Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This will help a TON! Thank you :) I know its a lot to ask, but I need all the questions. Question #6 - Jordan

This will help a TON! Thank you :)

I know its a lot to ask, but I need all the questions.

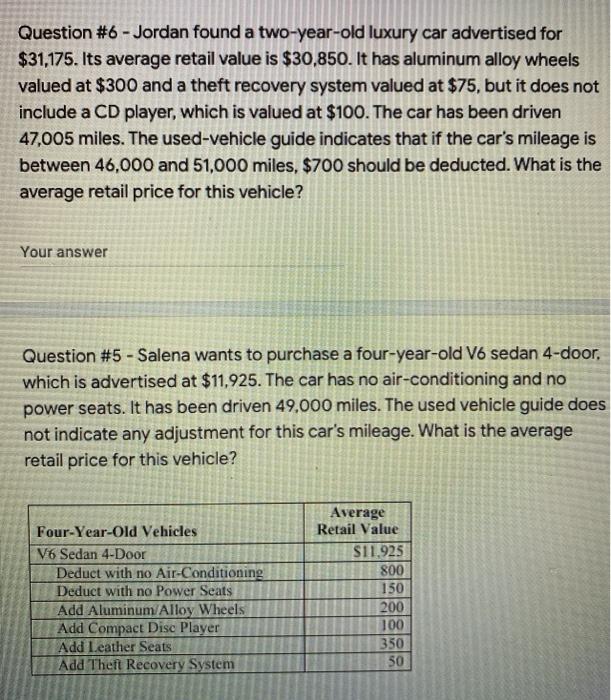

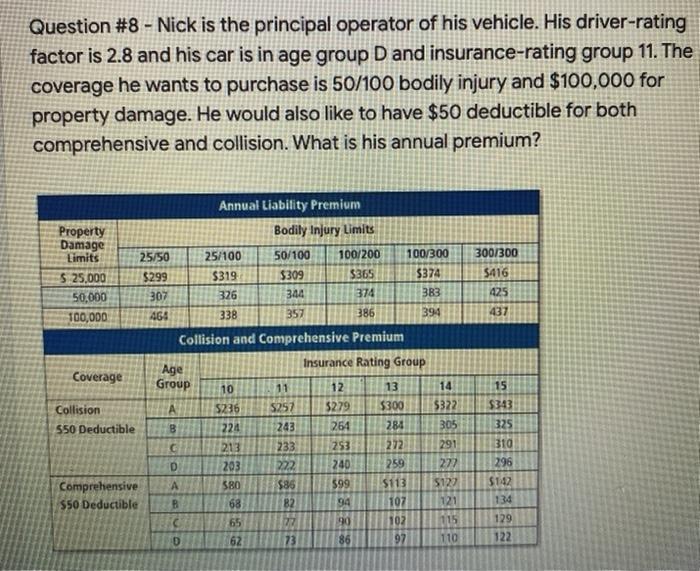

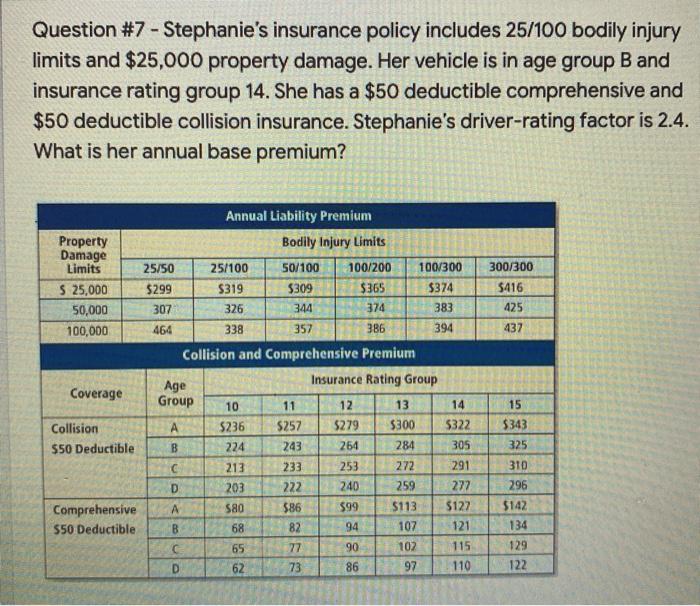

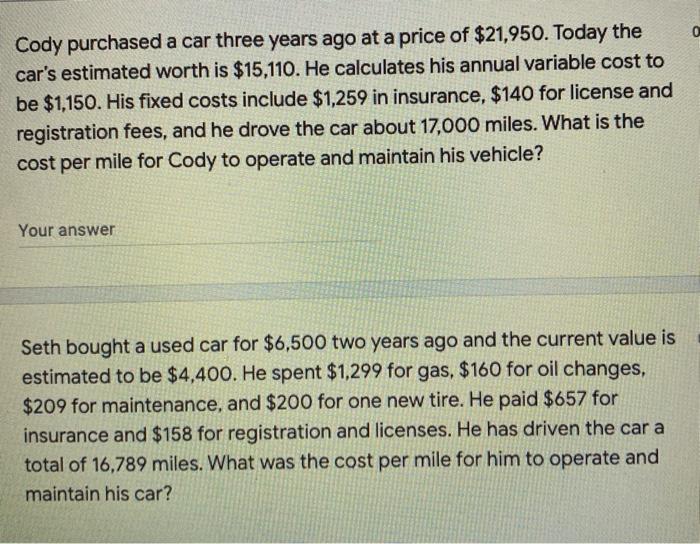

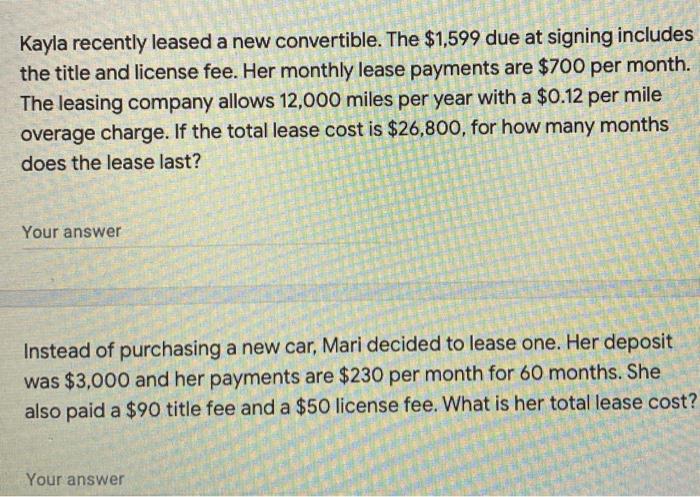

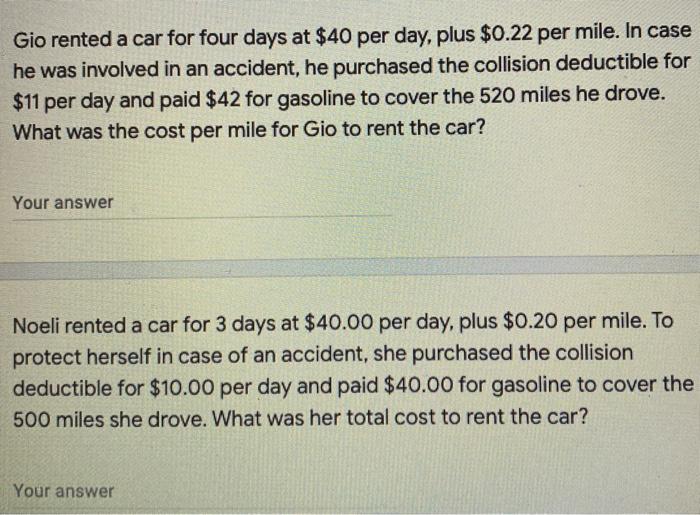

Question #6 - Jordan found a two-year-old luxury car advertised for $31,175. Its average retail value is $30,850. It has aluminum alloy wheels valued at $300 and a theft recovery system valued at $75, but it does not include a CD player, which is valued at $100. The car has been driven 47,005 miles. The used-vehicle guide indicates that if the car's mileage is between 46,000 and 51,000 miles, $700 should be deducted. What is the average retail price for this vehicle? Your answer Question #5 - Salena wants to purchase a four-year-old V6 sedan 4-door, which is advertised at $11,925. The car has no air-conditioning and no power seats. It has been driven 49,000 miles. The used vehicle guide does not indicate any adjustment for this car's mileage. What is the average retail price for this vehicle? Four-Year-Old Vehicles V6 Sedan 4-Door Deduct with no Air-Conditioning Deduct with no Power Seats Add Aluminum Alloy Wheels Add Compact Disc Player Add Leather Seats Add Theft Recovery System Average Retail Value S11,925 800 150 200 100 350 50 Question #8 - Nick is the principal operator of his vehicle. His driver-rating factor is 2.8 and his car is in age group D and insurance-rating group 11. The coverage he wants to purchase is 50/100 bodily