Answered step by step

Verified Expert Solution

Question

1 Approved Answer

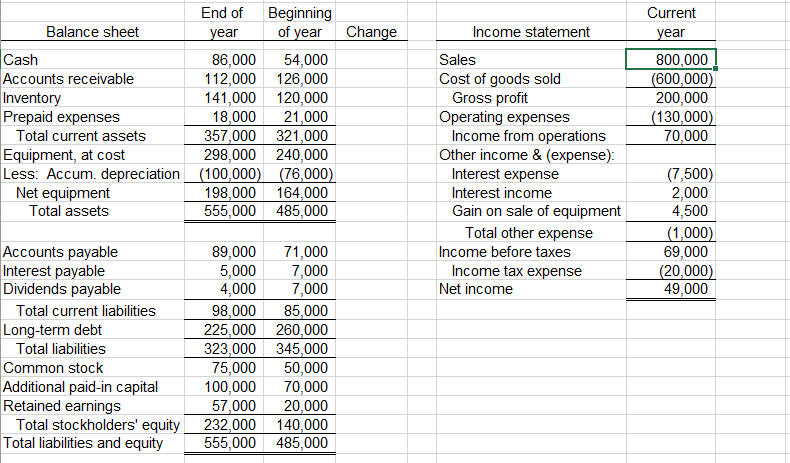

This was all the information provided to me. Change Current year End of Beginning Balance sheet year of year Cash 86,000 54,000 Accounts receivable 112,000

This was all the information provided to me.

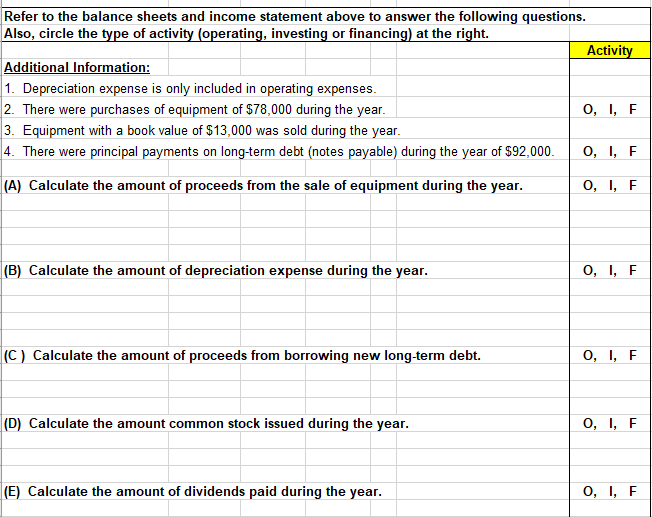

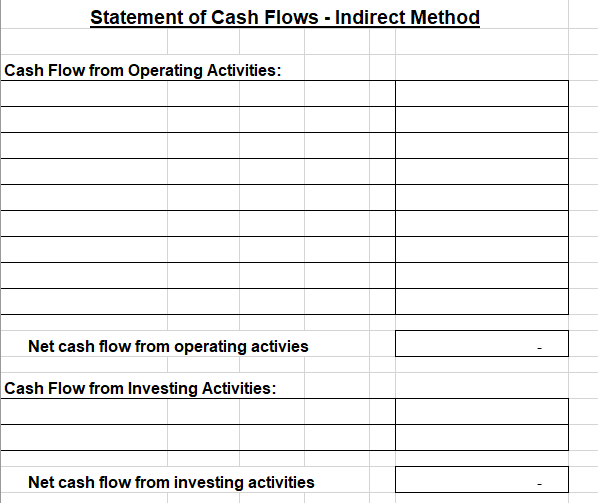

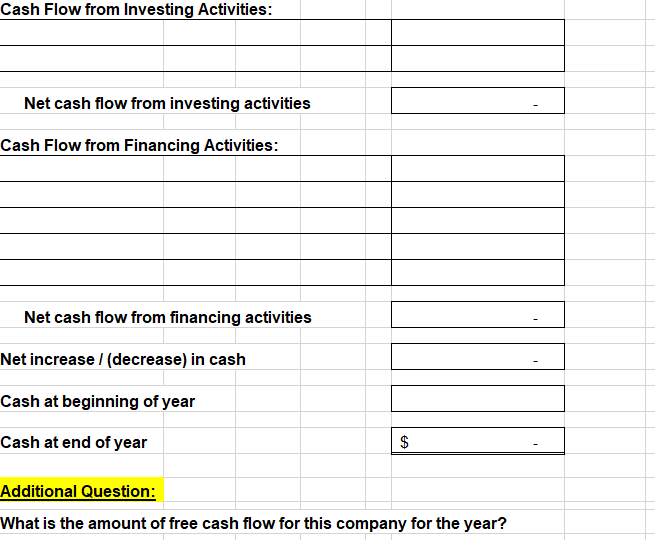

Change Current year End of Beginning Balance sheet year of year Cash 86,000 54,000 Accounts receivable 112,000 126,000 Inventory 141,000 120,000 Prepaid expenses 18,000 21,000 Total current assets 357,000 321,000 Equipment, at cost 298,000 240,000 Less: Accum. depreciation (100,000) (76,000) Net equipment 198,000 164,000 Total assets 555,000 485,000 800,000 (600,000) 200,000 (130,000) 70,000 Income statement Sales Cost of goods sold Gross profit Operating expenses Income from operations Other income & (expense) Interest expense Interest income Gain on sale of equipment Total other expense Income before taxes Income tax expense Net income (7,500) 2,000 4,500 (1,000) 69,000 (20,000) 49,000 Accounts payable Interest payable Dividends payable Total current liabilities Long-term debt Total liabilities Common stock Additional paid-in capital Retained earnings Total stockholders' equity Total liabilities and equity 89,000 71,000 5,000 7,000 4,000 7,000 98,000 85,000 225,000 260,000 323,000 345,000 75,000 50,000 100,000 70,000 57,000 20,000 232,000 140,000 555,000 485,000 Refer to the balance sheets and income statement above to answer the following questions. Also, circle the type of activity (operating, investing or financing) at the right Activity Additional Information: 1. Depreciation expense is only included in operating expenses. 2. There were purchases of equipment of $78,000 during the year. O, I, F 3. Equipment with a book value of $13,000 was sold during the year. 4. There were principal payments on long-term debt (notes payable) during the year of $92,000 O, I, F (A) Calculate the amount of proceeds from the sale of equipment during the year. O, I, F (B) Calculate the amount of depreciation expense during the year. O, I, F (C) Calculate the amount of proceeds from borrowing new long-term debt. 0, I, F (D) Calculate the amount common stock issued during the year. 0, I, F (E) Calculate the amount of dividends paid during the year. O, I, F Statement of Cash Flows - Indirect Method Cash Flow from Operating Activities: Net cash flow from operating activies Cash Flow from Investing Activities: Net cash flow from investing activities Cash Flow from Investing Activities: Net cash flow from investing activities Cash Flow from Financing Activities: Net cash flow from financing activities Net increase / (decrease) in cash Cash at beginning of year Cash at end of year $ Additional Question: What is the amount of free cash flow for this company for the yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started