Answered step by step

Verified Expert Solution

Question

1 Approved Answer

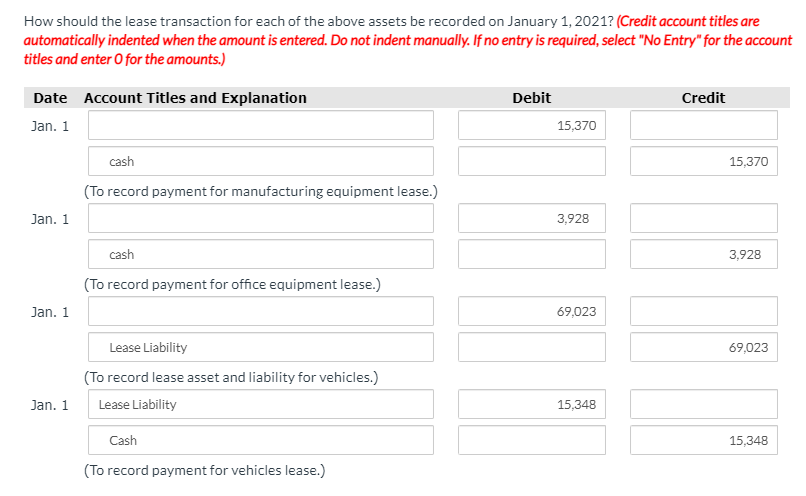

Three different lease transactions are presented below for Carla Vista Enterprises. Assume that all lease transactions start on January 1, 2021. Carla Vista does not

Three different lease transactions are presented below for Carla Vista Enterprises. Assume that all lease transactions start on January 1, 2021. Carla Vista does not receive title to the properties, either during the lease term or at the end of it. The yearly rental for each of the leases is paid on January 1 starting on January 1, 2021. Carla Vista Enterprises prepares its financial statements using ASPE.

| Manufacturing Equipment | Vehicles | Office Equipment | ||||||

| Lease term | 5 years | 6 years | 3 years | |||||

| Estimated economic life | 15 years | 7 years | 6 years | |||||

| Yearly rental payment | $15,370 | $15,348 | $3,928 | |||||

| Fair market value of leased asset | $99,050 | $89,150 | $16,910 | |||||

| Present value of lease rental payments | $58,910 | $69,023 | $10,340 | |||||

List of Accounts

- Accounts Payable

- Accumulated Depreciation

- Bonds Payable

- Cash

- Car Rental Expense

- Common Shares

- Current Portion of Mortgage Payable

- Current Portion of Notes Payable

- Current Portion of Lease Liability

- Depreciation Expense

- Equipment

- Equipment Rental Expense

- Lease Liability

- Gain on Bond Redemption

- Income Tax Payable

- Interest Expense

- Interest Payable

- Leased Asset - Equipment

- Leased Asset - Vehicles

- Loss on Bond Redemption

- Mortgage Note Payable

- No Entry

- Notes Payable

- Prepaid Rent

- Rent Expense

- Retained Earnings

- Right-of-Use Asset

- Unearned Revenue

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started