Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Those one with red need to be fixed please! Cullumber Company manufactures equipment. Cullumber's products range from simple automated machinery to complex systems containing numerous

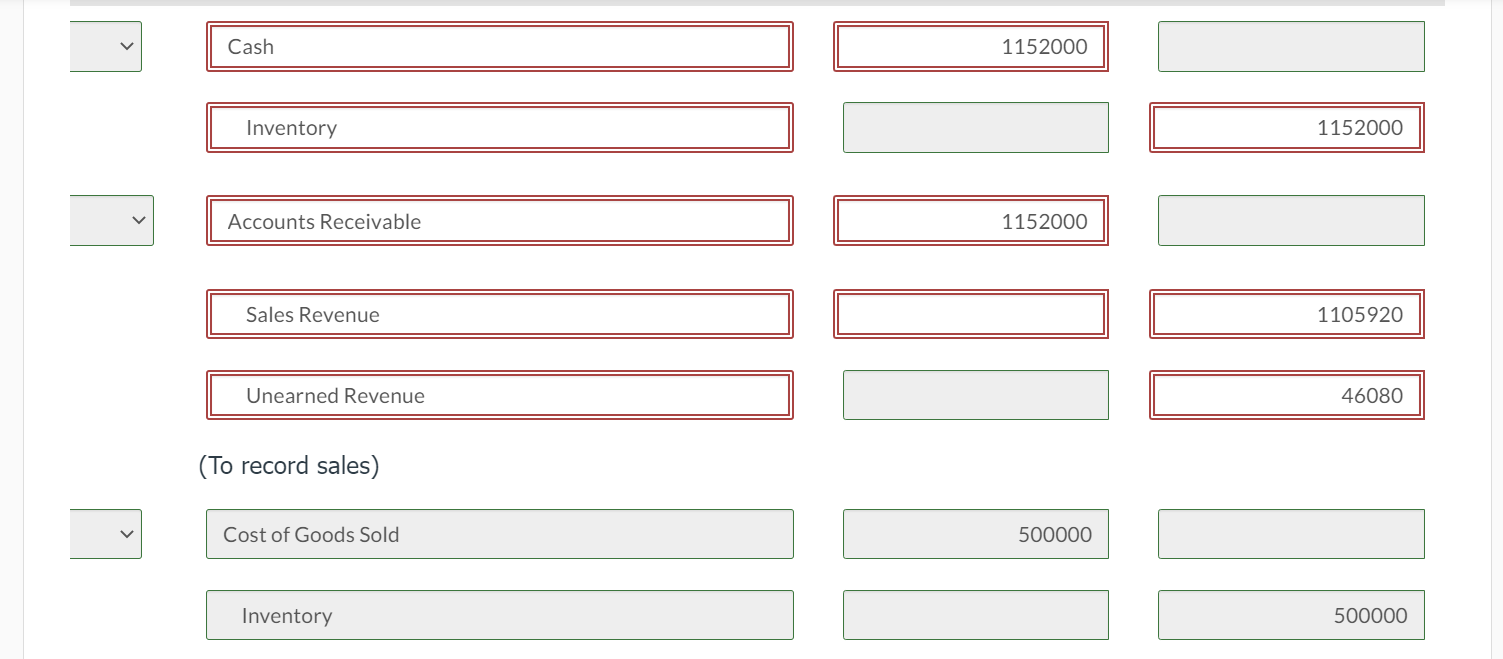

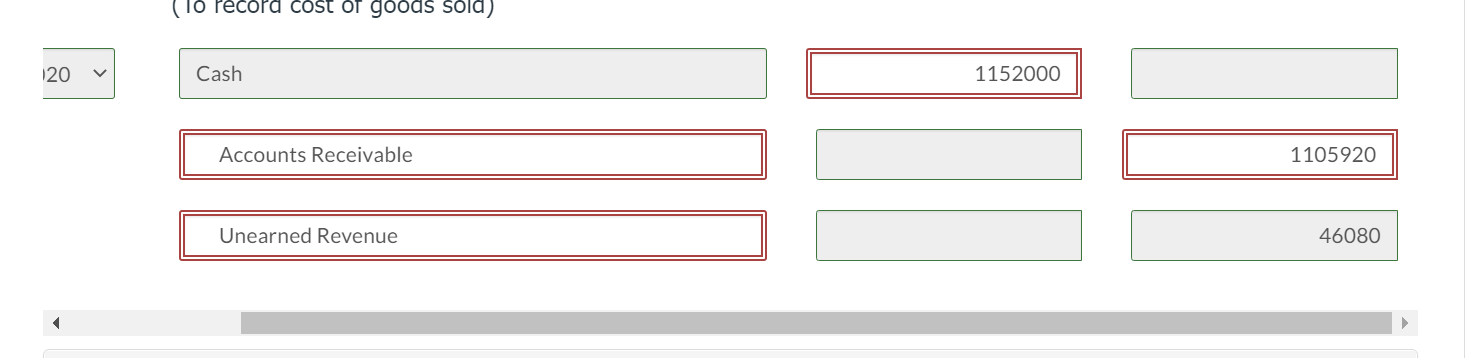

Those one with red need to be fixed please!

