Question

This week, we'll be returning to a discussion of working capital. As in the case of Reed's Clothier, you'll be analyzing a company that is

This week, we'll be returning to a discussion of working capital. As in the case of Reed's Clothier, you'll be analyzing a company that is attempting to maximize its cash inflows and liquidity by well-managing its short term assets and liabilities. In this case however, we'll be going beyond general working capital policy and actually calculating the length of the various constituent periods (in days) that make up what is known as the Cash Conversion Cycle.

Generally speaking, the Cash Conversion Cycle is the average length of time a dollar is tied up in current assets. In other words, it is how long it takes for the company to go through a complete operational cycle: purchasing product, inventorying that product, selling it, collecting on customer receivables, and paying vendors for the product purchased. To optimize cash inflows and liquidity, companies generally try to minimize the length of the cash conversion cycle; i.e., they want to convert their inventory to cash as quickly as possible. That means turning (selling) their products quickly, collecting on their accounts receivable quickly, and when possible and economical, stretching out their payments to vendors. (We say "economical" here because at times, there may be economic advantages to paying invoices quickly when vendors provide discounts for early payments).

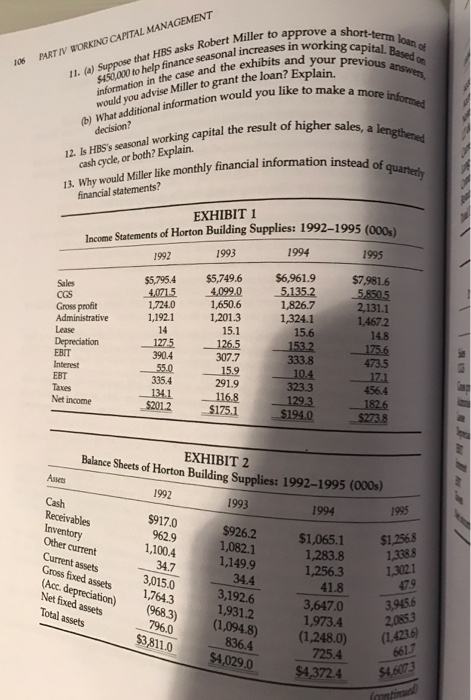

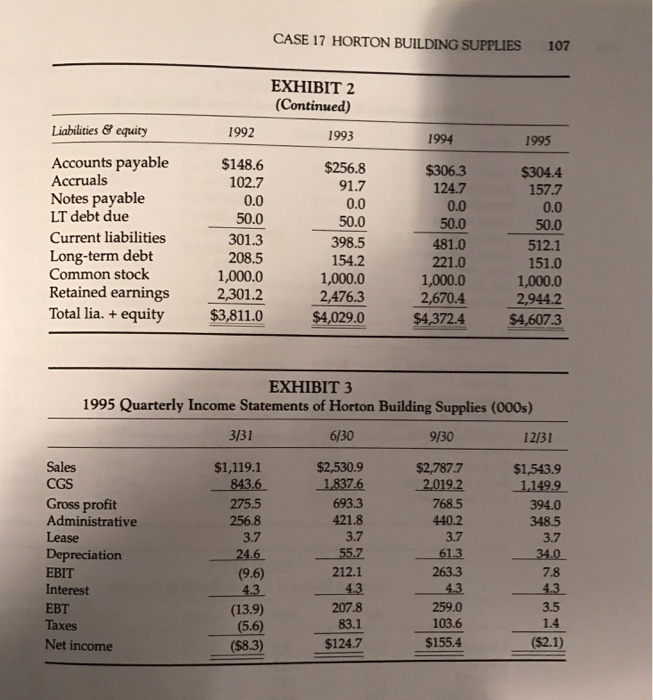

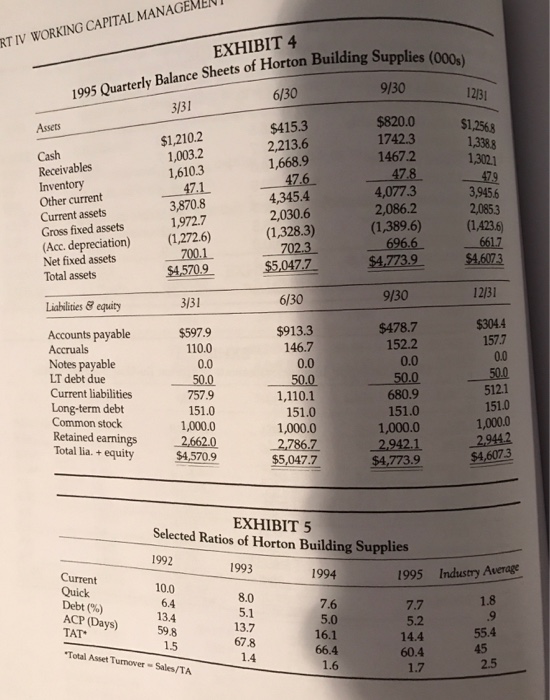

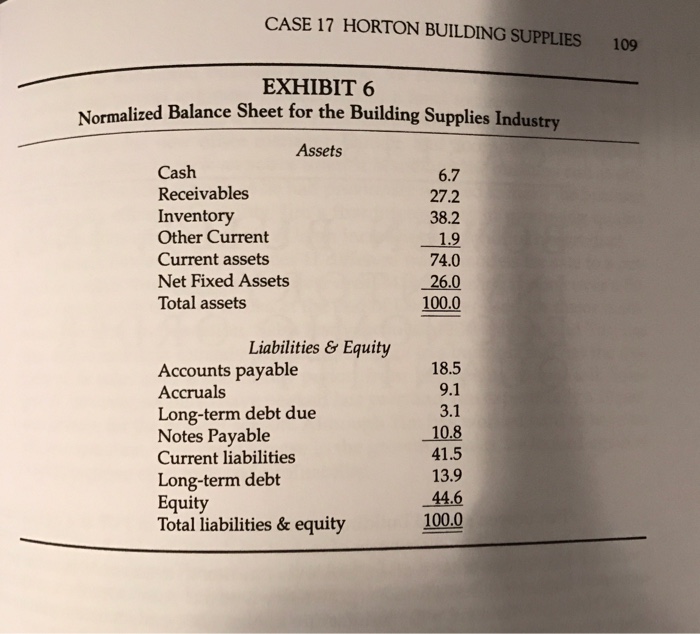

The Powerpoint slides provide a list of various short-term assets and liabilities that compose working capital. The entire Cash Conversion Cycle is then illustrated and formulas provided for each individual stage in the cycle. Note that the Inventory Conversion Period and Average Collection Period increase the length of the Cash Conversion Cycle while the Average Payment Period reduces the length of the Cash Conversion Cycle. You will be asked to calculate the length of each of these periods (in days) by inputting data drawn from the company's income statements and balance sheets appearing in the case EXHIBITS. Please answer Questions 1(a), 2, 3(a), 3(b), 4, 5.

