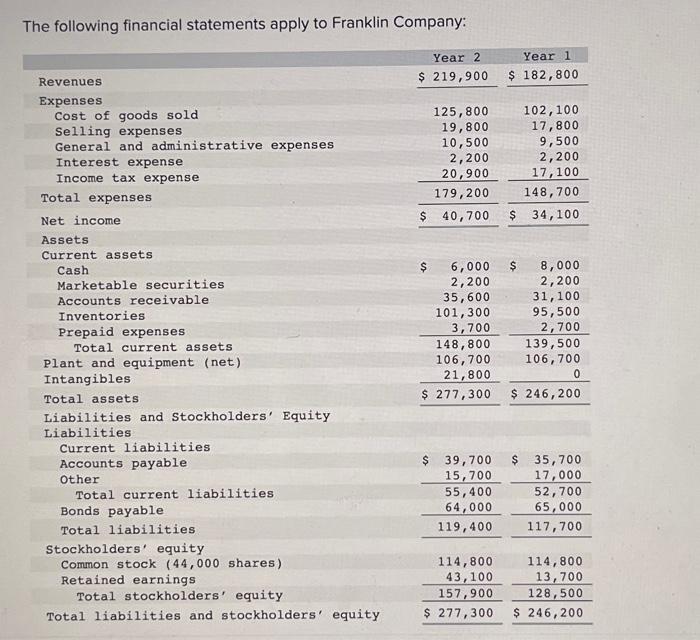

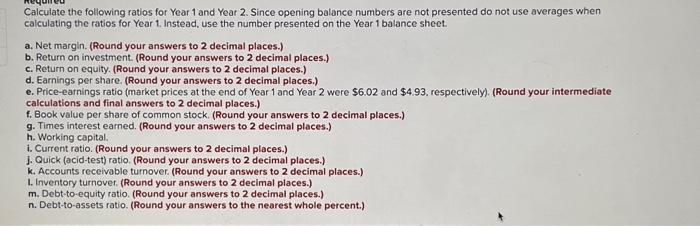

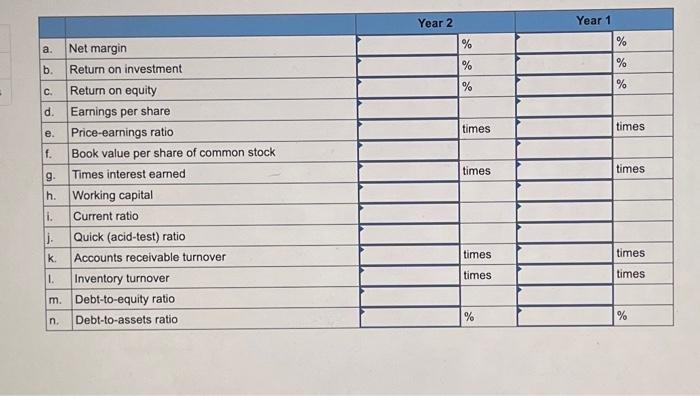

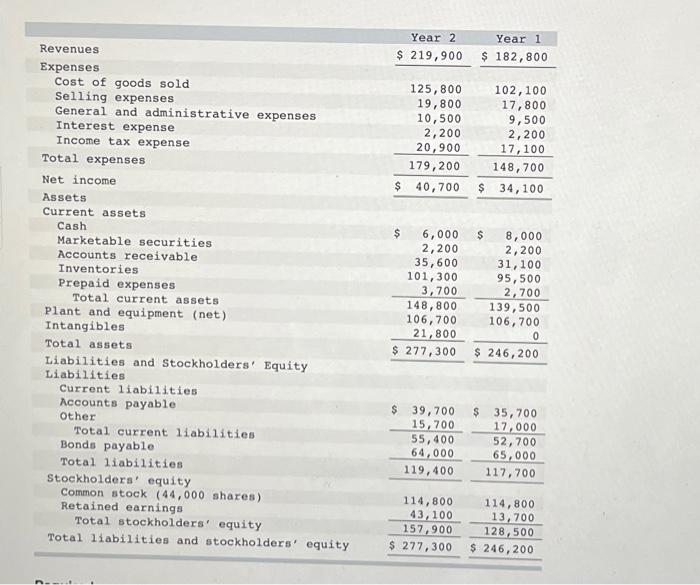

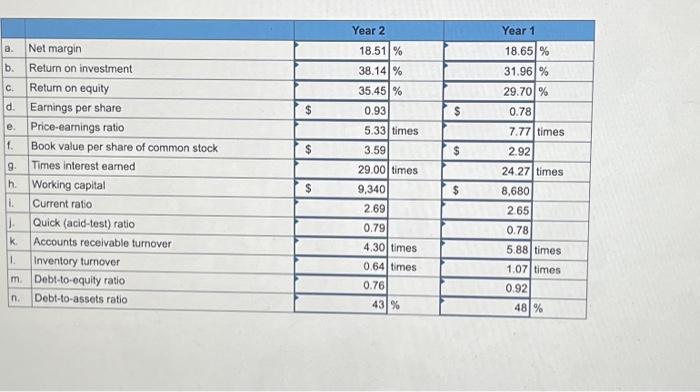

Thn fallnusinn financial ctatements annlv to Franklin Companv: Calculate the following ratios for Year 1 and Year 2 . Since opening balance numbers are not presented do not use averages when calculating the ratios for Year 1. Instead, use the number presented on the Year 1 balance sheet. a. Net margin. (Round your answers to 2 decimal places.) b. Return on investment. (Round your answers to 2 decimal places.) c. Return on equity. (Round your answers to 2 decimal places.) d. Earnings per share. (Round your answers to 2 decimal places.) e. Price-earnings ratio (market prices at the end of Year 1 and Year 2 were $6.02 and $4.93, respectively). (Round your intermediate calculations and final answers to 2 decimal places.) f. Book value per share of common stock. (Round your answers to 2 decimal places.) 9. Times interest earned. (Round your answers to 2 decimal places.) h. Working capital. i. Current ratio. (Round your answers to 2 decimal places.) j. Quick (acid-test) ratio. (Round your answers to 2 decimal places.) k. Accounts receivable turnover. (Round your answers to 2 decimal places.) I. Inventory turnover. (Round your answers to 2 decimal places.) m. Debt-to equity ratio. (Round your answers to 2 decimal places.) n. Debt-to-assets ratio. (Round your answers to the nearest whole percent.) Required Calculate the following ratios for Year 1 and Year 2. Since opening balance numbers are not presented do not use averages when calculating the ratios for Year 1 . Instead, use the number presented on the Year 1 balance sheet. a. Net margin. (Round your answers to 2 decimal places.) b. Return on investment. (Round your answers to 2 decimal places.) c. Return on equity. (Round your answers to 2 decimal places.) d. Earnings per share. (Round your answers to 2 decimal places.) e. Price-earnings ratio (market prices at the end of Year 1 and Year 2 were $6.02 and $4.93, respectively). (Round your intermediate calculations and final answers to 2 decimal places.) f. Book value per share of common stock. (Round your answers to 2 decimal places.) 9. Times interest earned. (Round your answers to 2 decimal places.) h. Working capital, i. Current ratio. (Round your answers to 2 decimal places.) j. Quick (acid-test) ratio. (Round your answers to 2 decimal places.) k. Accounts receivable turnover. (Round your answers to 2 decimal places.) I. Inventory turnover. (Round your answers to 2 decimal places.) m. Debt-to-equity ratio. (Round your answers to 2 decimal places.) n. Debt-to-assets ratio. (Round your answers to the nearest whole percent.)