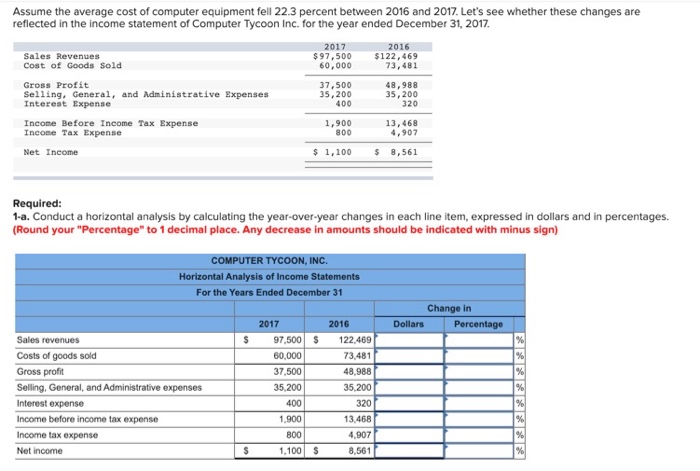

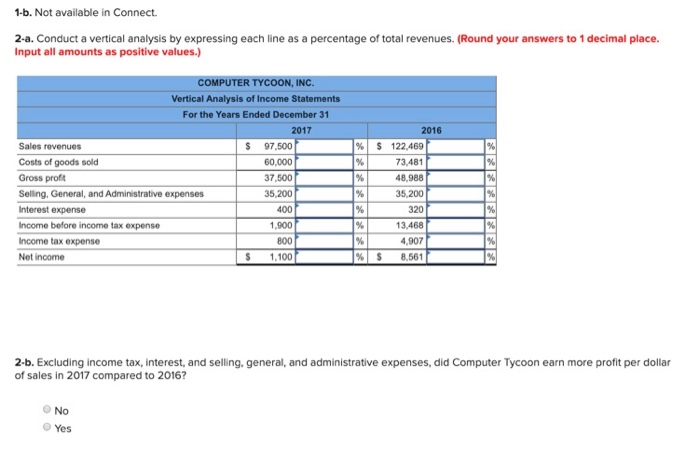

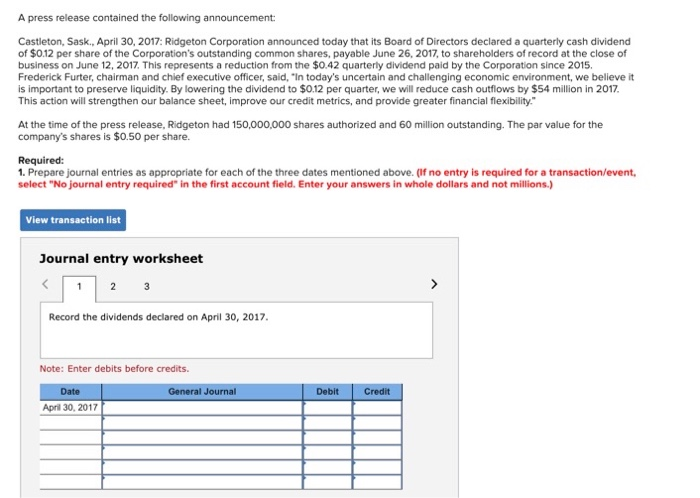

Assume the average cost of computer equipment fell 22.3 percent between 2016 and 2017. Let's see whether these changes are reflected in the income statement of Computer Tycoon Inc. for the year ended December 31, 2017 Sales Revenues Cost of Goods Sold 2017 $ 97,500 60,000 2016 $122,469 73,481 Gross Profit Selling, General, and Administrative Expenses Interest Expense 37.500 35,200 400 48,988 35. 200 320 1.900 Income Before Income Tax Expense Income Tax Expense 13,468 4,907 800 Net Income $ 1,100 $ 8,561 Required: 1-a. Conduct a horizontal analysis by calculating the year-over-year changes in each line item, expressed in dollars and in percentages. (Round your "Percentage" to 1 decimal place. Any decrease in amounts should be indicated with minus sign) COMPUTER TYCOON, INC. Horizontal Analysis of Income Statements For the Years Ended December 31 Change in Dollars Percentage 2016 $ Sales revenues Costs of goods sold Gross profit Selling, General, and Administrative expenses Interest expense Income before income tax expense Income tax expense Net income 2017 97,500 60,000 37.500 35,200 400 1,900 800 1.100 122,469 73.481 48,988 35,200 320 13.468 4,907 8.561 $ $ 1-b. Not available in Connect. 2-a. Conduct a vertical analysis by expressing each line as a percentage of total revenues. (Round your answers to 1 decimal place. Input all amounts as positive values.) % $ COMPUTER TYCOON, INC. Vertical Analysis of Income Statements For the Years Ended December 31 2017 Sales revenues $ 97,500 Costs of goods sold 60,000 Gross profit 37,500 Selling, General, and Administrative expenses 35,200 Interest expense 400 Income before income tax expense 1,900 Income tax expense 800 Net Income $ 1.100 2016 122,469 73.481 48.988 35,200 320 13.468 4,907 8,561 1% $ 2-b. Excluding income tax, interest, and selling, general, and administrative expenses, did Computer Tycoon earn more profit per dollar of sales in 2017 compared to 2016? No Yes A press release contained the following announcement: Castleton, Sask., April 30, 2017: Ridgeton Corporation announced today that its Board of Directors declared a quarterly cash dividend of $0.12 per share of the Corporation's outstanding common shares, payable June 26, 2017, to shareholders of record at the close of business on June 12, 2017. This represents a reduction from the $0.42 quarterly dividend paid by the Corporation since 2015. Frederick Furter, chairman and chief executive officer, said, 'In today's uncertain and challenging economic environment, we believe it is important to preserve liquidity. By lowering the dividend to $0.12 per quarter, we will reduce cash outflows by $54 million in 2017. This action will strengthen our balance sheet, improve our credit metrics, and provide greater financial flexibility." At the time of the press release, Ridgeton had 150,000,000 shares authorized and 60 million outstanding. The par value for the company's shares is $0.50 per share. Required: 1. Prepare journal entries as appropriate for each of the three dates mentioned above. (If no entry is required for a transaction/event, select "No journal entry required in the first account field. Enter your answers in whole dollars and not millions.) View transaction list Journal entry worksheet 1 2 3 Record the dividends declared on April 30, 2017. Note: Enter debits before credits. General Journal Debit Credit Date April 30, 2017