Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This was all the information given. Problem 2. Formulate this problem. An investor who is expecting to receive sizable income annually over the next three

This was all the information given.

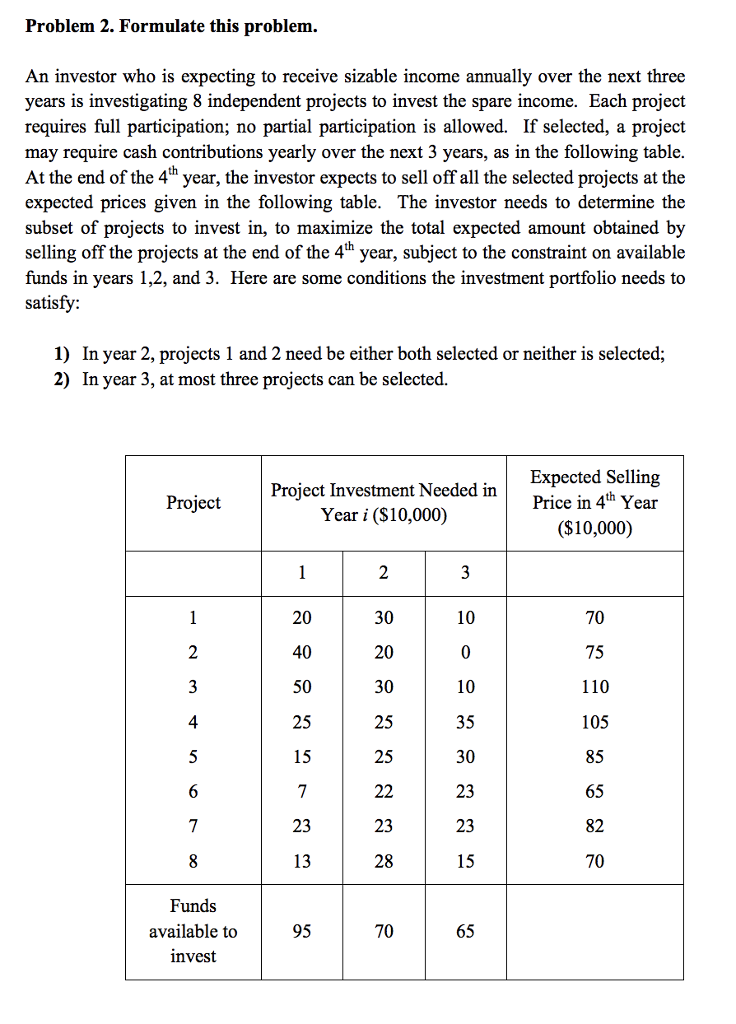

Problem 2. Formulate this problem. An investor who is expecting to receive sizable income annually over the next three years is investigating 8 independent projects to invest the spare income. Each project requires full participation; no partial participation is allowed. If selected, a project may require cash contributions yearly over the next 3 years, as in the following table. At the end of the 4th year, the investor expects to sell off all the selected projects at the expected prices given in the following table. The investor needs to determine the subset of projects to invest in, to maximize the total expected amount obtained by selling off the projects at the end of the 4th year, subject to the constraint on available funds in years 1,2, and 3. Here are some conditions the investment portfolio needs to satisfy: 1) In year 2, projects 1 and 2 need be either both selected or neither is selected; 2) In year 3, at most three projects can be selected. Project Investment Needed in Year i (S10,000) Expected Selling Price in 4th Year ($10,000) Project 20 40 50 25 15 30 20 30 10 10 35 30 23 23 15 70 75 110 105 85 65 82 70 4 25 23 23 13 28 Funds available to nvest 95 70 65Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started