Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this was a question i didnt think i dod well on ill just ask my teacher for notes after its graded Use the following information

this was a question i didnt think i dod well on ill just ask my teacher for notes after its graded

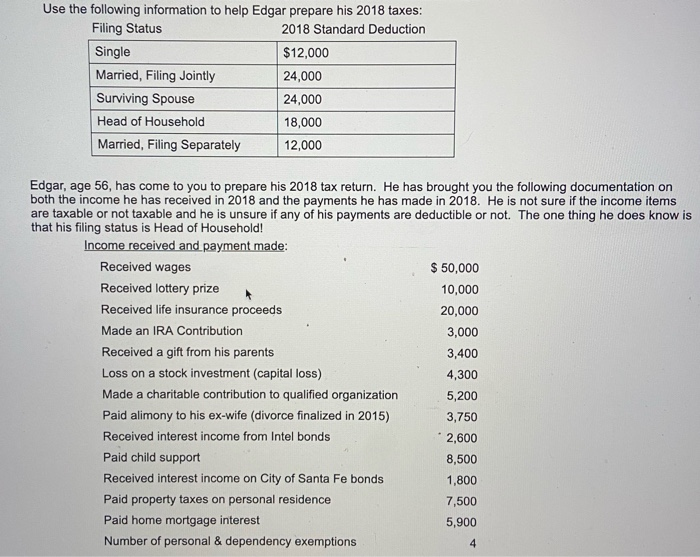

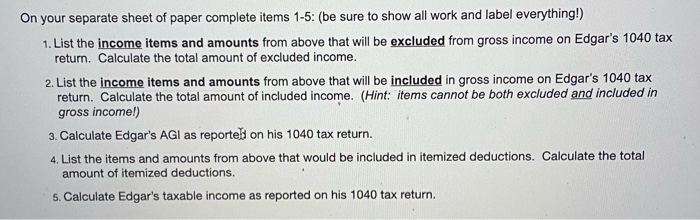

Use the following information to help Edgar prepare his 2018 taxes: Filing Status 2018 Standard Deduction Single $12,000 Married, Filing Jointly 24,000 Surviving Spouse 24,000 Head of Household 18,000 Married, Filing Separately 12,000 Edgar, age 56, has come to you to prepare his 2018 tax return. He has brought you the following documentation on both the income he has received in 2018 and the payments he has made in 2018. He is not sure if the income items are taxable or not taxable and he is unsure if any of his payments are deductible or not. The one thing he does know is that his filing status is Head of Household! Income received and payment made: Received wages $ 50,000 Received lottery prize 10,000 Received life insurance proceeds 20,000 Made an IRA Contribution 3,000 Received a gift from his parents 3,400 Loss on a stock investment (capital loss) 4,300 Made a charitable contribution to qualified organization 5,200 Paid alimony to his ex-wife (divorce finalized in 2015) 3,750 Received interest income from Intel bonds 2,600 Paid child support 8,500 Received interest income on City of Santa Fe bonds 1,800 Paid property taxes on personal residence 7,500 Paid home mortgage interest 5,900 Number of personal & dependency exemptions 4 On your separate sheet of paper complete items 1-5: (be sure to show all work and label everything!) 1. List the income items and amounts from above that will be excluded from gross income on Edgar's 1040 tax return. Calculate the total amount of excluded income. 2. List the income items and amounts from above that will be included in gross income on Edgar's 1040 tax return. Calculate the total amount of included income. (Hint: items cannot be both excluded and included in gross income!) 3. Calculate Edgar's AGI as reported on his 1040 tax return. 4. List the items and amounts from above that would be included in itemized deductions. Calculate the total amount of itemized deductions. 5. Calculate Edgar's taxable income as reported on his 1040 tax return Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started