Those are sheets for data, the questions are at the bottom. Please show all of your work!

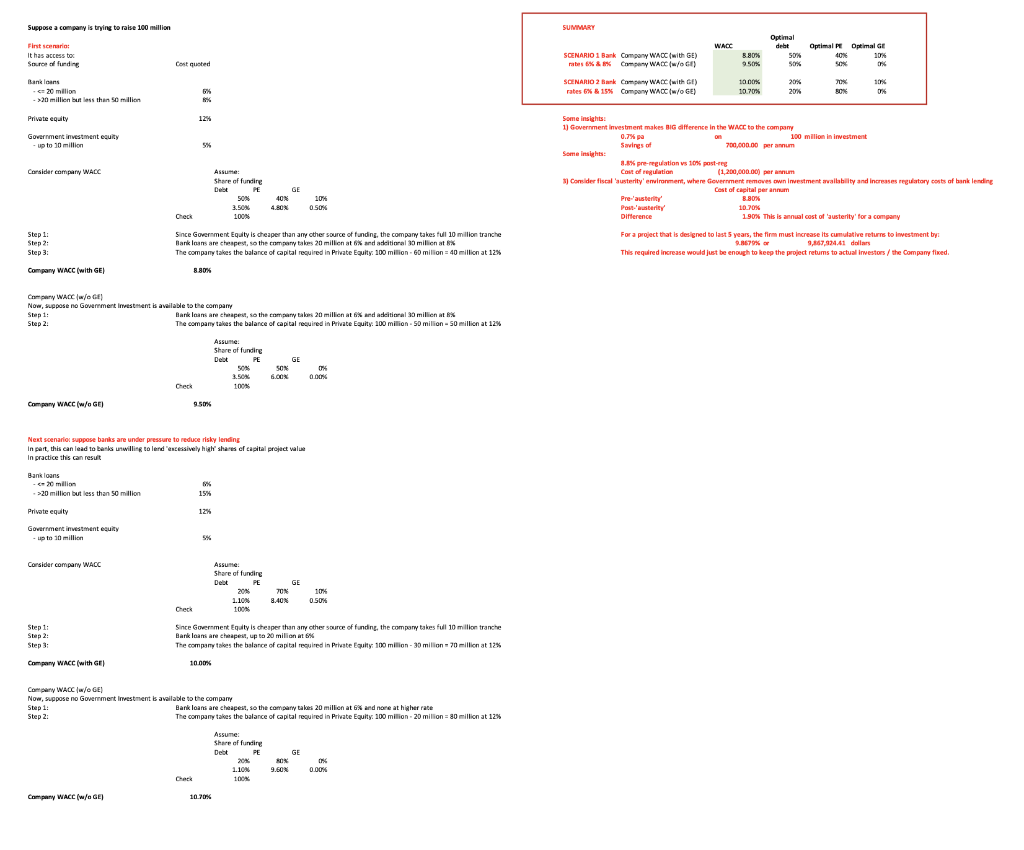

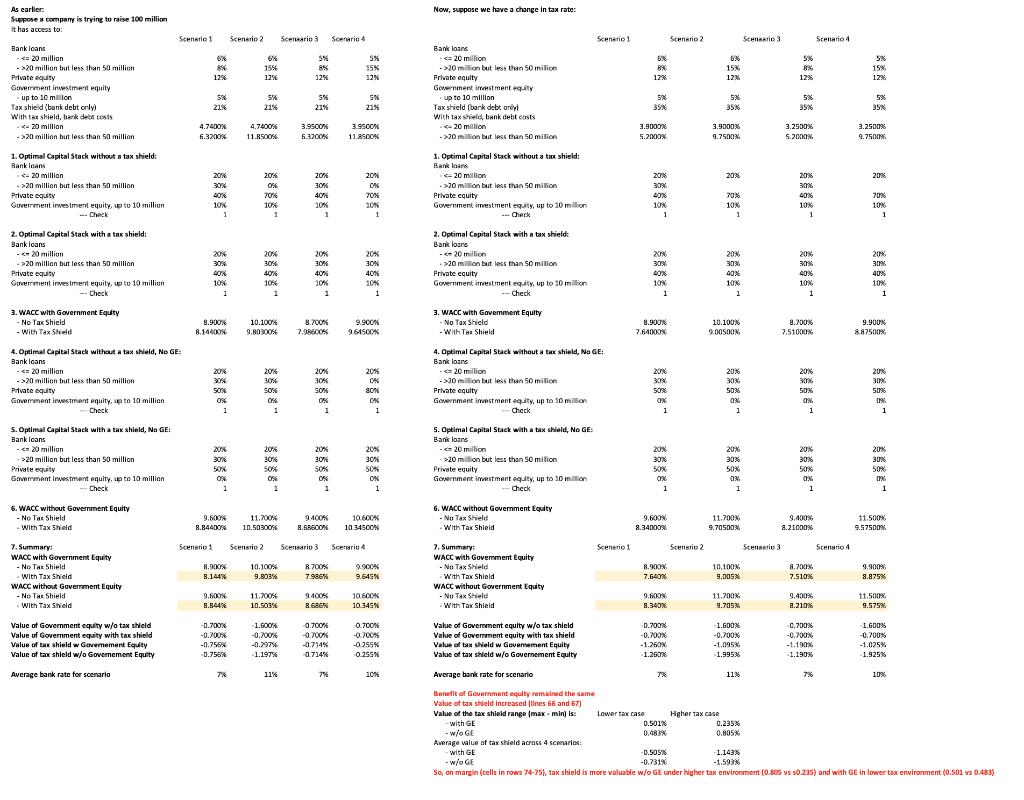

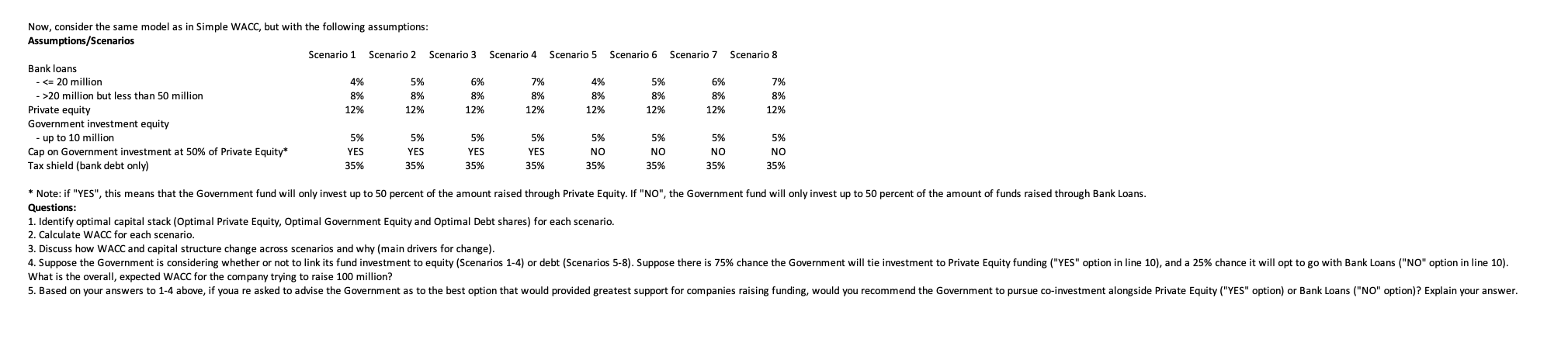

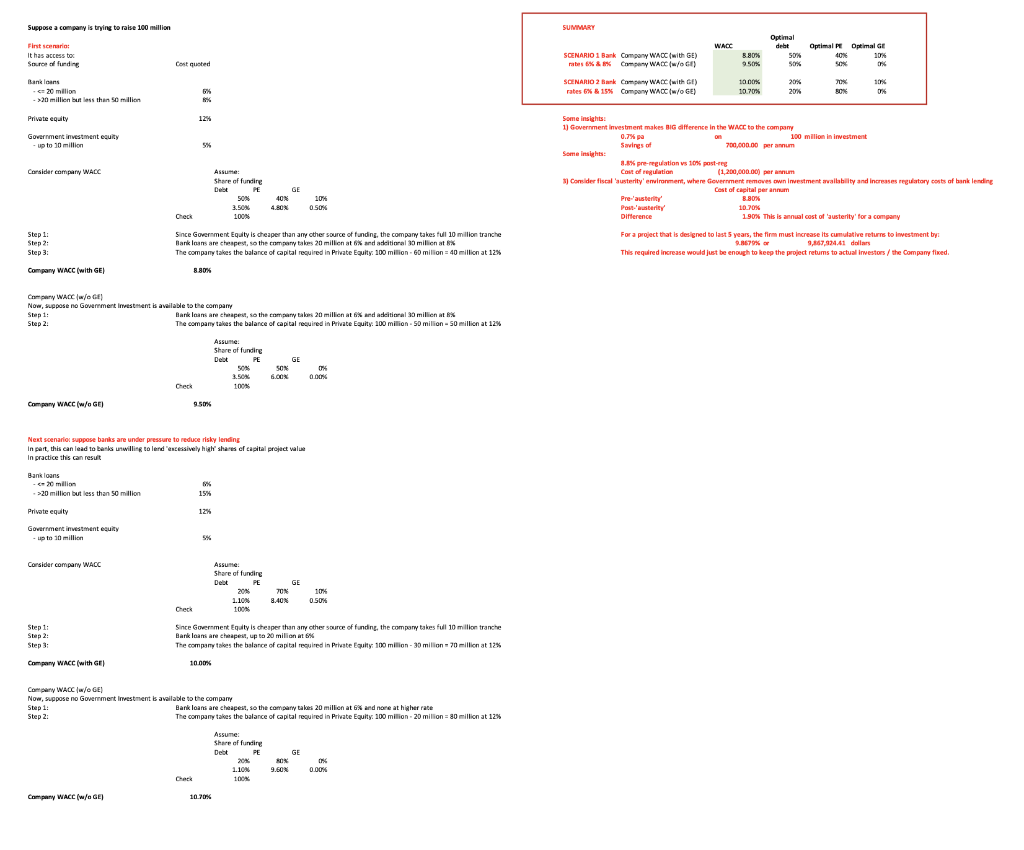

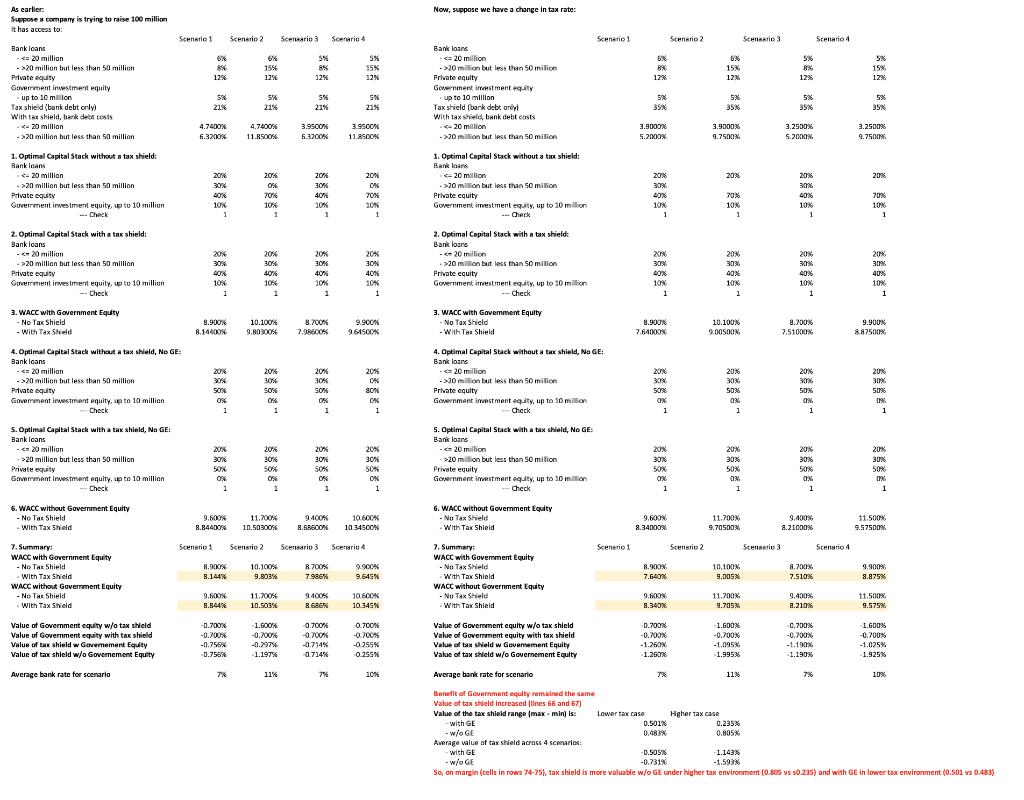

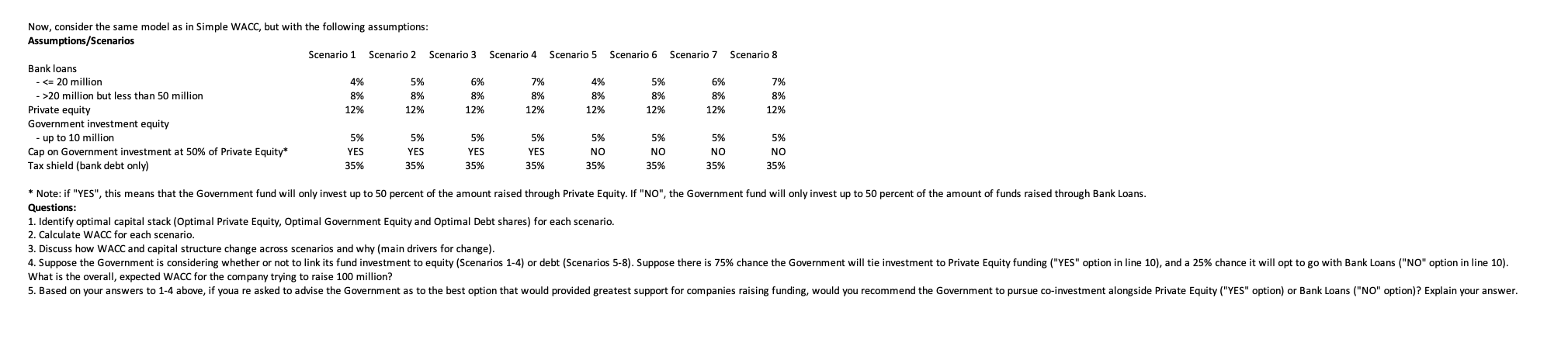

Suppose a company is trying to raise 100 million SUMMARY WACC First scenario It has access to Source of funding Optimal debat 50% 50% 880 9.50% Optimal Pt Optimal GE 40% 0% Cost quoted SCENARIO 1 Bank Company WAOC (with GE rabes 8X & Company WACC (W/OGE SCENARIO 2 Bank Company WACC (with GEY rates 6% & 15% Company WAOC (W/O GE) Rank loans 20 milion >20 million but less than 5 million 10.00% 10.70% 20% 20% 0 6 X TH 124 Private equity Government investment equity - up to 10 million 5% Some insights: 1) Government investment makes it difference in the WACC to the company 0.7% pa 100 million in investment Savings 700,000.00 perum Some insights: 3.8% pre-regulations 10% postre Cost of regulation (1.200,000.00) per annum Consider fiscal austerity environment, where