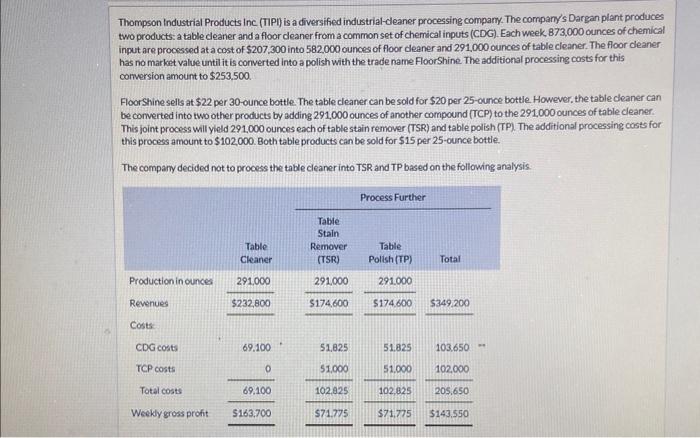

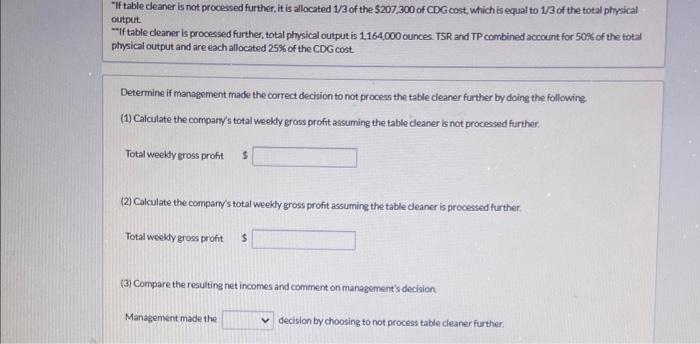

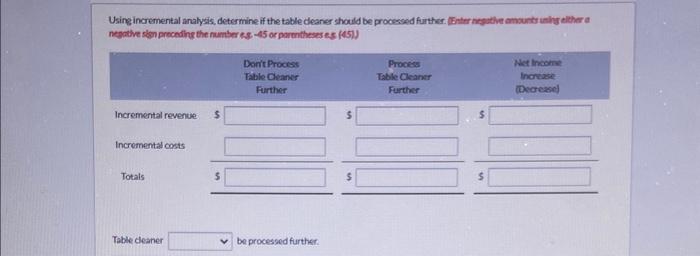

Thompson Industrial Products Inc (TIPI) is a diversified industrial-cleaner processing company. The company's Dargan plant produces two products: a table cleaner and a floor deaner from a common set of chemical inputs (CDG). Each week, 873,000 ounces of chemical input are processed at a cost of $207,300 into 582,000 cunces of floor deaner and 291,000 ounces of table cleaner. The floor deaner: has no market value until it is converted into a polish with the trade name FloorShine The additional processing costs for this compersion amount to $253.500 Floor Shine sells at $22 per 30 -ounce bottle. The table cleaner can be sold for $20 per 25 -ounce bottle However, the table cleaner can be comverted into two other products by adding 291,000 ounces of another compound (TCP) to the 291,000 ounces of table cleaner. This joint process will yleld 291,000 ounces each of table stain remover (TSR) and table polish (TP). The additional processing costs for this process amount to $102,000. Both table products can be sold for $15 per 25 -ounce bottle. The compary decided not to process the table cleaner into TSR and TP based on the following analysis. "If table deaner is not processed further, it is allocated 1/3 of the $207,300 of CDG cost which is equal to 1/3 of the total physical output * If table deaner is processed further, total physical output is 1,164,000 ounces. TSR and TP combined account for 50BS of the total physical output and are each allocated 25% of the CDG cost. Determine if manapement made the correct decision to not process the table deaner further by doing the following. (1) Calculate the company's total weekdy gross profit assuming the table cleaner is not processed further: Total weekty gross profit (2) Calculate the company's total weeldy gross profit assuming the table cleaner is procested further. Total weokdy gross profit (3) Cornpare the resulting net incomes and comment on management's decision Manajement made the decision by choosing to not process table cleaner further. Usingincremental analysis, determine if the table deanes should be processed further fifttr ncsuthe amsuntr inity oleher a negative slon proceding the number 8845 or parmtheses es (45)) Table cleaner be processed further