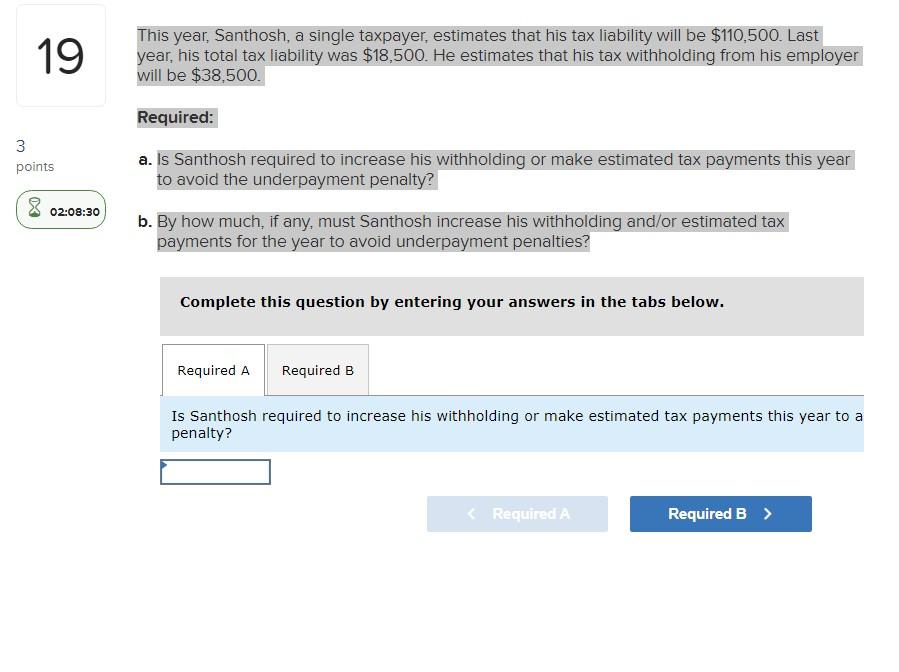

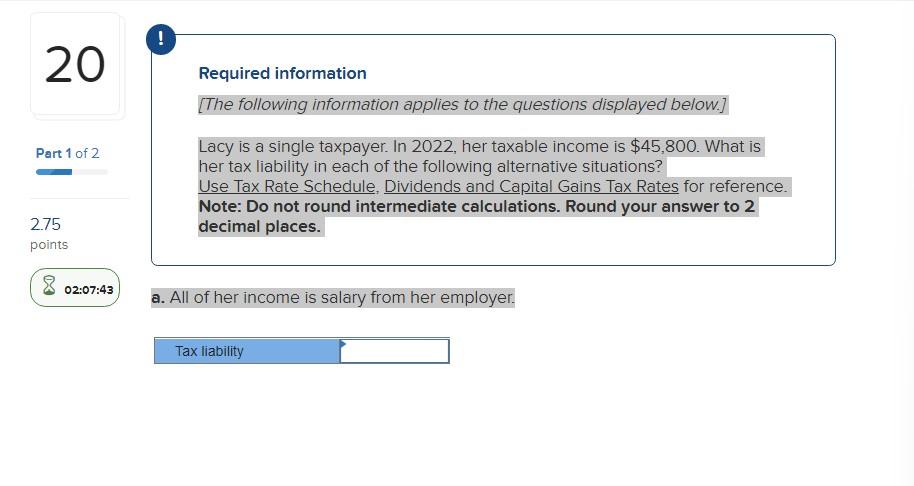

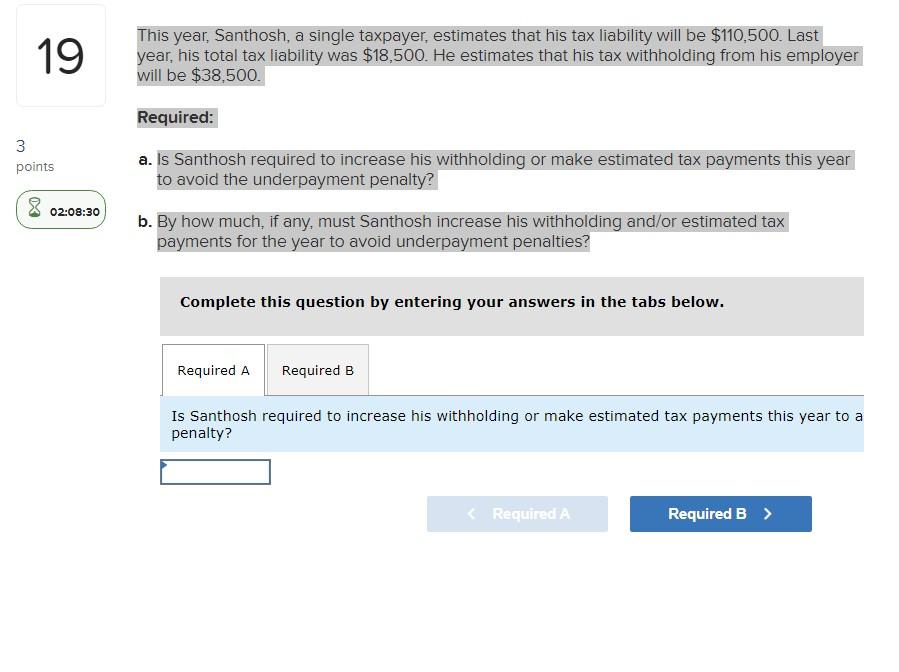

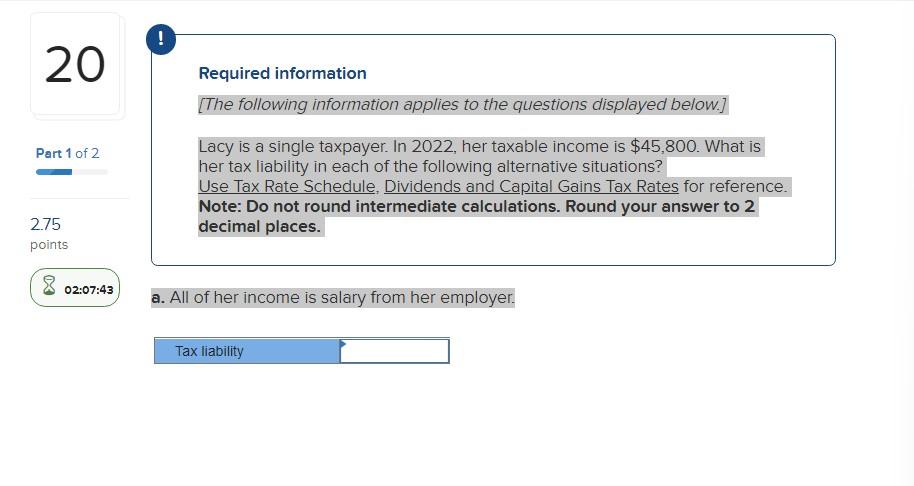

This year, Santhosh, a single taxpayer, estimates that his tax liability will be $110,500. Last rear, his total tax liability was $18,500. He estimates that his tax withholding from his employer vill be $38,500. Is Santhosh required to increase his withholding or make estimated tax payments this year to avoid the underpayment penalty? By how much, if any, must Santhosh increase his withholding and/or estimated tax payments for the year to avoid underpayment penalties? Complete this question by entering your answers in the tabs below. Is Santhosh required to increase his withholding or make estimated tax payments this year to a penalty? Required information [The following information applies to the questions displayed below.] Lacy is a single taxpayer. In 2022 , her taxable income is $45,800. What is her tax liability in each of the following alternative situations? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. Note: Do not round intermediate calculations. Round your answer to 2 decimal places. a. All of her income is salary from her employer. This year, Santhosh, a single taxpayer, estimates that his tax liability will be $110,500. Last rear, his total tax liability was $18,500. He estimates that his tax withholding from his employer vill be $38,500. Is Santhosh required to increase his withholding or make estimated tax payments this year to avoid the underpayment penalty? By how much, if any, must Santhosh increase his withholding and/or estimated tax payments for the year to avoid underpayment penalties? Complete this question by entering your answers in the tabs below. Is Santhosh required to increase his withholding or make estimated tax payments this year to a penalty? Required information [The following information applies to the questions displayed below.] Lacy is a single taxpayer. In 2022 , her taxable income is $45,800. What is her tax liability in each of the following alternative situations? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. Note: Do not round intermediate calculations. Round your answer to 2 decimal places. a. All of her income is salary from her employer