Government removes own Investment availability and increases regulatory costs of bank lending Cost of capital per annum Pre-austerity 8.80% Postustarity 10.70% 190% This is annual cost of austerity for a company Consider company WALC Assum: Share of funding Debt PE SON 3.500 % 100% GE 40% 4.80% 0.50% Check Difference Step 1: Step 2: Step 3: Since Government Equity is cheaper than any other source of funding, the company takes full 10 million tranche Bank loans are cheapest, so the company takes 20 million at 6% and aditional 30 milionat The company takes the balance of capital required in Private Equity 100 million - 60 million = 40 million at 12% For a project that is designed to last 5 years, the firm must increase its cumulative returns to Investment by 0.3667% 9,867,974.41 dollars This required increase would just be enough to keep the project retums to actual investors / the Company fixed Company WACC (with GE) 8.80% Company WACC w/6) Now, suppose no Government investment is available to the company Step 1: Bank loans are cheapest, so the company tak 20 million at 6% and aditional 30 miliona Step 2: The company takes the balance of capital required in Private Equity 100 million-50 million-50 million at 12% Assume : Share of funding Debt PE 50% 3.50. 100% GE SON 6.00% 0 0.00% Check Company WACC (W/O GE) 9.50% Next scenarios suppose banks are under pressure to reduce risky lending In part, this can lead to banks willing to lend anzessively shares of capital project value In practice this can result Bank loans - million . >20 million but less than 50 milion 15% Private equity 12% Government investment equity - up to 10 million 5% Consider company WACC ASS Assunta Share of funding De PL PE 20% 1.100 100% GE 70% 8.40N 10% 0.50% Check Step 1: Step 2: Step 3: Since Government Equity is cheaper than any other source of funding the company takes full 10 million tranche Bank loans are cheapes, up to 20 milionat 6% The company takes the balance of capital required in Prieste Equity 100 milion - 30 milion - 70 million at 12% 10.00% Company WACC (with Gr Company WACC w/ GE Now, suppose no Government Investment is available to the company Step 1: Bank loans are cheapest, so the company