injury and $100,000 for property damage. He would also like to have $50 deductible for both comprehensive and collision. What is his annual premium? Annual Liability Premium Bodily Injury Limits 25/100 300/300 Property Damage Limits $ 25,000 50,000 100,000 25/50 $299 307 50/100 $309 100/200 $365 $319 326 100/300 5374 383 $416 425 344 374 464 338 357 386 394 437 Coverage 15 $343 Collision 550 Deductible 325 Collision and Comprehensive Premium Age Insurance Rating Group Group 10 11 12 13 14 A 5236 5257 5279 $300 $322 B 224 243 264 284 305 233 253 272 291 D 203 222 240 259 277 A S80 $86 $99 $113 512 68 B2 94 107 90 102 115 D 62 73 86 97 110 213 310 296 Comprehensive 550 Deductible $1442 134 121 129 122 Question #7 - Stephanie's insurance policy includes 25/100 bodily injury limits and $25,000 property damage. Her vehicle is in age group B and insurance rating group 14. She has a $50 deductible comprehensive and $50 deductible collision insurance. Stephanie's driver-rating factor is 2.4. What is her annual base premium? Property Damage Limits $ 25,000 50,000 100,000 25/50 $299 Annual Liability Premium Bodily Injury Limits 25/100 50/100 100/200 $319 $309 $365 326 344 374 338 357 386 100/300 $374 383 300/300 $416 425 307 464 394 437 Age Coverage 15 $236 $343 Collision 550 Deductible 325 Collision and Comprehensive Premium Insurance Rating Group Group 10 11 12 13 $257 $279 $300 B 224 243 254 284 c 213 233 253 272 D 203 222 240 259 A S80 $86 599 $113 B 68 82 94 107 C 65 77 90 102 D 62 73 86 97 14 $322 305 291 277 5127 121 31D Comprehensive S50 Deductible 296 $142 134 115 110 129 122 0 Cody purchased a car three years ago at a price of $21,950. Today the car's estimated worth is $15,110. He calculates his annual variable cost to be $1,150. His