This two image contain same question. VERY VERY URGENT!!!

This two image contain same question. VERY VERY URGENT!!!

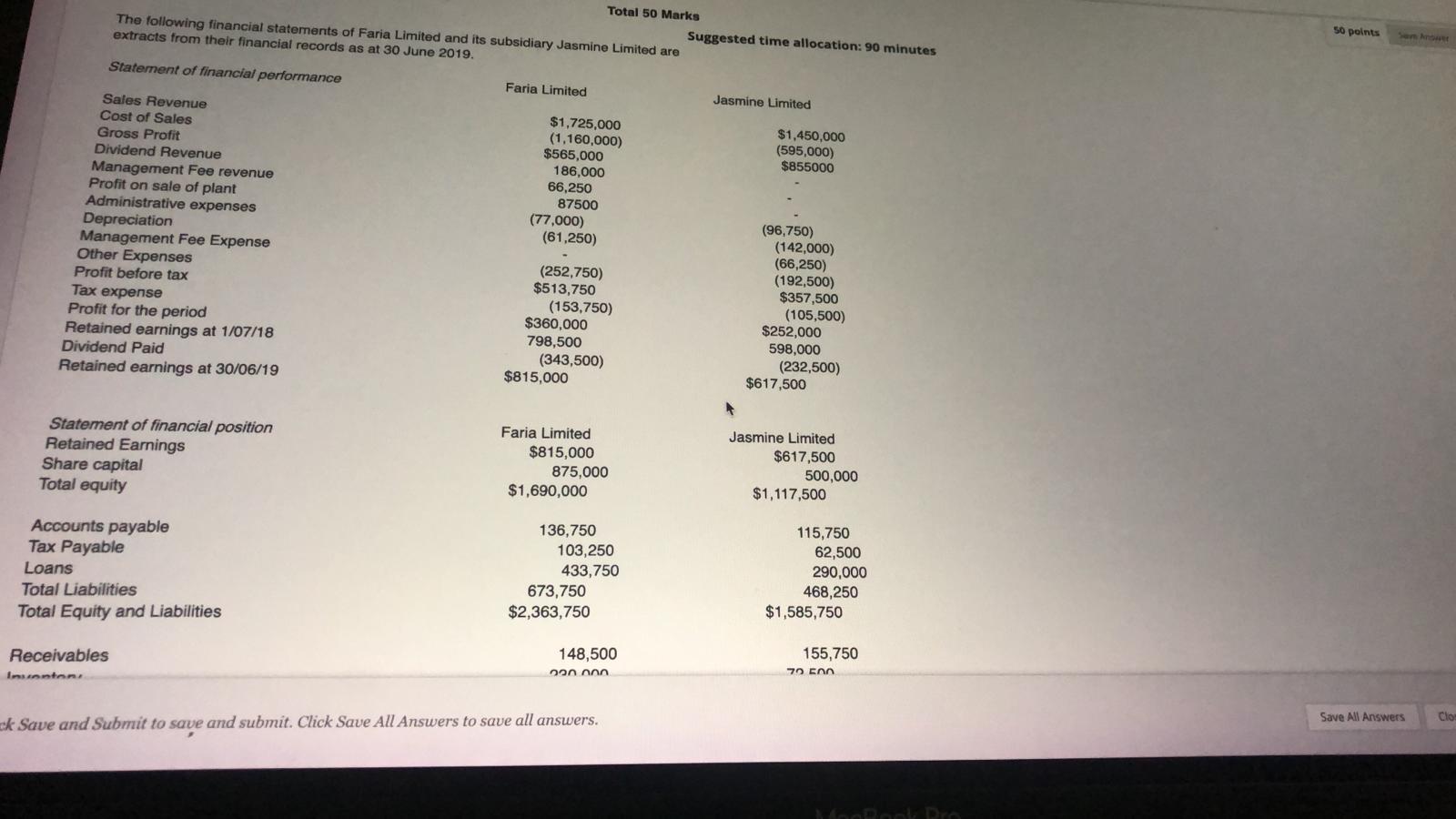

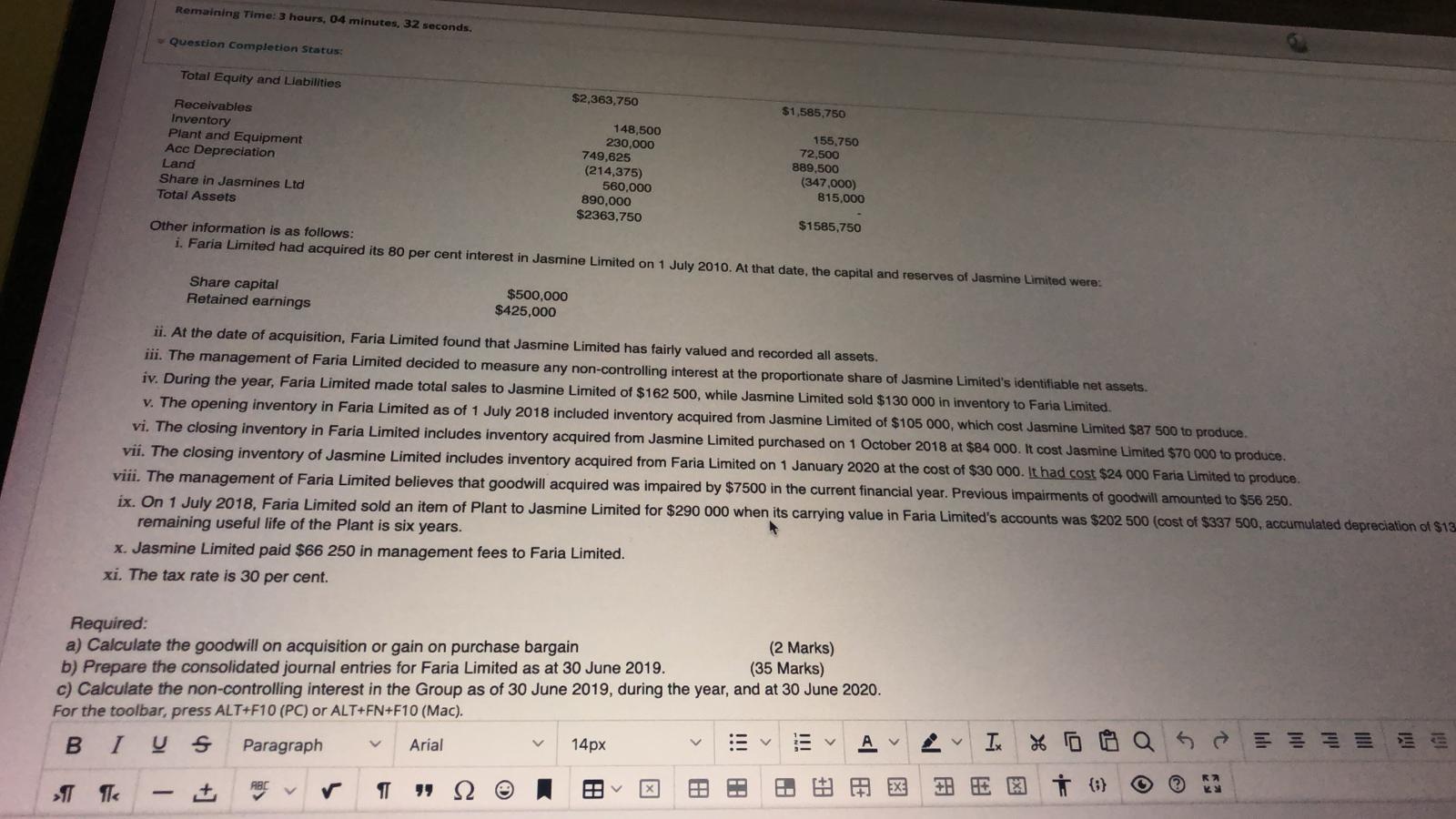

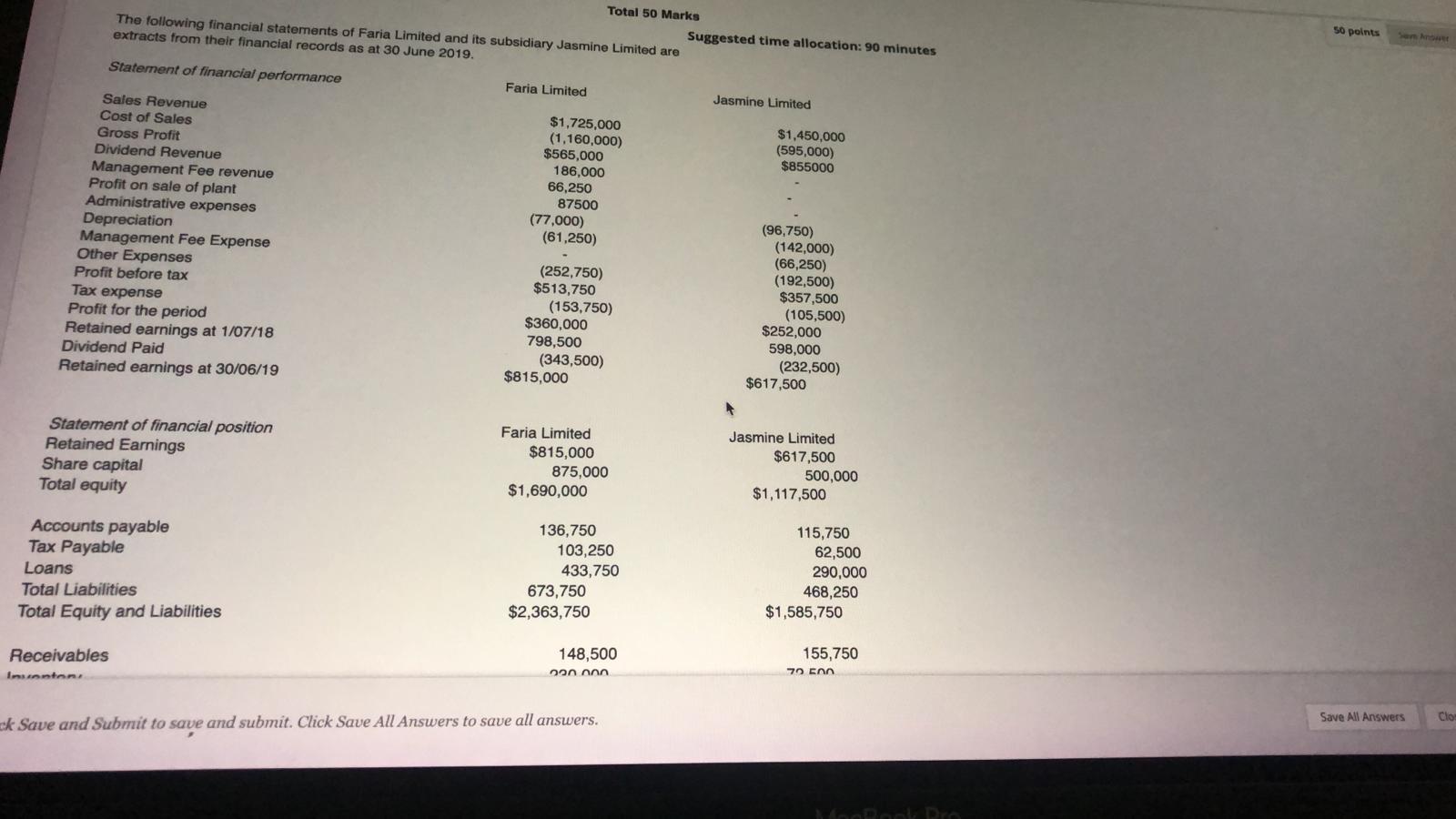

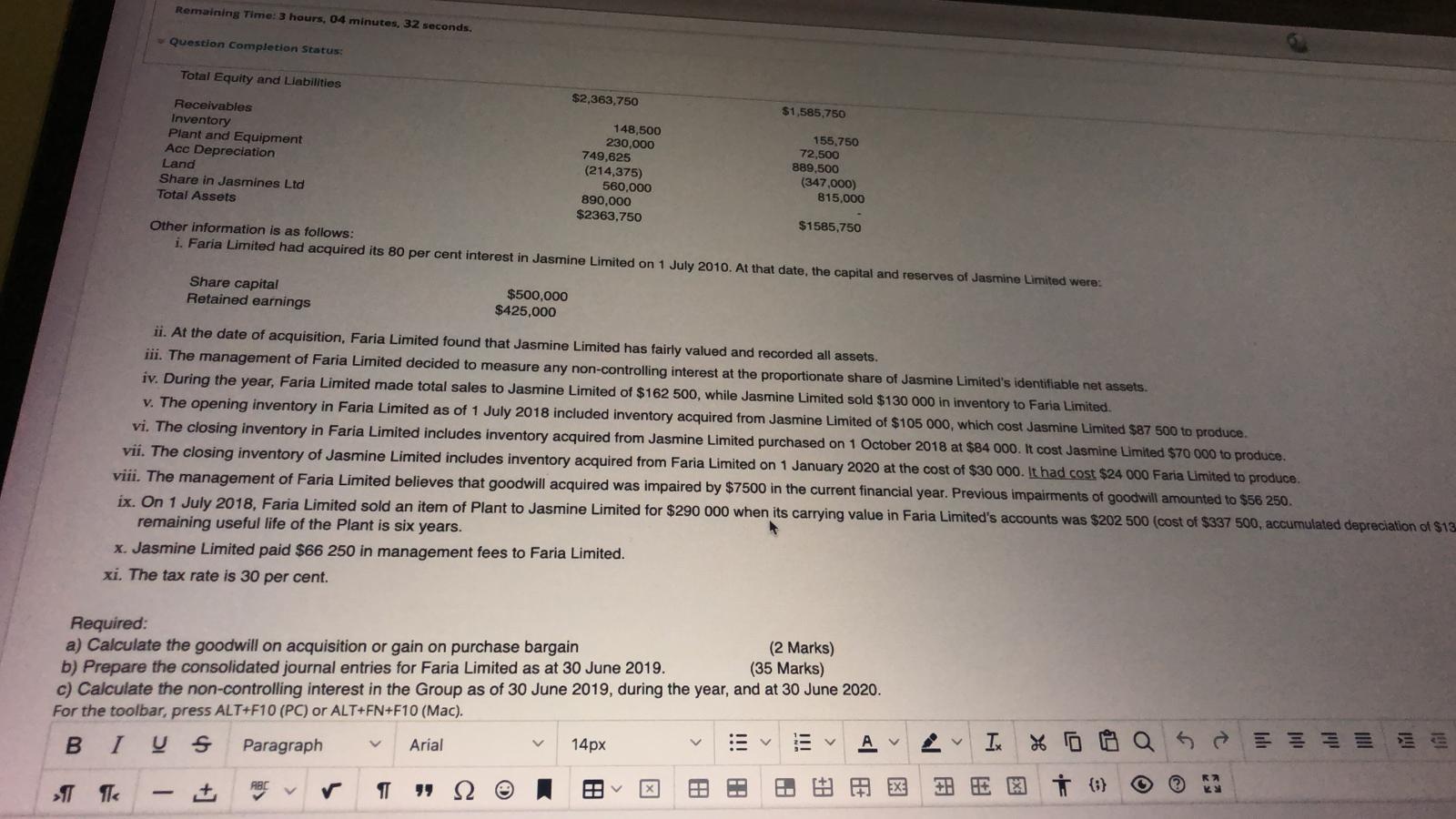

Total 50 Marks Suggested time allocation: 90 minutes The following financial statements of Faria Limited and its subsidiary Jasmine Limited are extracts from their financial records as at 30 June 2019. 50 points Statement of financial performance Faria Limited Jasmine Limited $1,450,000 (595,000) $855000 Sales Revenue Cost of Sales Gross Profit Dividend Revenue Management Fee revenue Profit on sale of plant Administrative expenses Depreciation Management Fee Expense Other Expenses Profit before tax Tax expense Profit for the period Retained earnings at 1/07/18 Dividend Paid Retained earnings at 30/06/19 $1.725,000 (1,160,000) $565,000 186,000 66,250 87500 (77,000) (61,250) (252,750) $513,750 (153,750) $360,000 798,500 (343,500) $815,000 (96,750) (142,000) (66,250) (192,500) $357,500 (105,500) $252,000 598,000 (232,500) $617,500 Statement of financial position Retained Earnings Share capital Total equity Faria Limited $815,000 875,000 $1,690,000 Jasmine Limited $617,500 500,000 $1,117,500 Accounts payable Tax Payable Loans Total