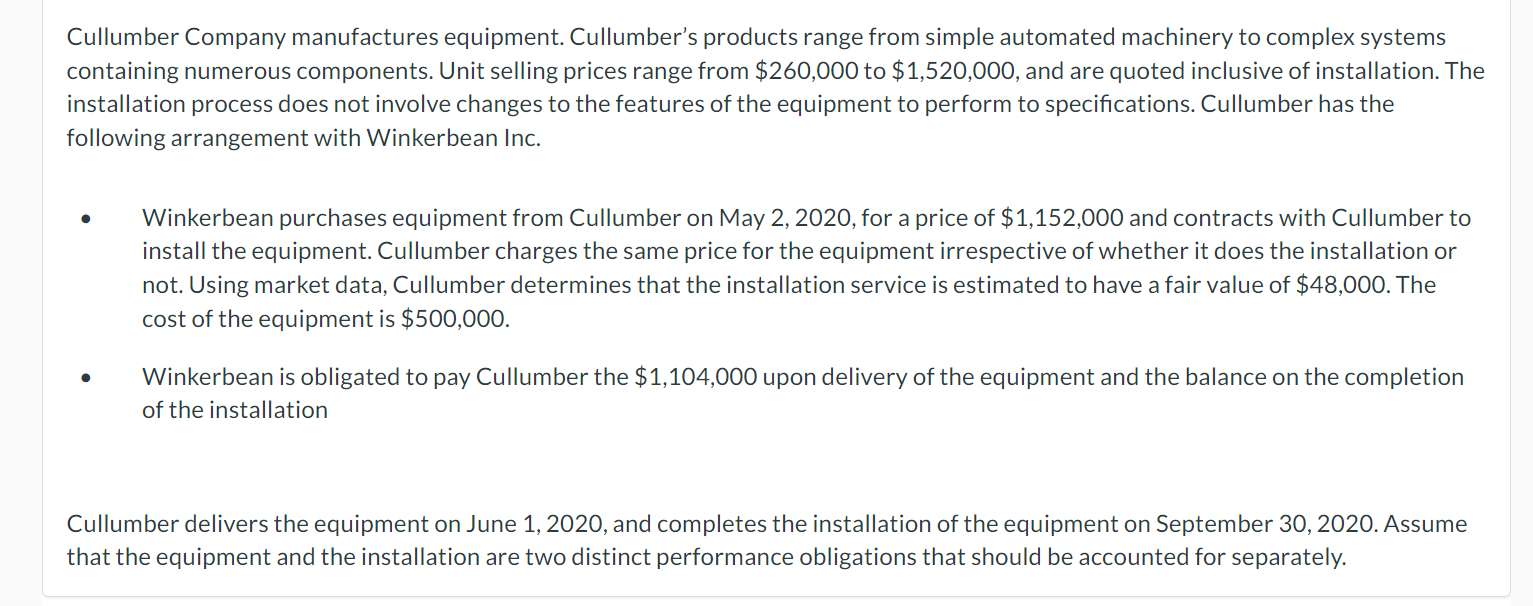

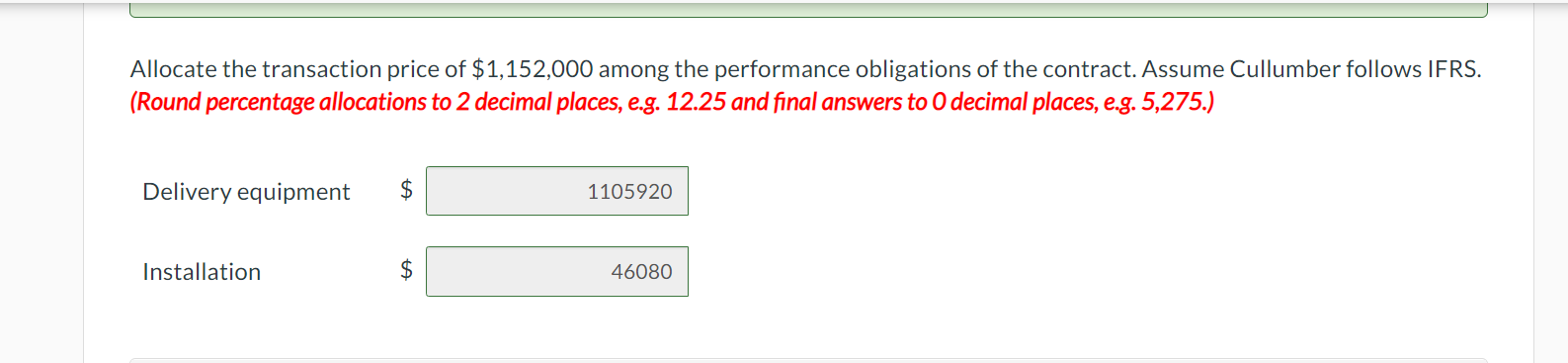

Cullumber Company manufactures equipment. Cullumber's products range from simple automated machinery to complex systems containing numerous components. Unit selling prices range from $260,000 to $1,520,000, and are quoted inclusive of installation. The installation process does not involve changes to the features of the equipment to perform to specifications. Cullumber has the following arrangement with Winkerbean Inc. Winkerbean purchases equipment from Cullumber on May 2, 2020, for a price of $1,152,000 and contracts with Cullumber to install the equipment. Cullumber charges the same price for the equipment irrespective of whether it does the installation or not. Using market data, Cullumber determines that the installation service is estimated to have a fair value of $48,000. The cost of the equipment is $500,000. Winkerbean is obligated to pay Cullumber the $1,104,000 upon delivery of the equipment and the balance on the completion of the installation Cullumber delivers the equipment on June 1, 2020, and completes the installation of the equipment on September 30, 2020. Assume that the equipment and the installation are two distinct performance obligations that should be accounted for separately. Allocate the transaction price of $1,152,000 among the performance obligations of the contract. Assume Cullumber follows IFRS. (Round percentage allocations to 2 decimal places, e.g. 12.25 and final answers to O decimal places, e.g. 5,275.) Delivery equipment $ 1105920 Installation $ 46080 LA Cash Inventory Accounts Receivable Sales Revenue Unearned Revenue (To record sales) Cost of Goods Sold Inventory 1152000 1152000 500000 1152000 1105920 46080 500000 120 Pecora cost of goods sola) Cash Accounts Receivable Unearned Revenue 1152000 1105920 46080Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started