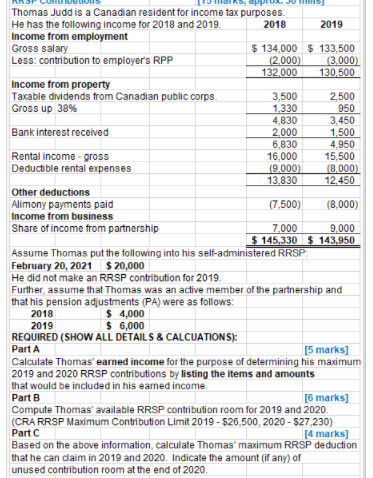

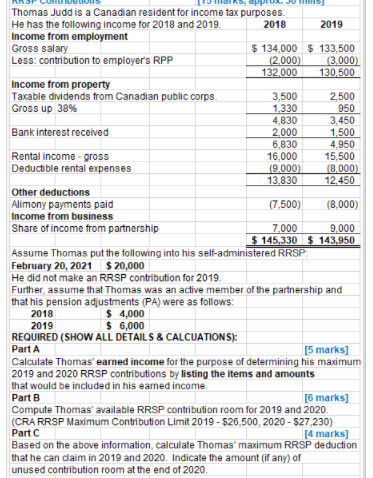

Thomas Judd is a Canadian resident for income tax purposes. He has the following income for 2018 and 2019. 2018 2019 Income from employment Gross salary $ 134,000 $ 133,500 Less: contribution to employer's RPP (2.000) (3.000) 132.000 130.500 Income from property Taxable dividends from Canadian public corps. 3,500 2,500 Gross up 38% 1,330 950 4,830 3,450 Bank interest received 2.000 1,500 6.830 4,950 Rental income-gross 16,000 15,500 Deductible rental expenses 19.000) (8,000) 13.830 12.450 Other deductions Alimony payments paid (7,500) (8,000) Income from business Share of income from partnership 7.000 9.000 $ 145,330 $ 143.950 Assume Thomas put the following into his self-administered RRSP: February 20, 2021 $ 20,000 He did not make an RRSP contribution for 2019 Further assume that Thomas was an active member of the partnership and that his pension adjustments (PA) were as follows: 2018 $ 4,000 2019 $ 6,000 REQUIRED (SHOW ALL DETAILS & CALCUATIONS): Part A [5 marks] Calculate Thomas' earned income for the purpose of determining his maximum 2019 and 2020 RRSP contributions by listing the items and amounts that would be included in his earned income. Part B [6 marks] Compute Thomas' available RRSP contribution room for 2019 and 2020. (CRA RRSP Maximum Contribution Limit 2019 - $26.500, 2020 - 527 230) Part [4 marks] Based on the above information, calculate Thomas' maximum RRSP deduction that he can daim in 2019 and 2020. Indicate the amount (if any) of unused contribution room at the end of 2020. Thomas Judd is a Canadian resident for income tax purposes. He has the following income for 2018 and 2019. 2018 2019 Income from employment Gross salary $ 134,000 $ 133,500 Less: contribution to employer's RPP (2.000) (3.000) 132.000 130.500 Income from property Taxable dividends from Canadian public corps. 3,500 2,500 Gross up 38% 1,330 950 4,830 3,450 Bank interest received 2.000 1,500 6.830 4,950 Rental income-gross 16,000 15,500 Deductible rental expenses 19.000) (8,000) 13.830 12.450 Other deductions Alimony payments paid (7,500) (8,000) Income from business Share of income from partnership 7.000 9.000 $ 145,330 $ 143.950 Assume Thomas put the following into his self-administered RRSP: February 20, 2021 $ 20,000 He did not make an RRSP contribution for 2019 Further assume that Thomas was an active member of the partnership and that his pension adjustments (PA) were as follows: 2018 $ 4,000 2019 $ 6,000 REQUIRED (SHOW ALL DETAILS & CALCUATIONS): Part A [5 marks] Calculate Thomas' earned income for the purpose of determining his maximum 2019 and 2020 RRSP contributions by listing the items and amounts that would be included in his earned income. Part B [6 marks] Compute Thomas' available RRSP contribution room for 2019 and 2020. (CRA RRSP Maximum Contribution Limit 2019 - $26.500, 2020 - 527 230) Part [4 marks] Based on the above information, calculate Thomas' maximum RRSP deduction that he can daim in 2019 and 2020. Indicate the amount (if any) of unused contribution room at the end of 2020