Answered step by step

Verified Expert Solution

Question

1 Approved Answer

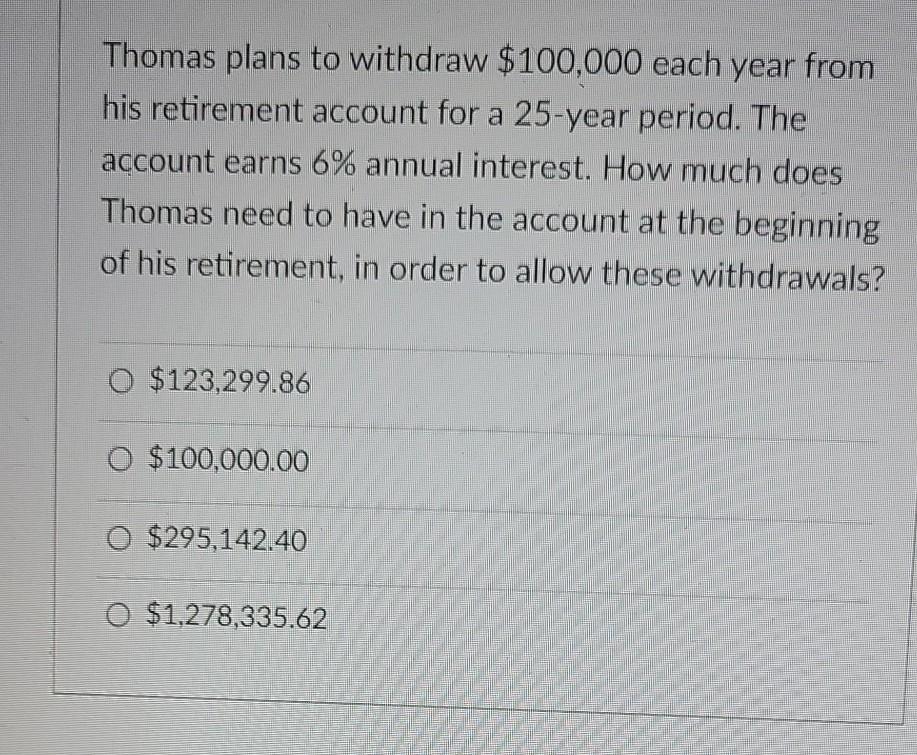

Thomas plans to withdraw $100,000 each year from his retirement account for a 25-year period. The account earns 6% annual interest. How much does Thomas