takes 20 million at 6% and none at higher rate Step 2: The company takes the balance of capital required in Private Equity: 100 million 20 million = 30 million at 12% Assume: Share of funding Debt PE 20. 1.100 100% GE RON 9.60 0 0.00% Dhar Company WACC (w/GE) 10.70% Scenario 2 10.1001 8.700% li 4.2012 10.100% 11.com SA 10.600% 9.OOT 11.2008 9.2003 Scenario 1 Scenario 2 8.7004 9.9004 9 100% SOUS 11.00 10.BD ge he 09 100 114 74 20% * 7% 403 Now, consider the same model as in Simple WACC, but with the following assumptions: Assumptions/Scenarios Scenario 1 Scenario 2 Scenario 3 Scenario 4 Scenario 5 Scenario 6 Scenario 7 Scenario 8 Bank loans - 20 million but less than 50 million 8% 8% 8% 8% 8% 8% 8% 8% 8% Private equity 12% 12% 12% 12% 12% 12% 12% 12% Government investment equity - up to 10 million 5% 5% 5% 5% 5% 5% 5% 5% Cap on Government investment at 50% of Private Equity* YES YES YES YES NO NO NO NO Tax shield (bank debt only) 35% 35% 35% 35% 35% 35% 35% 35% * Note: if "YES", this means that the Government fund will only invest up to 50 percent of the amount raised through Private Equity. If "NO", the Government fund will only invest up to 50 percent of the amount of funds raised through Bank Loans. Questions: 1. Identify optimal capital stack (Optimal Private Equity, Optimal Government Equity and Optimal Debt shares) for each scenario. 2. Calculate WACC for each scenario. 3. Discuss how WACC and capital structure change across scenarios and why (main drivers for change). 4. Suppose the Government is considering whether or not to link its fund investment to equity (Scenarios 1-4) or debt (Scenarios 5-8). Suppose there is 75% chance the Government will tie investment to Private Equity funding ("YES" option in line 10), and a 25% chance it will opt to go with Bank Loans ("NO" option in line 10). What is the overall, expected WACC for the company trying to raise 100 million? 5. Based on your answers to 1-4 above, if youa re asked to advise the Government as to the best option that would provided greatest support for companies raising funding, would you recommend the Government to pursue co-investment alongside Private Equity ("YES" option) or Bank Loans ("NO" option)? Explain your