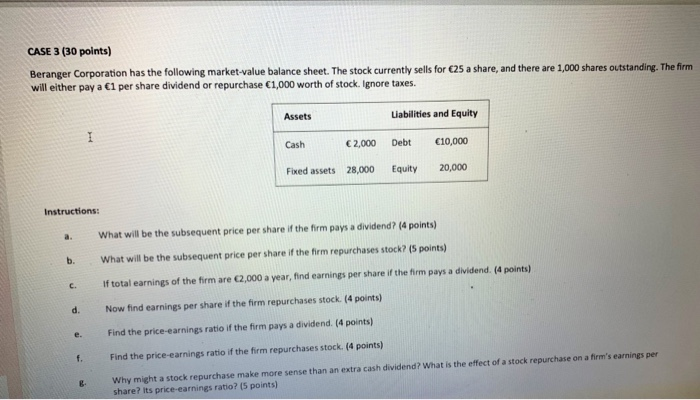

This task asseses the following learning outcomes: Demonstrate a deep understanding of the theory and practices of financing a firm and its capital structure. Evaluate the financing risk that may result from the chosen debt ratio. Critically evaluate the dividend payout ratio. Describe and analyze the trade-off between paying dividends and retaining the profits within the company. Explain the purpose and procedure related to stock repurchases. Evaluate and advice on a firm going from private to a public company. . . a CASE 3 (30 points) Beranger Corporation has the following market value balance sheet. The stock currently sells for 25 a share, and there are 1,000 shares outstanding. The firm will either pay a 1 per share dividend or repurchase 1,000 worth of stock. Ignore taxes. Assets Liabilities and Equity Cash 2,000 Debt 10,000 Fixed assets 28,000 Equity 20,000 Instructions: b What will be the subsequent price per share if the firm pays a dividend? (4 points) What will be the subsequent price per share if the firm repurchases stock? (5 points) If total earnings of the firm are 22,000 a year, find earnings per share if the firm pays a dividend. (4 points) Now find earnings per share if the firm repurchases stock. (4 points) Find the price-earnings ratio of the firm pays a dividend. (4 points) d. e. f. Find the price-earnings ratio if the firm repurchases stock. (4 points) B Why might a stock repurchase make more sense than an extra cash dividend? What is the effect of a stock repurchase on a firm's earnings per share? its price-earnings ratio? (5 points) This task asseses the following learning outcomes: Demonstrate a deep understanding of the theory and practices of financing a firm and its capital structure. Evaluate the financing risk that may result from the chosen debt ratio. Critically evaluate the dividend payout ratio. Describe and analyze the trade-off between paying dividends and retaining the profits within the company. Explain the purpose and procedure related to stock repurchases. Evaluate and advice on a firm going from private to a public company. . . a CASE 3 (30 points) Beranger Corporation has the following market value balance sheet. The stock currently sells for 25 a share, and there are 1,000 shares outstanding. The firm will either pay a 1 per share dividend or repurchase 1,000 worth of stock. Ignore taxes. Assets Liabilities and Equity Cash 2,000 Debt 10,000 Fixed assets 28,000 Equity 20,000 Instructions: b What will be the subsequent price per share if the firm pays a dividend? (4 points) What will be the subsequent price per share if the firm repurchases stock? (5 points) If total earnings of the firm are 22,000 a year, find earnings per share if the firm pays a dividend. (4 points) Now find earnings per share if the firm repurchases stock. (4 points) Find the price-earnings ratio of the firm pays a dividend. (4 points) d. e. f. Find the price-earnings ratio if the firm repurchases stock. (4 points) B Why might a stock repurchase make more sense than an extra cash dividend? What is the effect of a stock repurchase on a firm's earnings per share? its price-earnings ratio? (5 points)