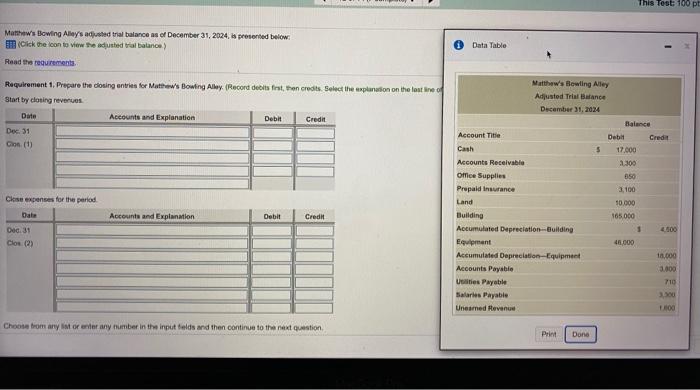

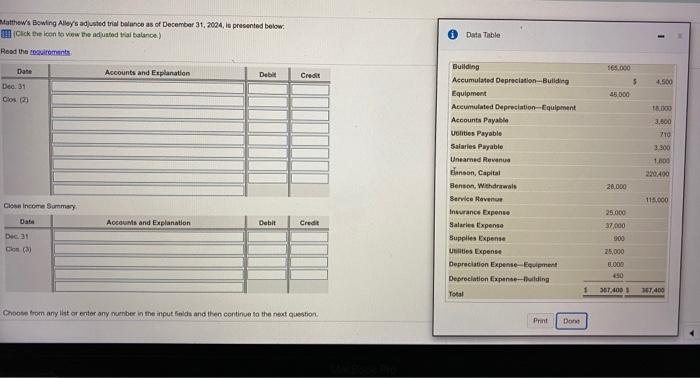

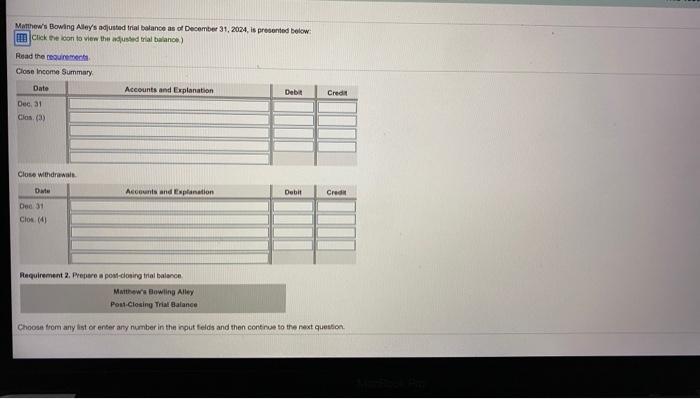

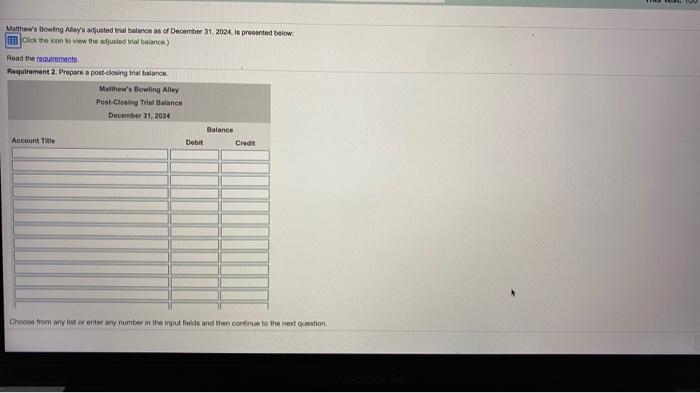

This Test 100 pt Matthews Blowing Aley's adjusted trial balance as of December 31, 2024, is presented below Click the icon to view the adjusted a balance) Read the requirements Data Table Matthew's Bowling Alley Adjusted Trial Balance December 31, 2024 Requirement 1. Prepare the closing entries for Mathews Blowing Alley. (Record debits first, then credits. Select the explanation on the last line of Start by closing revenues Date Accounts and Explanation Debit Credit Dec 31 Gion (1) Account Title Cash Balance Debilt Cred 17.000 2.300 5 550 3.100 50.000 Close expenses for the period Date Accounts and Explanation Debit Credit Dec 31 Clos (2) 4300 Accounts Receivable Office Supplies Prepaid insurance Land Building Accumulated Depreciation Building Equipment Accumulated Depreciation Equipment Accounts Payable Utilities Payable Salaris Payable Uneared Revenue 165.000 1 48,000 18.000 3.000 710 3500 Choose from any Morner any number in the input fields and then continue to the next question Print Done Matthews Bowling Aley's adjusted to balance as of December 31, 2024, le presented below. Click the icon to view the adjusted balance) Data Table Read the togalements Accounts and Explanation 165.000 Debe Credit 4,500 Date Dec 31 Gios 2 15.000 18000 3.800 710 3.300 1.000 220499 Building Accumulated Depreciation-Building Equipment Accumulated Depreciation Equipment Accounts Payable Untities Payable Salarles Puyable Unearned Revenue Binneon, Capital Benson, Withdrawals Service Revenge Insurance Expense Salaries Expense Supplies Expense Utes Expense Depreciation Expense-Equipment Depreciation Expenselding Total 20.000 115.000 Close Income Summary Date Accounts and Explanation Debit Credit Dec 31 Cor) 25.000 37,000 000 25,000 B0000 650 1 367,400 367,400 Choose from any it or enter any number in me input fields and then continue to the next question Print Done Matthew's Bowing Alley's adjusted trial balance as of December 31, 2024, is presented below: Click the con lo view the usled trial balance) Read the requireme Close Income Summary Date Accounts and Explanation Debi Dec 31 Clos (3) Crede Cluse withdrawal Date Accounts and explanation Debit Cred Dec 31 Clos (4) Requirement 2. Prepare a poucosing trial balance Matthew Bowling Alley Pou Closing Trial Balance Choose from any list or enter any number in the input fields and then continue to the next question Matthew's flowing Aley's adjusted trial balance as of December 31, 2024. is presented below. Click the icon to view the adjusted trial balance) Read the requirements Requirement 2. Prepare a post-closing trial balance Matthews Bowling Alley Pest Closing Trial Balance December 31, 2024 Balance Account Title Debit Credit Choose from any list or enter any number in the input Kelds and the core to the next question Matthews Bowing Alley's adjusted trial balance as of December 31, 2024. is presented below. Click the icon to view the adjusted trial balance.) Read the reglements Total Requirement 3. Compute the current ratio for Matthew's Bowling Alley Select the besenter the amounts, then compute the current ratio. (Round your answer to two decimal places) Current ratio Choose from any ist or enter any number in the input fields and then continue to the next