Question

Those are the instructions for the project. I need help with filling out the tables. Learn to work with financial calculations and create a weighted

Those are the instructions for the project. I need help with filling out the tables. Learn to work with financial calculations and create a weighted scoring model. Be sure to make your output look professional.

Rainforest.com (RFC) is an Internet based bookstore solely and has never had a physicalbuilding where they sell books and other items. The startup company was recently fundedusing private donations and they have come to us, The Boilermaker Special Consulting Group(BSCG), to help them select the best projects which will provide them the best return on theirinvestments. We have been put on the steering committee to improve the project selectionprocess. RFC has decided that any new projects selected for implementation must first meetstrict financial measures as well as several other criteria. They have set minimum values for ROI, NPV, IRR, and the payback period.

| NPV | IRR | ROI | Payback Period | |

| Minimums | $50,000 | 20% | 30% | 3 years or less |

The following information was generated for the current set (4 projects) of proposednew projects.

Project 1

Year 0 | Year 1 | Year 2 | Year 3 | Year 4 | |

Costs | $120,000 | $15,000 | $12,000 | $7500 | $7500 |

Revenue | $0 | $5,000 | $70,000 | $100,000 | $110,000 |

Level of Risk | High |

Strategic Plan Alignment | Directly supports several line items |

Competitive Analysis | Current Competitors have not yet completed a similar project |

Resource Availability | Good |

Project 2

Year 0 | Year 1 | Year 2 | Year 3 | Year 4 | |

Costs | $0 | $51,000 | $25,000 | $6,000 | $6000 |

Revenue | $0 | $4,000 | $77,000 | $80,000 | $100,000 |

Level of Risk | Medium |

Strategic Plan Alignment | The project is something entirely new, not on the strategic plan, but being mandated by the FDA of the U.S. government |

Competitive Analysis | One current competitor has completed a similar project |

Resource Availability | Good |

Project 3

Year 0 | Year 1 | Year 2 | Year 3 | Year 4 | |

Costs | $120,000 | $15,000 | $5,000 | $5,000 | $5000 |

Revenue | $0 | $50,000 | $100,000 | $150,000 | $100,000 |

Level of Risk | Low |

Strategic Plan Alignment | Supports several line items |

Competitive Analysis | Current Competitors have not yet completed a similar project |

Resource Availability | Average |

Project 4

Year 0 | Year 1 | Year 2 | Year 3 | Year 4 | |

Costs | 0 | $60,000 | $50,000 | $20,000 | $7500 |

Revenue | $0 | $7,000 | $71,000 | $65,000 | $90,000 |

Level of Risk | Medium to High |

Strategic Plan Alignment | Supports several line items |

Competitive Analysis | Current Competitors have not yet completed a similar project |

Resource Availability | Poor |

Assignment: Prepare a professional looking report that answers the following questions:

