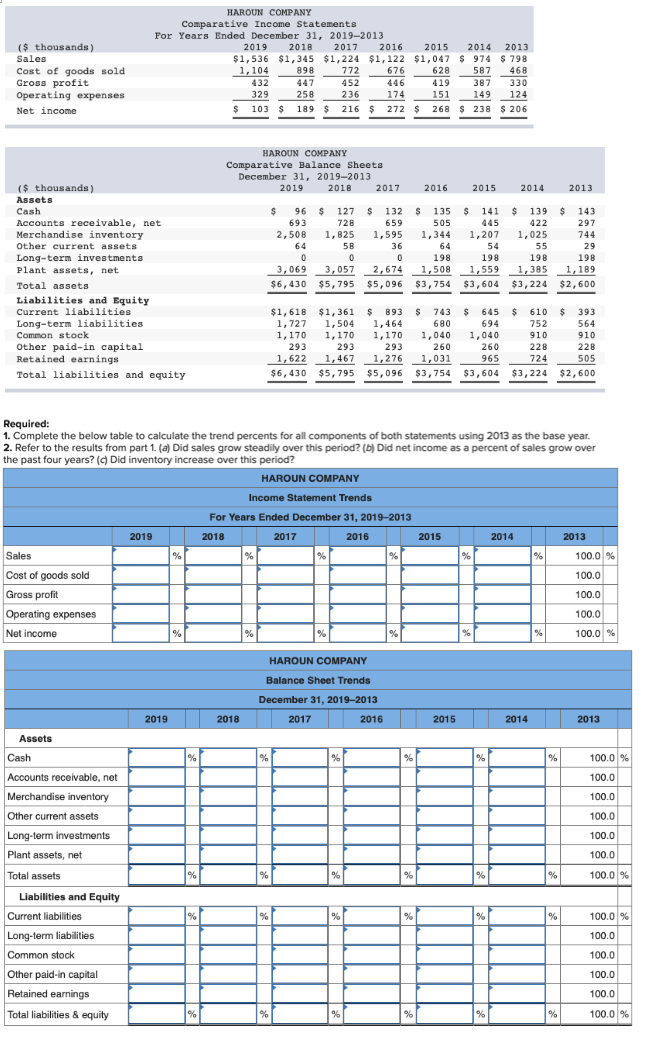

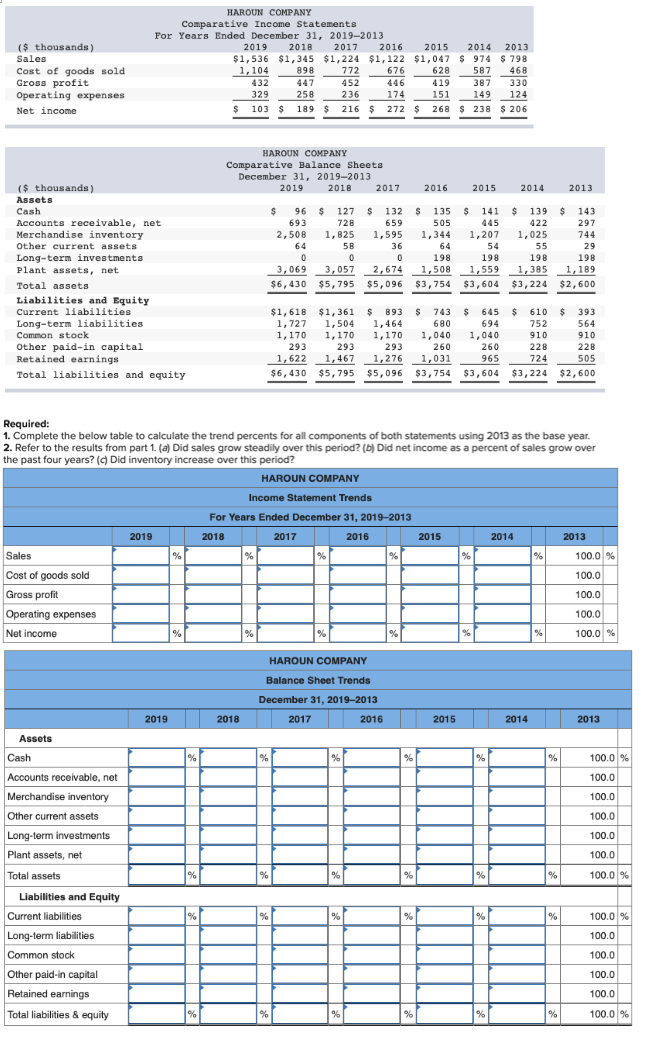

($ thousands) Sales Cost of goods sold Gross profit Operating expenses Net income HAROUN COMPANY Comparative Income Statements For Years Ended December 31, 2019-2013 2019 2018 2017 2016 2015 2014 2013 $1,536 $1,345 $1,224 $1,122 $1,047 $ 974 $ 798 1,104 898 772 676 628 587 468 432 447 452 446419 387 330 329 258 236 174 151 149 124 $ 103 $ 189 $ 216 $ 272 $ 268 $ 238 $ 206 HAROUN COMPANY Comparative Balance Sheets December 31, 2019-2013 2019 2018 2017 2016 2015 2014 2013 $ 143 2 97 744 ($ thousands) Assets Cash Accounts receivable, net Merchandise inventory Other current assets Long-term investments Plant assets, net Total assets Liabilities and Equity Current liabilities Long-term liabilities Common stock Other paid-in capital Retained earnings Total liabilities and equity $ 96 693 2,508 64 0 3,069 $6,430 $ 127 728 1,825 58 0 3,057 $5,795 $ 132 $ 135 659 505 1,5951,344 36 64 0 198 2,674 1,508 $5,096 $3,754 $ 141 445 1,207 54 198 1,559 $3,604 $ 139 422 1,025 55 198 1,385 $3,224 29 198 1,189 $2,600 $1,618 1,727 1,170 293 1,622 $6,430 $1,361 1.504 1,170 293 1,467 $5,795 $ 893 1.464 1,170 293 1,276 $5,096 $ 743 6 80 1,040 260 1,031 $3,754 $ 645 694 1,040 260 965 $3,604 $ 610 752 910 228 724 $3,224 $ 393 564 910 228 505 $2,600 Required: 1. Complete the below table to calculate the trend percents for all components of both statements using 2013 as the base year. 2. Refer to the results from part 1. (a) Did sales grow steadily over this period? (b) Did net income as a percent of sales grow over the past four years? (Did inventory increase over this period? HAROUN COMPANY Income Statement Trends For Years Ended December 31, 2019-2013 2018 2017 2016 2019 2015 2014 Sales 2013 100.0 % 100.0 Cost of goods sold Gross profit 100.0 Operating expenses 100.0 Net income 100.0 % HAROUN COMPANY Balance Sheet Trends December 31, 2019-2013 2017 2016 2019 2018 2015 2014 2013 Assets Cash Accounts receivable, net 100.0 % 100.0 100.0 Merchandise inventory Other current assets 100.0 100.0 Long-term investments Plant assets, net Total assets 100.0 100.0 % 100.0 % 100.0 Liabilities and Equity Current liabilities Long-term liabilities Common stock Other paid-in capital Retained earnings Total liabilities & equity 100.0 100.0 100.0 100.0 % %