Answered step by step

Verified Expert Solution

Question

1 Approved Answer

THP Co is planning to buy CRX Co, a company in the same business sector, and is considering paying cash for the shares of the

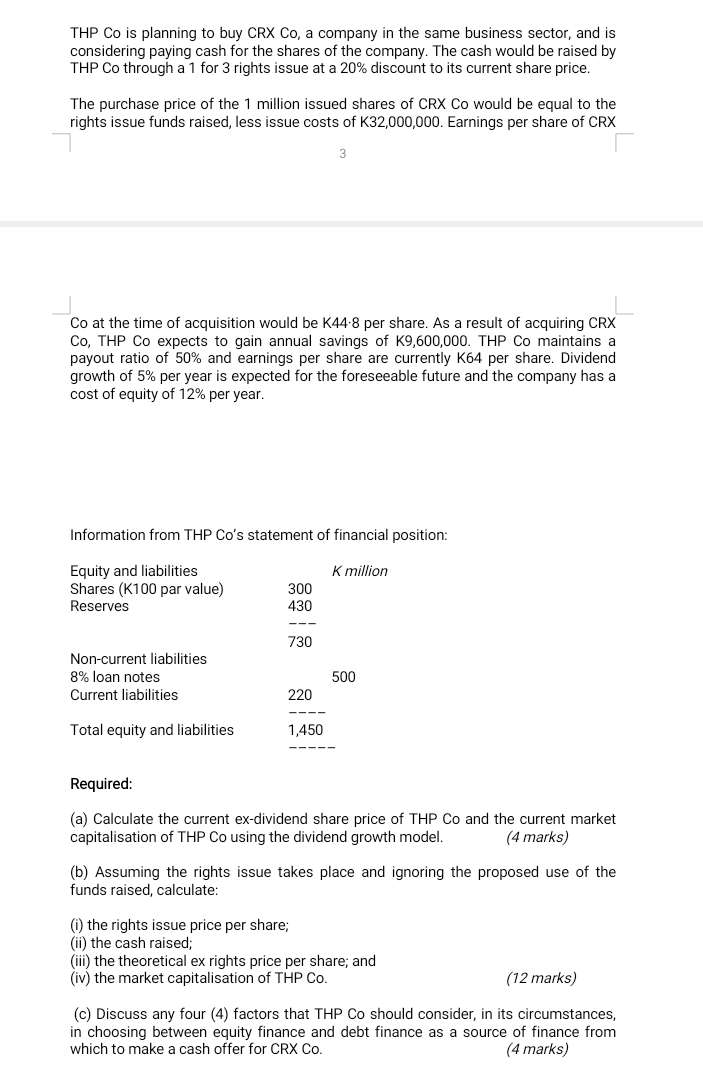

THP Co is planning to buy CRX Co, a company in the same business sector, and is considering paying cash for the shares of the company. The cash would be raised by THP Co through a 1 for 3 rights issue at a 20% discount to its current share price. The purchase price of the 1 million issued shares of CRX Co would be equal to the rights issue funds raised, less issue costs of K32,000,000. Earnings per share of CRX 3 Co at the time of acquisition would be K44.8 per share. As a result of acquiring CRX Co, THP Co expects to gain annual savings of K,600,000. THP Co maintains a payout ratio of 50% and earnings per share are currently K64 per share. Dividend growth of 5% per year is expected for the foreseeable future and the company has a cost of equity of 12% per year. Information from THP Co's statement of financial position: Required: (a) Calculate the current ex-dividend share price of THP Co and the current market capitalisation of THP Co using the dividend growth model. (4 marks) (b) Assuming the rights issue takes place and ignoring the proposed use of the funds raised, calculate: (i) the rights issue price per share; (ii) the cash raised; (iii) the theoretical ex rights price per share; and (iv) the market capitalisation of THP Co. (12 marks) (c) Discuss any four (4) factors that THP Co should consider, in its circumstances, in choosing between equity finance and debt finance as a source of finance from which to make a cash offer for CRX Co. (4 marks) THP Co is planning to buy CRX Co, a company in the same business sector, and is considering paying cash for the shares of the company. The cash would be raised by THP Co through a 1 for 3 rights issue at a 20% discount to its current share price. The purchase price of the 1 million issued shares of CRX Co would be equal to the rights issue funds raised, less issue costs of K32,000,000. Earnings per share of CRX 3 Co at the time of acquisition would be K44.8 per share. As a result of acquiring CRX Co, THP Co expects to gain annual savings of K,600,000. THP Co maintains a payout ratio of 50% and earnings per share are currently K64 per share. Dividend growth of 5% per year is expected for the foreseeable future and the company has a cost of equity of 12% per year. Information from THP Co's statement of financial position: Required: (a) Calculate the current ex-dividend share price of THP Co and the current market capitalisation of THP Co using the dividend growth model. (4 marks) (b) Assuming the rights issue takes place and ignoring the proposed use of the funds raised, calculate: (i) the rights issue price per share; (ii) the cash raised; (iii) the theoretical ex rights price per share; and (iv) the market capitalisation of THP Co. (12 marks) (c) Discuss any four (4) factors that THP Co should consider, in its circumstances, in choosing between equity finance and debt finance as a source of finance from which to make a cash offer for CRX Co. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started