Question

n We have four mutually exclusive investment projects to choose from: Time (years) Alfa Beta Gama Delta CF CF CF CF 0 -1000 -1000 -1000

n

n

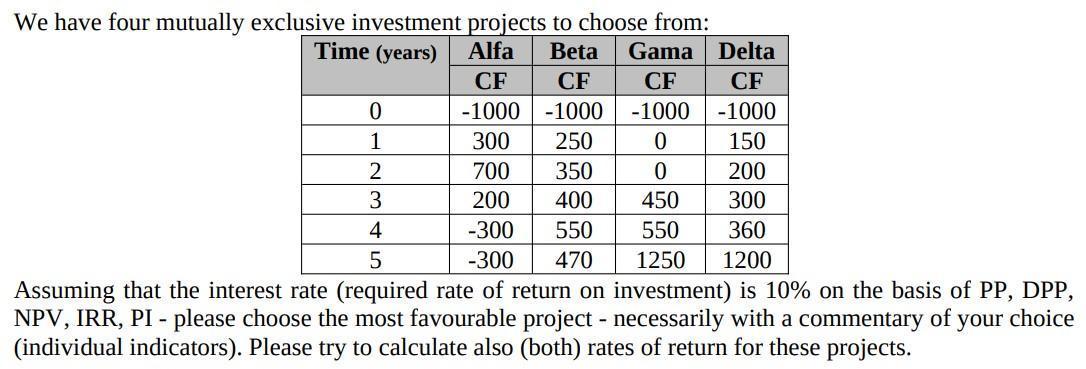

We have four mutually exclusive investment projects to choose from: Time (years) Alfa Beta Gama Delta CF CF CF CF 0 -1000 -1000 -1000 -1000 1 300 250 0 150 2 700 350 0 200 3 200 400 450 300 4 -300 550 550 360 5 -300 470 1250 1200 Assuming that the interest rate (required rate of return on investment) is 10% on the basis of PP, DPP, NPV, IRR, PI - please choose the most favourable project - necessarily with a commentary of your choice (individual indicators). Please try to calculate also (both) rates of return for these projects.

Step by Step Solution

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided belo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Contemporary business 2012 update

Authors: Louis E. Boone, David L. Kurtz

14th edition

1118010302, 978-1118010303

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App