Question

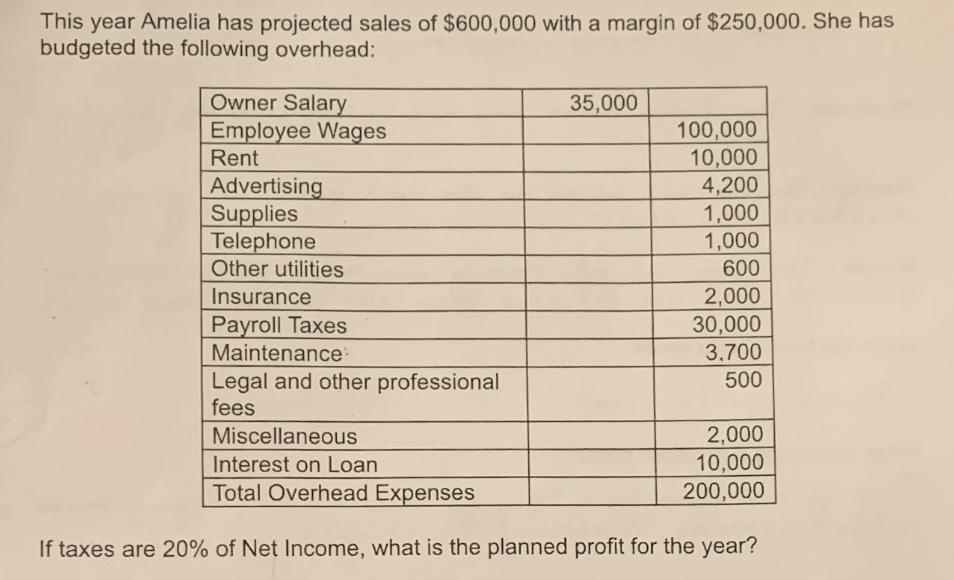

This year Amelia has projected sales of $600,000 with a margin of $250,000. She has budgeted the following overhead: Owner Salary Employee Wages Rent

This year Amelia has projected sales of $600,000 with a margin of $250,000. She has budgeted the following overhead: Owner Salary Employee Wages Rent Advertising Supplies Telephone Other utilities Insurance Payroll Taxes Maintenance: Legal and other professional fees 35,000 100,000 10,000 4,200 1,000 1,000 600 2,000 30,000 3.700 500 Miscellaneous Interest on Loan Total Overhead Expenses If taxes are 20% of Net Income, what is the planned profit for the year? 2,000 10,000 200,000

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the planned profit for the year we need to subtract the total overhead ex...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Construction accounting and financial management

Authors: Steven j. Peterson

2nd Edition

135017114, 978-0135017111

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App