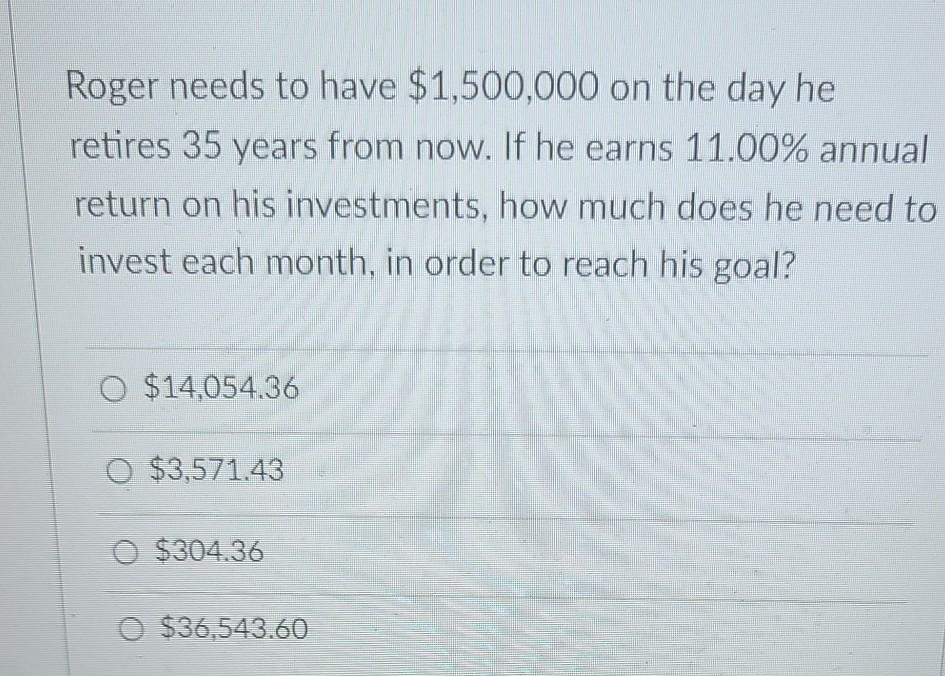

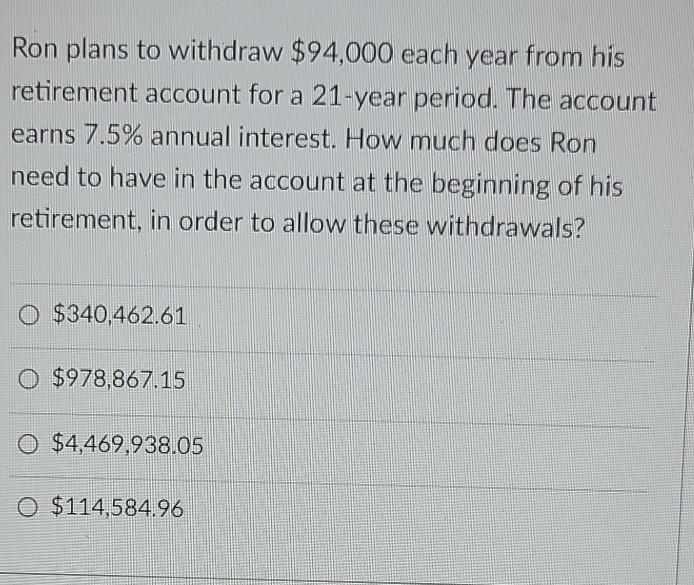

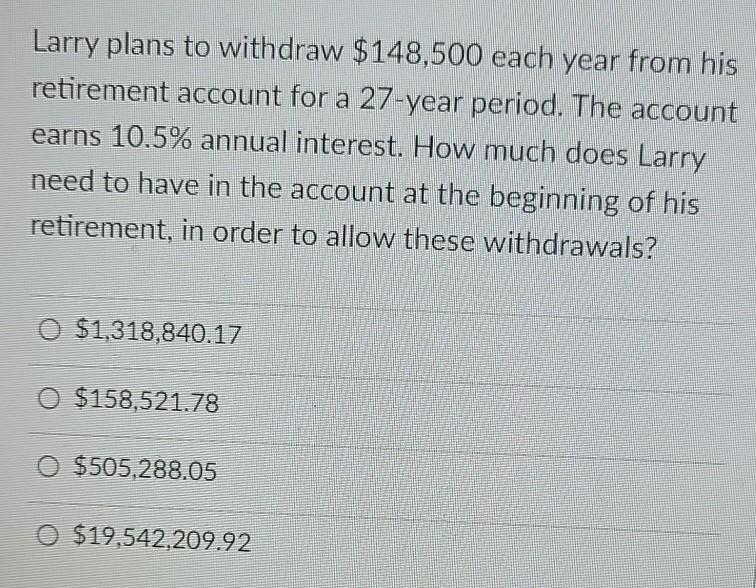

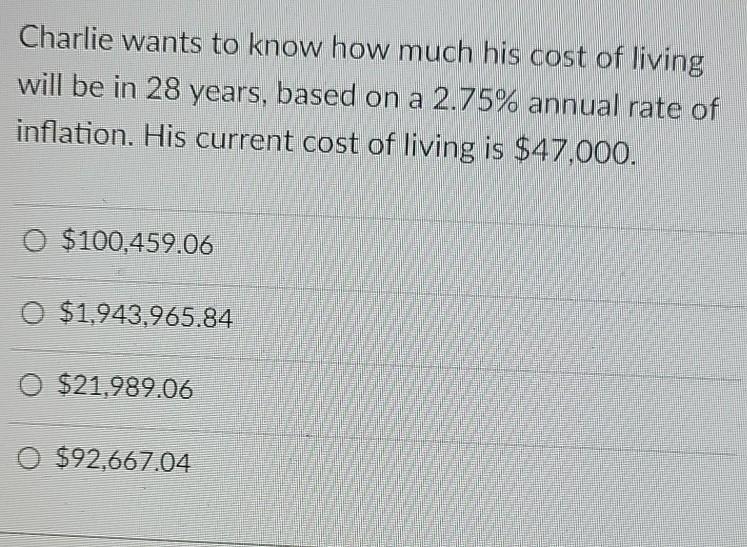

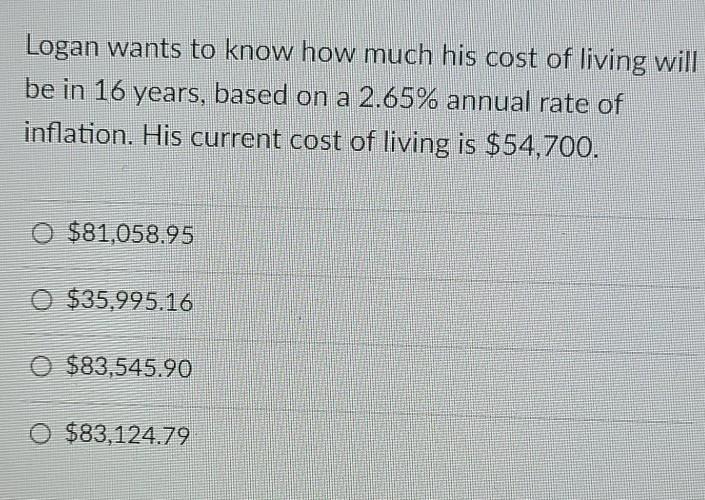

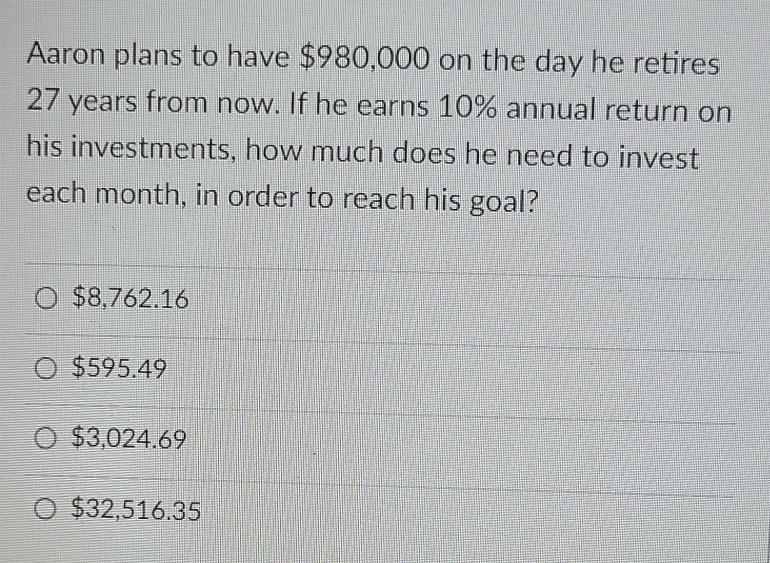

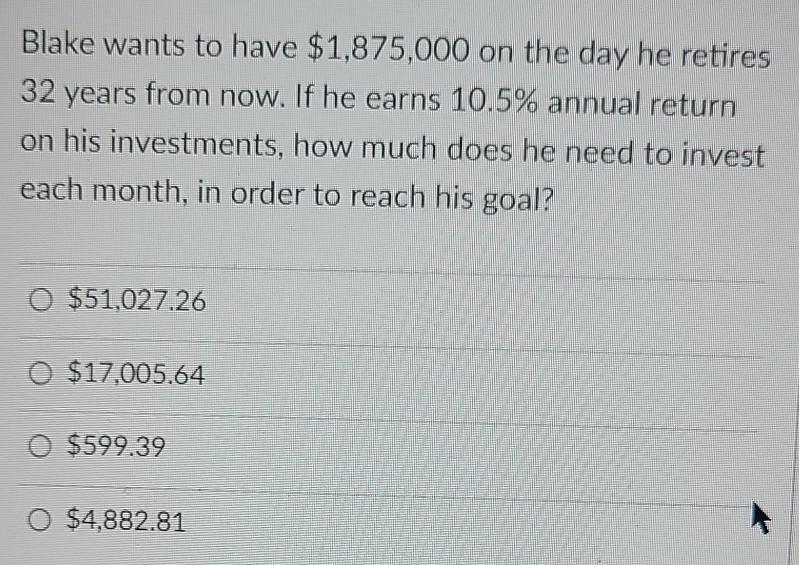

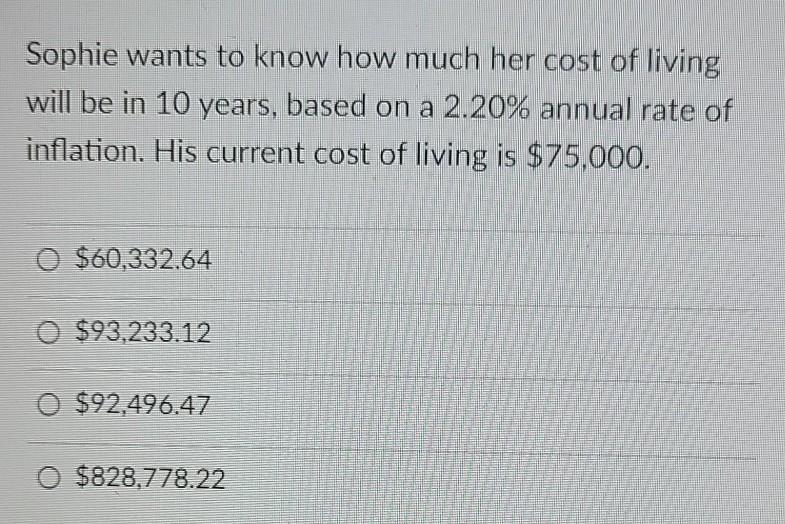

Thomas plans to withdraw $100,000 each year from his retirement account for a 25-year period. The account earns 6% annual interest. How much does Thomas need to have in the account at the beginning of his retirement, in order to allow these withdrawals? O $123,299.86 O $100,000.00 0 $295,142.40 0 $1,278,335.62 Roger needs to have $1,500,000 on the day he retires 35 years from now. If he earns 11.00% annual return on his investments, how much does he need to invest each month, in order to reach his goal? O $14,054.36 o $3,571.43 O $304.36 0 $36.543.60 