Liabilities Total Equity and Liabilities 136,750 103,250 433,750 673,750 $2,363,750 115,750 62,500 290,000 468,250 $1,585,750 Receivables Instantan 148,500 nnnn 155,750 7 con Save All Answers Clo Ek Save and Submit to save and submit. Click Save All Answers to save all answers. PAD Remaining Time: 3 hours, 04 minutes, 32 seconds. Question Completion Status: Total Equity and Liabilities $2,363,750 $1,585,750 Receivables Inventory Plant and Equipment Acc Depreciation Land Share in Jasmines Ltd Total Assets 148,500 230,000 749,625 (214,375) 560,000 890,000 $2363.750 155,750 72,500 889,500 (347,000) 815,000 $1585,750 Other information is as follows: i. Faria Limited had acquired its 80 per cent interest in Jasmine Limited on 1 July 2010. At that date, the capital and reserves of Jasmine Limited were: Share capital Retained earnings $500,000 $425,000 ii. At the date of acquisition, Faria Limited found that Jasmine Limited has fairly valued and recorded all assets. iii. The management of Faria Limited decided to measure any non-controlling interest at the proportionate share of Jasmine Limited's identifiable net assets. iv. During the year, Faria Limited made total sales to Jasmine Limited of $162 500, while Jasmine Limited sold $130 000 in inventory to Faria Limited. y. The opening inventory in Faria Limited as of 1 July 2018 