For Question 3, please pay close attention to the case where definitions for "seasonal working capital" and "permanent working capital" are provided.

For Questions 4 and 5, think carefully about the various categories of short-term assets and the qualitative differences between them.

HORTON BU IL DING SUPPLIES WORKING CAPITAL Millsbaugh County is located a few miles south of Kansas City, Kansas and Kansas City, Missouri and has a population of over 175,000. Population growth has been about 2 percent annually for the last decade, but there are signs that the area will grow sharply in the next five years or so. Attracted by relatively low taxes, a skilled labor pool, and low-cost industrial sites, numerous businesses have begun to relocate to Millsbaugh and more are expected to follow. The economy is diverse and there is no single dominant industry or em- ployer. Roughly 70 percent of employment is in service, retail, wholesale, and fi nancial, and the remainder is in manufacturing. HORTON BUILDING SUPPLIES The Kansas-Nebraska Actin 1854 opened the territories of Kansas and Nebraska to homesteaders. Thomas Horton, I, a farmer in was aware of the opportunities being presented in these territories and moved to coach stop in 1858. After the Civil War started the Horton House, a stage- on the Santa Fe Trail. The railroad came to the area in 1871 and the that House ceased operations. An enterprising sort, Thomas I quickly the railroad meant economic growth for the area and he established the Horton Lumber Company 1874. The firm began as a retail selling to townspeople and local contractors. over time, however, it has gradually ex- panded into numerous other products like paint, hardware lines, and even fin- ished and semifinished lumber items like deck flooring and fencing. In short, the company is a rather building supplies and the name was to Horton Building supplies (HBs) years ago to reflect this. HBS has been continuously run by five generations of Hortons and at present nearly every important position is occupied by a family member. For example

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started