fixed costs include $1,259 in insurance, $140 for license and registration fees, and he drove the car about 17,000 miles. What is the cost per mile for Cody to operate and maintain his vehicle? Your answer Seth bought a used car for $6,500 two years ago and the current value is estimated to be $4,400. He spent $1,299 for gas, $160 for oil changes, $209 for maintenance, and $200 for one new tire. He paid $657 for insurance and $158 for registration and licenses. He has driven the car a total of 16,789 miles. What was the cost per mile for him to operate and maintain his car? Kayla recently leased a new convertible. The $1,599 due at signing includes the title and license fee. Her monthly lease payments are $700 per month. The leasing company allows 12,000 miles per year with a $0.12 per mile overage charge. If the total lease cost is $26,800, for how many months does the lease last? Your answer Instead of purchasing a new car, Mari decided to lease one. Her deposit was $3,000 and her payments are $230 per month for 60 months. She also paid a $90 title fee and a $50 license fee. What is her total lease cost? Your answer Gio rented a car for four days at $40 per day, plus $0.22 per mile. In case he was involved in an accident, he purchased the collision deductible for $11 per day and paid $42 for gasoline to cover the 520 miles he drove. What was the cost per mile for Gio to rent the car? Your answer Noeli rented a car for 3 days at $40.00 per day, plus $0.20 per mile. To protect herself in case of an accident, she purchased the collision deductible for $10.00 per day and paid $40.00 for gasoline to cover the 500 miles she drove. What was her total cost to rent the car? Your Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started