Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This topic is in Taxable Income and Tax Payable for Individual 8. Home Accessibility Tax Credit Mauricio Saidi is a single parent. He and his

This topic is in Taxable Income and Tax Payable for Individual

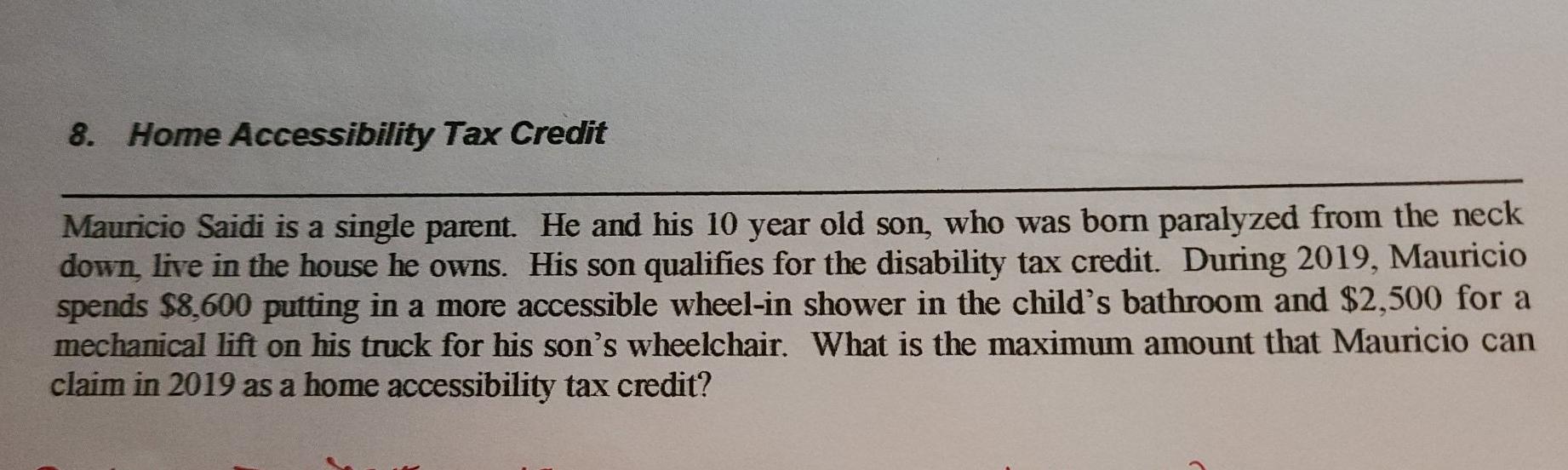

8. Home Accessibility Tax Credit Mauricio Saidi is a single parent. He and his 10 year old son, who was born paralyzed from the neck down. live in the house he owns. His son qualifies for the disability tax credit. During 2019, Mauricio spends $8,600 putting in a more accessible wheel-in shower in the child's bathroom and $2,500 for a mechanical lift on his truck for his son's wheelchair. What is the maximum amount that Mauricio can claim in 2019 as a home accessibility tax creditStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started