Ron plans to withdraw $94,000 each year from his retirement account for a 21-year period. The account earns 7.5% annual interest. How much does Ron need to have in the account at the beginning of his retirement, in order to allow these withdrawals? O $340,462.61 O $978,867.15 0 $4,469,938.05 0 $114,584.96 Larry plans to withdraw $148,500 each year from his retirement account for a 27-year period. The account earns 10.5% annual interest. How much does Larry need to have in the account at the beginning of his retirement, in order to allow these withdrawals? $1,318,840.17 O $158,521.78 0 $505,288.05 0 $19,542,209.92 Charlie wants to know how much his cost of living will be in 28 years, based on a 2.75% annual rate of inflation. His current cost of living is $47,000. 0 $100,459.06 0 $1,943,965.84 O $21,989.06 O $92,667.04 Logan wants to know how much his cost of living will be in 16 years, based on a 2.65% annual rate of inflation. His current cost of living is $54,700. O $81,058.95 O $35,995.16 0 $83,545.90 0 $83,124.79 Aaron plans to have $980,000 on the day he retires 27 years from now. If he earns 10% annual return on his investments, how much does he need to invest each month, in order to reach his goal? 0 $8,762.16 O $595.49 0 $3,024.69 0 $32,516.35 Blake wants to have $1,875,000 on the day he retires 32 years from now. If he earns 10.5% annual return on his investments, how much does he need to invest each month, in order to reach his goal? 0 $51,027.26 $17,005.64 O $599.39 0 $4,882.81 Sophie wants to know how much her cost of living will be in 10 years, based on a 2.20% annual rate of inflation. His current cost of living is $75,000. $60,332.64 0 $93,233.12 0 $92,496.47 $828,778.22

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started