included inventory acquired from Jasmine Limited of $105 000, which cost Jasmine Limited $87 500 to produce. vi. The closing inventory in Faria Limited includes inventory acquired from Jasmine Limited purchased on 1 October 2018 at $84 000. It cost Jasmine Limited $70 000 to produce. vii. The closing inventory of Jasmine Limited includes inventory acquired from Faria Limited on 1 January 2020 at the cost of $30 000. It had cost $24 000 Faria Limited to produce. viii. The management of Faria Limited believes that goodwill acquired was impaired by $7500 in the current financial year. Previous impairments of goodwill amounted to $56 250. ix. On 1 July 2018, Faria Limited sold an item of Plant to Jasmine Limited for $290 000 when its carrying value in Faria Limited's accounts was $202 500 (cost of $337 500, accumulated depreciation of $13 remaining useful life of the plant is six years. X. Jasmine Limited paid $66 250 in management fees to Faria Limited. xi. The tax rate is 30 per cent. Required: a) Calculate the goodwill on acquisition or gain on purchase bargain (2 Marks) b) Prepare the consolidated journal entries for Faria Limited as at 30 June 2019. (35 Marks) c) Calculate the non-controlling interest in the Group as of 30 June 2019, during the year, and at 30 June 2020. For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). B I g Paragraph Arial 14px V V V V IK % R X > Il + v EX: FP E 0 k Total 50 Marks Suggested time allocation: 90 minutes The following financial statements of Faria Limited and its subsidiary Jasmine Limited are extracts from their financial records as at 30 June 2019. 50 points Statement of financial performance Faria Limited Jasmine Limited $1,450,000 (595,000) $855000 Sales Revenue Cost of Sales Gross Profit Dividend Revenue Management Fee revenue Profit on sale of plant Administrative expenses Depreciation Management Fee Expense Other Expenses Profit before tax Tax expense Profit for the period Retained earnings at 1/07/18 Dividend Paid Retained earnings at 30/06/19 $1.725,000 (1,160,000) $565,000 186,000 66,250 87500 (77,000) (61,250) (252,750) $513,750 (153,750) $360,000 798,500 (343,500) $815,000 (96,750) (142,000) (66,250) (192,500) $357,500 (105,500) $252,000 598,000 (232,500) $617,500 Statement of financial position Retained Earnings Share capital Total equity Faria Limited $815,000 875,000 $1,690,000 Jasmine Limited $617,500 500,000 $1,117,500 Accounts payable Tax Payable Loans Total Liabilities Total Equity and Liabilities 136,750 103,250 433,750 673,750 $2,363,750 115,750 62,500 290,000 468,250 $1,585,750 Receivables Instantan 148,500 nnnn 155,750 7 con Save All Answers Clo Ek Save and