Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This template was given to us with another problem so I'm not sure if all the categories are correct. Please help/ show work if you

This template was given to us with another problem so I'm not sure if all the categories are correct. Please help/ show work if you can thank you!

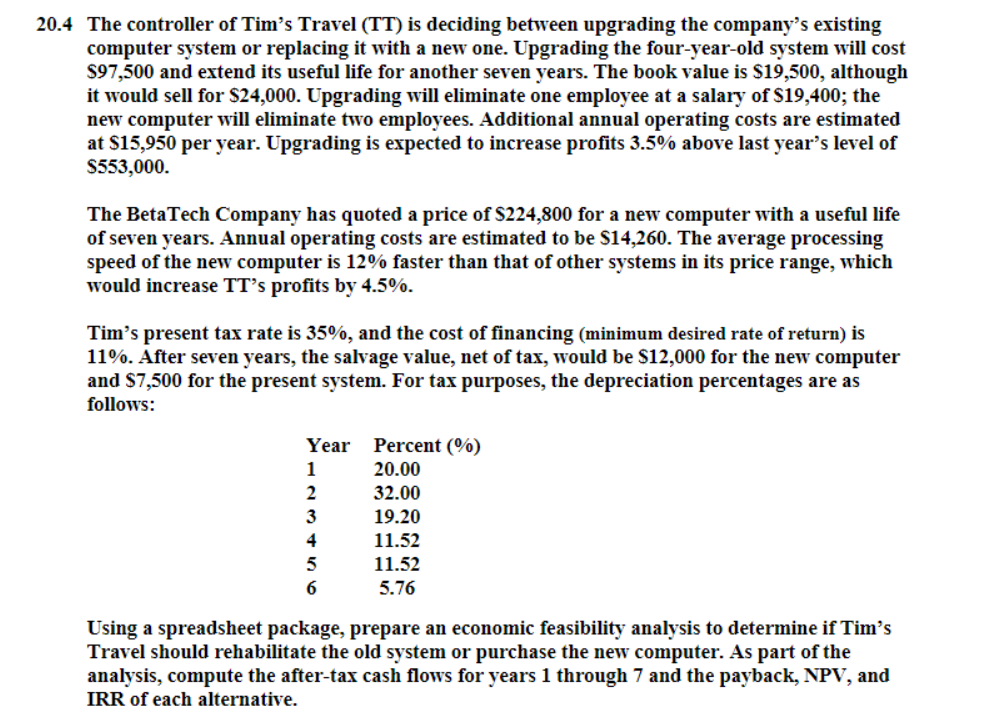

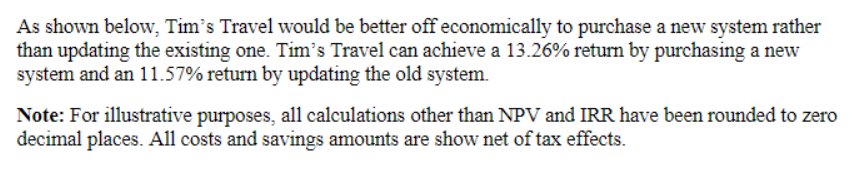

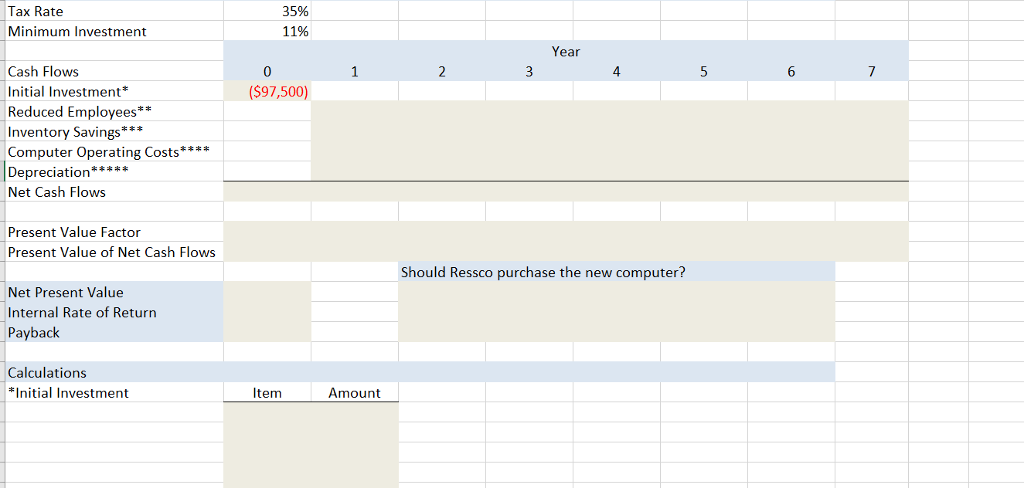

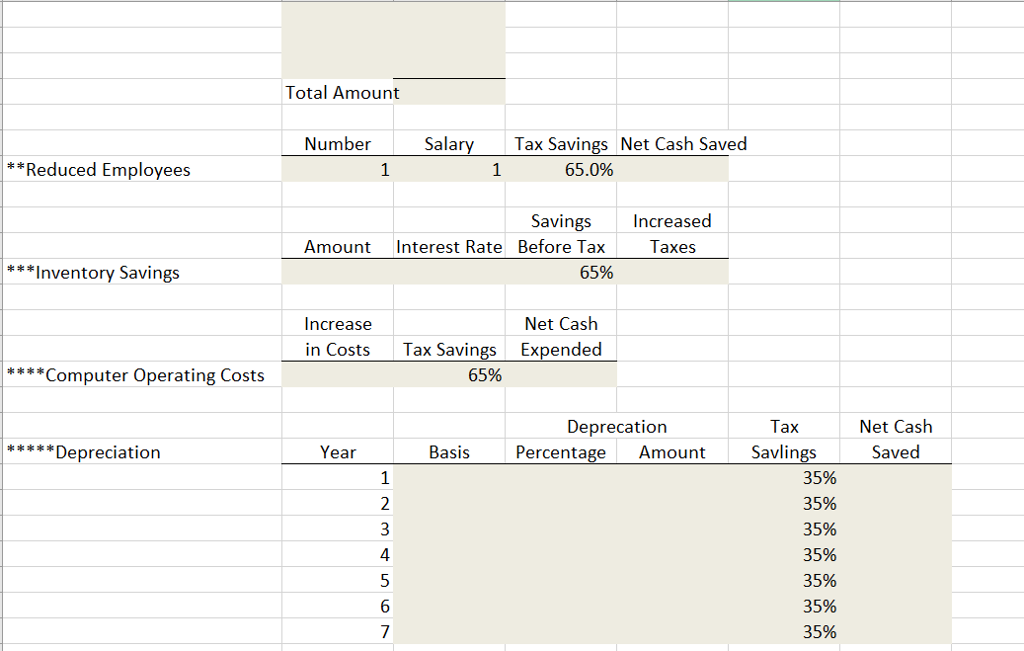

20.4 The controller of Tim's Travel (TT) is deciding between upgrading the company's existing computer system or replacing it with a new one. Upgrading the four-year-old system will cost S97,500 and extend its useful life for another seven years. The book value is S19,500, although it would sell for S24,000. Upgrading will eliminate one employee at a salary ofS19,400; the new computer will eliminate two employees. Additional annual operating costs are estimated at $15,950 per year. Upgrading is expected to increase profits 3.5% above last year's level of S553,000. The BetaTech Company has quoted a price of S224,800 for a new computer with a useful life of seven years. Annual operating costs are estimated to be S14,260. The average processing speed of the new computer is 12% faster than that of other systems in its price range, which would increase TT's profits bv 4.5%. Tim's present tax rate is 35%, and the cost of financing (minimum desired rate of return) is 11%. After seven years, the salvage value, net of tax, would be $12,000 for the new computer and S7,500 for the present system. For tax purposes, the depreciation percentages are as follows: Year Percent (%) 20.00 32.00 19.20 11.52 11.52 5.76 Using a spreadsheet package, prepare an economic feasibility analysis to determine if Tim's Travel should rehabilitate the old system or purchase the new computer. As part of the analysis, compute the after-tax cash flows for years 1 through 7 and the payback, NPV, and IRR of each alternativeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started