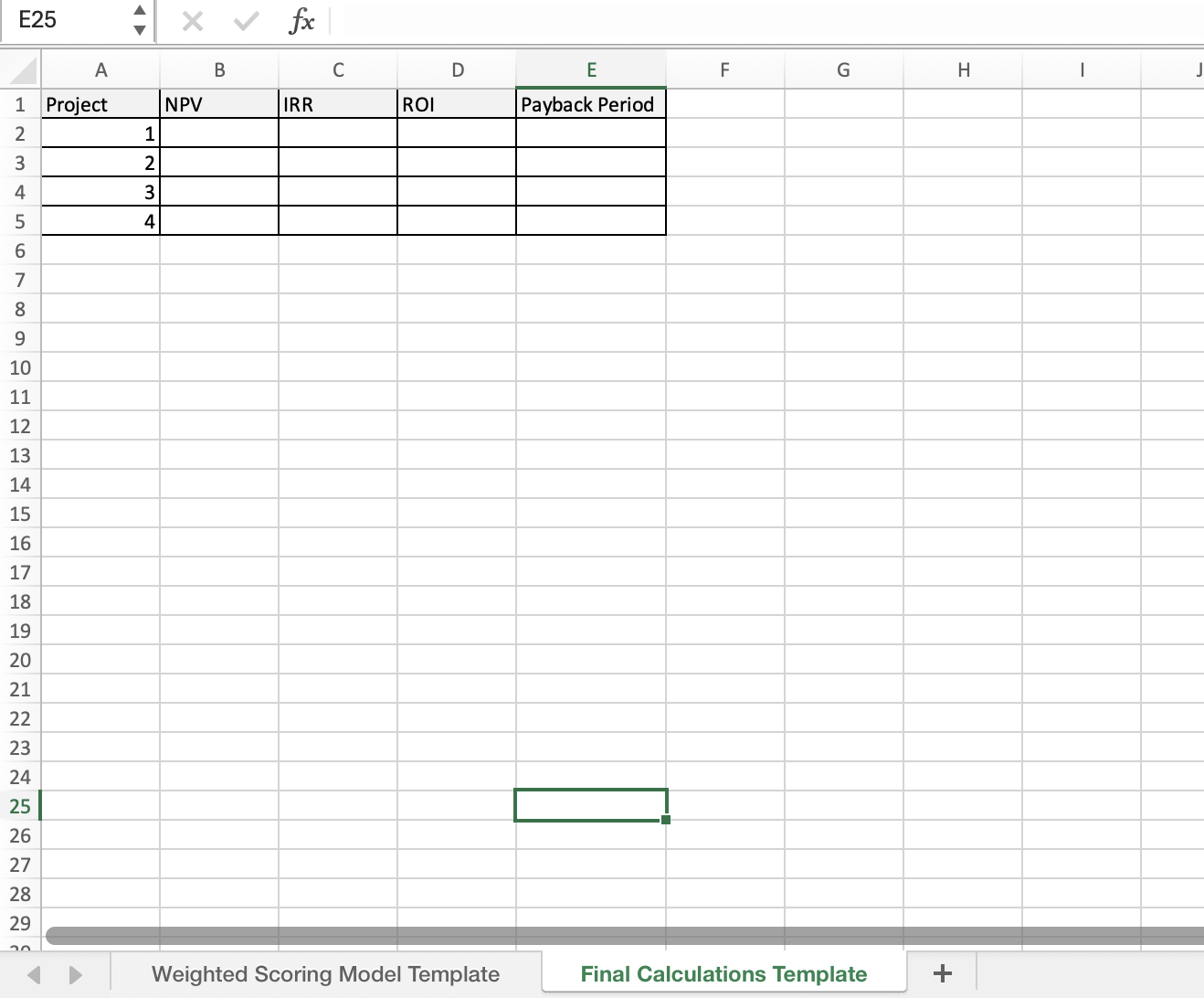

Part 1: Use Microsoft Excel or equivalent to calculate: (Use template provided in Brightspace)

- Calculate NPV for each project using a 10% discount rate.

- Calculate IRR for each project.

- Calculate ROI for each project using a 10% discount rate.

- Calculate payback period for each project.