Submit to save and submit. Click Save All Answers to save all answers. PAD Remaining Time: 3 hours, 04 minutes, 32 seconds. Question Completion Status: Total Equity and Liabilities $2,363,750 $1,585,750 Receivables Inventory Plant and Equipment Acc Depreciation Land Share in Jasmines Ltd Total Assets 148,500 230,000 749,625 (214,375) 560,000 890,000 $2363.750 155,750 72,500 889,500 (347,000) 815,000 $1585,750 Other information is as follows: i. Faria Limited had acquired its 80 per cent interest in Jasmine Limited on 1 July 2010. At that date, the capital and reserves of Jasmine Limited were: Share capital Retained earnings $500,000 $425,000 ii. At the date of acquisition, Faria Limited found that Jasmine Limited has fairly valued and recorded all assets. iii. The management of Faria Limited decided to measure any non-controlling interest at the proportionate share of Jasmine Limited's identifiable net assets. iv. During the year, Faria Limited made total sales to Jasmine Limited of $162 500, while Jasmine Limited sold $130 000 in inventory to Faria Limited. y. The opening inventory in Faria Limited as of 1 July 2018 included inventory acquired from Jasmine Limited of $105 000, which cost Jasmine Limited $87 500 to produce. vi. The closing inventory in Faria Limited includes inventory acquired from Jasmine Limited