Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Three clients - Sam's Sporting Goods, Jamie's Basketball Academy, and Jessica's Sport Marketing Agency, have asked you to determine the best investment option for them.

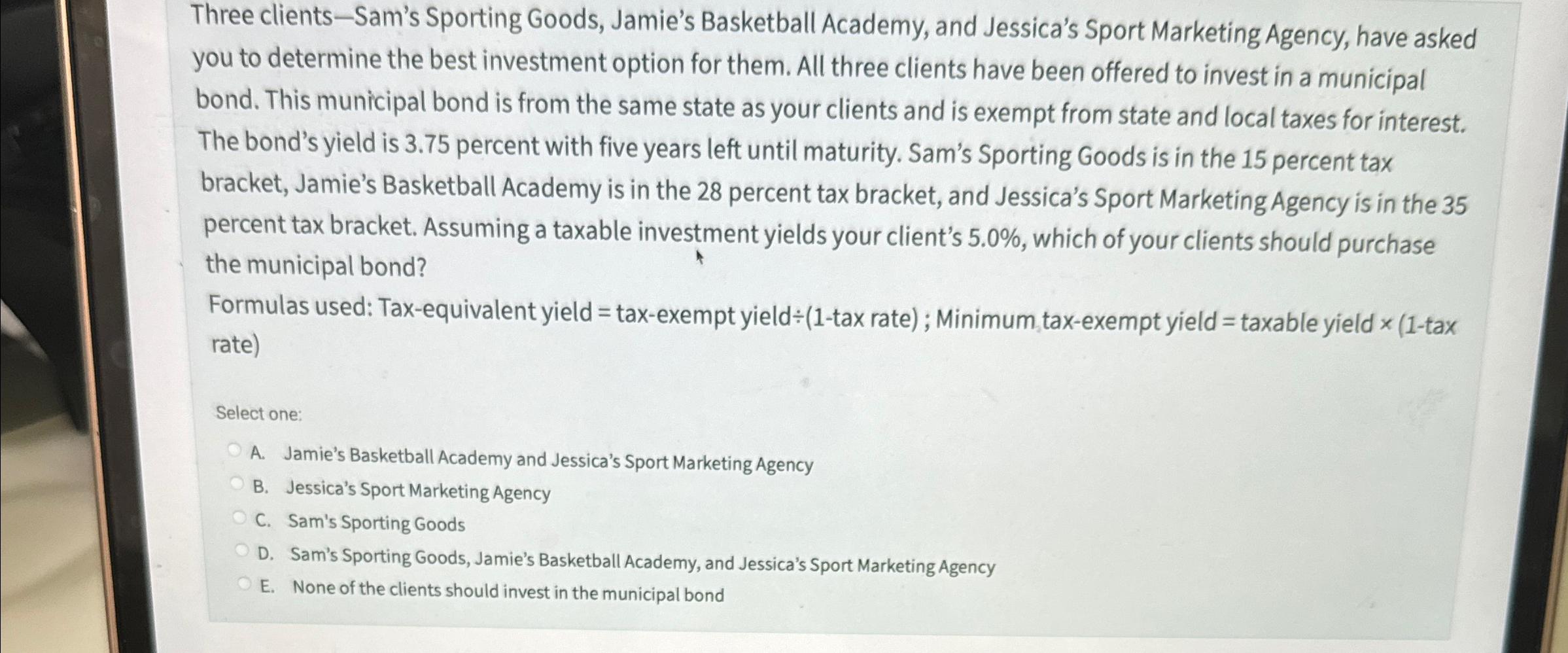

Three clientsSam's Sporting Goods, Jamie's Basketball Academy, and Jessica's Sport Marketing Agency, have asked you to determine the best investment option for them. All three clients have been offered to invest in a municipal bond. This municipal bond is from the same state as your clients and is exempt from state and local taxes for interest. The bond's yield is percent with five years left until maturity. Sam's Sporting Goods is in the percent tax bracket, Jamie's Basketball Academy is in the percent tax bracket, and Jessica's Sport Marketing Agency is in the percent tax bracket. Assuming a taxable investment yields your client's which of your clients should purchase the municipal bond?

Formulas used: Taxequivalent yield taxexempt yield tax rate ; Minimum taxexempt yield taxable yield tax rate

Select one:

A Jamie's Basketball Academy and Jessica's Sport Marketing Agency

B Jessica's Sport Marketing Agency

C Sam's Sporting Goods

D Sam's Sporting Goods, Jamie's Basketball Academy, and Jessica's Sport Marketing Agency

E None of the clients should invest in the municipal bond

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started