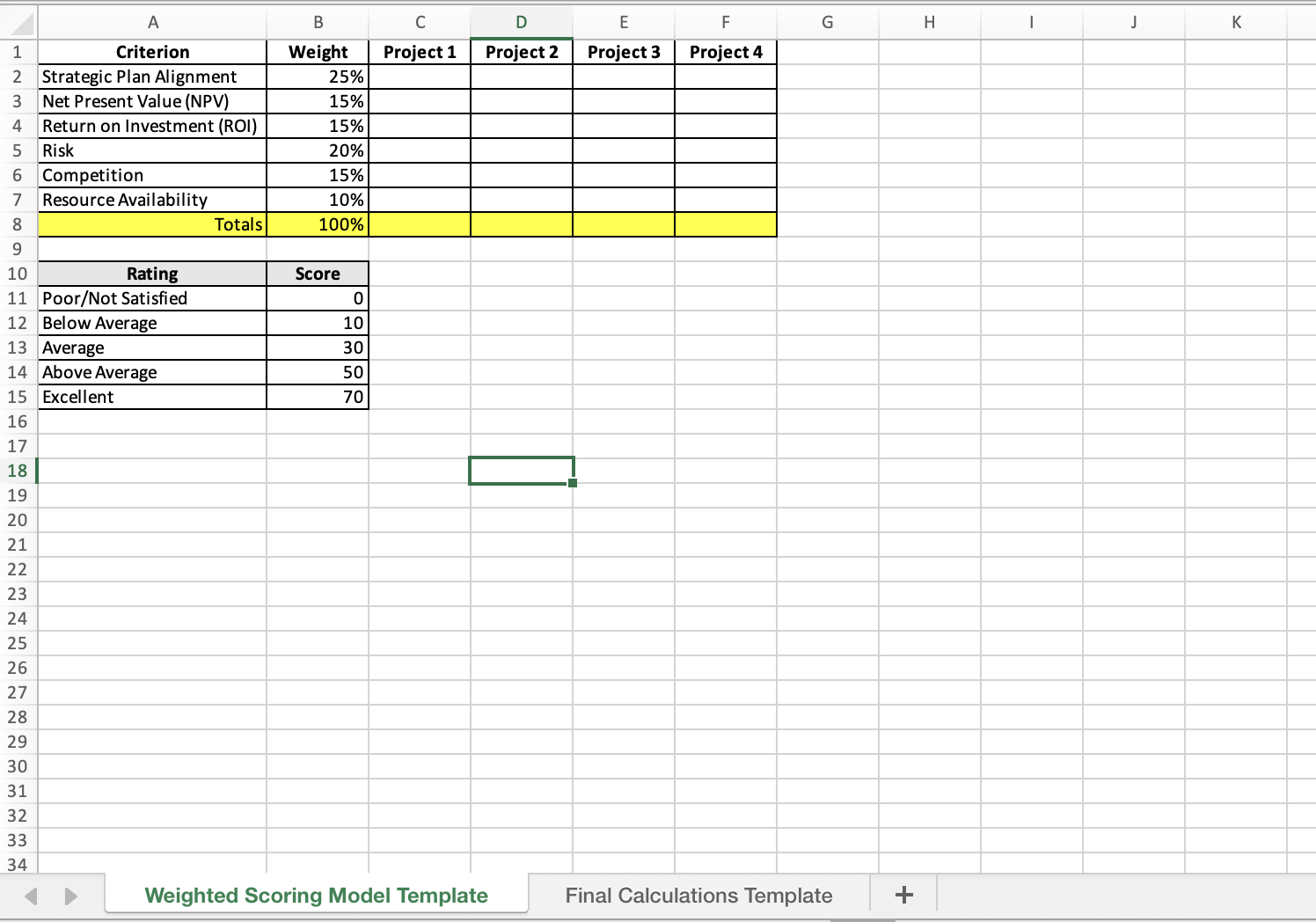

Part 2: Create a weighted scoring model using the following criteria: Strategic Plan Alignment, NPV, ROI, Risk, Competition, and Resource Availability. The organization has decided to apply the following weights to each of the criteria as: 25%, 15%, 15%, 20%, 15%, and 10% respectively. (Use template presented in lecture)

Part 3: Answer the question: If the steering committee can pick only one project to work on, which would it be? Why?

Part 4: Prepare a Professional looking report (cover page, TOC, executive summary, etc.) that contains the results and answers to Parts 1-3.

123456789 A Criterion Strategic Plan Alignment Net Present Value (NPV) B D Weight E Project 1 Project 2 Project 3 F G H J K Project 4 25% 15% Return on Investment (ROI) Risk 15% 20% 6 Competition 15% Resource Availability 10% Totals 100% 10 Rating Score 11 Poor/Not Satisfied 0 12 Below Average 10 13 Average 30 14 Above Average 50 15 Excellent 70 16 17 96 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 Weighted Scoring Model Template Final Calculations Template +

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started