purchased on 1 October 2018 at $84 000. It cost Jasmine Limited $70 000 to produce. vii. The closing inventory of Jasmine Limited includes inventory acquired from Faria Limited on 1 January 2020 at the cost of $30 000. It had cost $24 000 Faria Limited to produce. viii. The management of Faria Limited believes that goodwill acquired was impaired by $7500 in the current financial year. Previous impairments of goodwill amounted to $56 250. ix. On 1 July 2018, Faria Limited sold an item of Plant to Jasmine Limited for $290 000 when its carrying value in Faria Limited's accounts was $202 500 (cost of $337 500, accumulated depreciation of $13 remaining useful life of the plant is six years. X. Jasmine Limited paid $66 250 in management fees to Faria Limited. xi. The tax rate is 30 per cent. Required: a) Calculate the goodwill on acquisition or gain on purchase bargain (2 Marks) b) Prepare the consolidated journal entries for Faria Limited as at 30 June 2019. (35 Marks) c) Calculate the non-controlling interest in the Group as of 30 June 2019, during the year, and at 30 June 2020. For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). B I g Paragraph Arial 14px V V V V IK % R X > Il + v EX: FP E 0 k

This two image contain same question. VERY VERY URGENT!!!

This two image contain same question. VERY VERY URGENT!!!