Answered step by step

Verified Expert Solution

Question

1 Approved Answer

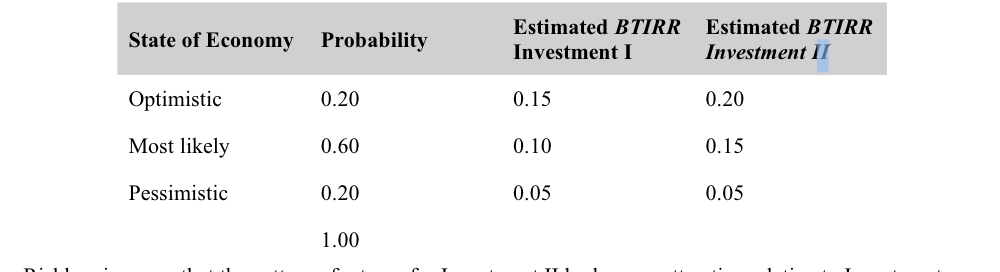

Three are two projects. The IRR for each under three possible scenarios and assigned probabilities of occurrence to each scenario are as follows Riskless is

Three are two projects. The IRR for each under three possible scenarios and assigned probabilities of occurrence to each scenario are as follows

Riskless is aware that the pattern of returns for Investment II looks very attractive relative to InvestmentI; however, one believes that Investment II could be more risky than Investment I.How can you compare the two investments considering both the risk and return on each investment?

please show steps through excel if possible, Thank you so much!

\begin{tabular}{llll} State of Economy & Probability & Estimated BTIRR Investment I & Estimated BTIRR Investment II \\ \hline Optimistic & 0.20 & 0.15 & 0.20 \\ Most likely & 0.60 & 0.10 & 0.15 \\ Pessimistic & 0.20 & 0.05 & 0.05 \\ & 1.00 & & \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started