Question

Thorndike Oil (TO) is a diversified company with two operating divisions: Oil and Telecom which represent 70% and 30% of the firms value, respectively. TO

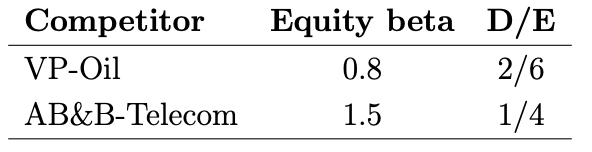

Thorndike Oil (TO) is a diversified company with two operating divisions: Oil and Telecom which represent 70% and 30% of the firms value, respectively. TO has no debt on its balance sheet. To estimate the cost of capital for each division, TO has identified one principal competitor for each of its two divisions. The competitors are pure-plays, i.e., they are not diversified and operate in only one industry each. They maintain a constant Debt-Equity ratio at all times. Assume that the debt of the two competitors is risk-free, the risk-free interest rate is 1%, the expected return on the market portfolio is 6% and that the CAPM holds.

(a) Estimate the expected return on TOs equity.

Now assume that TO is considering a change in its capital structure that will increase its leverage. Two plans are considered:

1. Issue $55 million immediately in debt and maintain its level in perpetuity.

2. Issue $90 million immediately in debt, repay $20 million of its principal in one year, $20 million in two years and maintaining the remaining $50 million in perpetuity.

Assume that in both plans TO will be able to borrow at the risk-free interest rate; that all proceeds are paid out to equity holders and that in Plan 2 the reduction in debt is financed by issuing equity. Corporate tax rate is 35% and there are no other markets imperfections.

(b) Which of these two plans would you recommend? Explain.

Competitor Equity beta D/E VP-Oil AB&B-Telecom 0.8 1.5 2/6 1/4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started