Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Three general partners running a private equity firm called NVC. This question is about the firm's 5th fund, which has $500M in commitments from

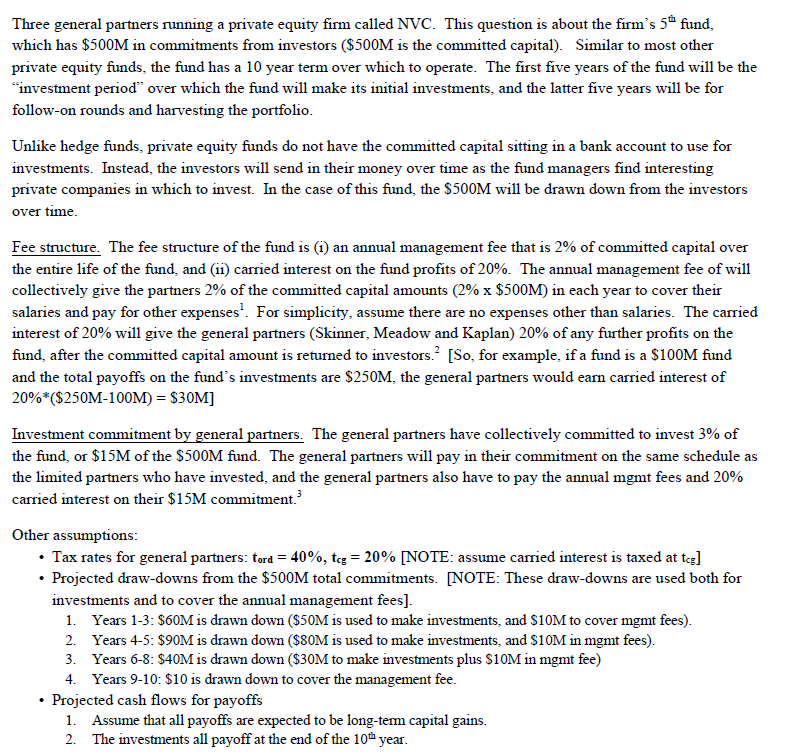

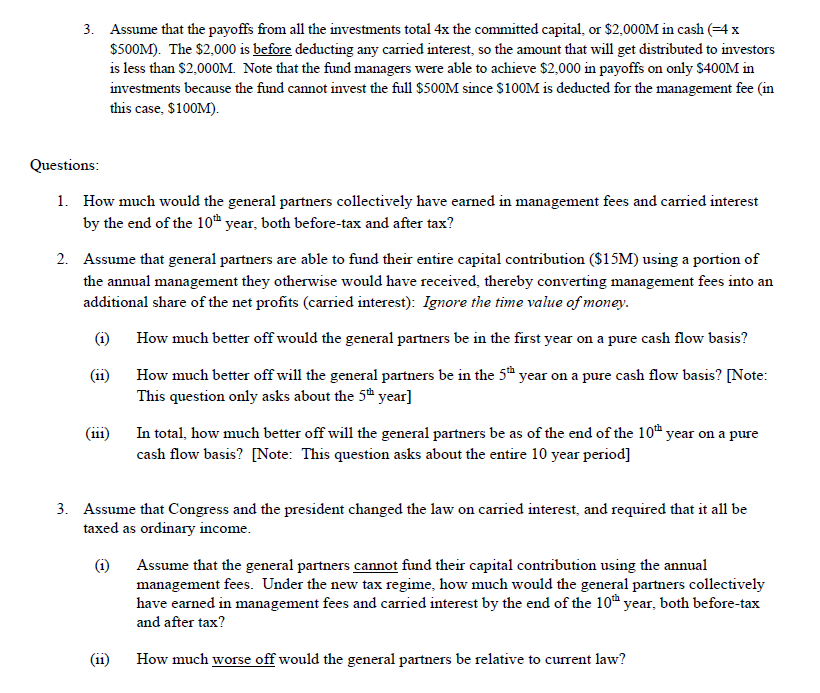

Three general partners running a private equity firm called NVC. This question is about the firm's 5th fund, which has $500M in commitments from investors ($500M is the committed capital). Similar to most other private equity funds, the fund has a 10 year term over which to operate. The first five years of the fund will be the "investment period" over which the fund will make its initial investments, and the latter five years will be for follow-on rounds and harvesting the portfolio. Unlike hedge funds, private equity funds do not have the committed capital sitting in a bank account to use for investments. Instead, the investors will send in their money over time as the fund managers find interesting private companies in which to invest. In the case of this fund, the $500M will be drawn down from the investors over time. Fee structure. The fee structure of the fund is (i) an annual management fee that is 2% of committed capital over the entire life of the fund, and (ii) carried interest on the fund profits of 20%. The annual management fee of will collectively give the partners 2% of the committed capital amounts (2% x $500M) in each year to cover their salaries and pay for other expenses. For simplicity, assume there are no expenses other than salaries. The carried interest of 20% will give the general partners (Skinner, Meadow and Kaplan) 20% of any further profits on the fund, after the committed capital amount is returned to investors. [So, for example, if a fund is a $100M fund and the total payoffs on the fund's investments are $250M, the general partners would earn carried interest of 20%*($250M-100M) = $30M] Investment commitment by general partners. The general partners have collectively committed to invest 3% of the fund, or $15M of the $500M fund. The general partners will pay in their commitment on the same schedule as the limited partners who have invested, and the general partners also have to pay the annual mgmt fees and 20% carried interest on their $15M commitment. Other assumptions: Tax rates for general partners: ford = 40%, tog = 20% [NOTE: assume carried interest is taxed at tcg] Projected draw-downs from the $500M total commitments. [NOTE: These draw-downs are used both for investments and to cover the annual management fees]. 1. Years 1-3: $60M is drawn down ($50M is used to make investments, and $10M to cover mgmt fees). 2. Years 4-5: $90M is drawn down ($80M is used to make investments, and $10M in mgmt fees). 3. Years 6-8: $40M is drawn down ($30M to make investments plus $10M in mgmt fee) 4. Years 9-10: $10 is drawn down to cover the management fee. . Projected cash flows for payoffs 1. Assume that all payoffs are expected to be long-term capital gains. 2. The investments all payoff at the end of the 10th year. 3. Assume that the payoffs from all the investments total 4x the committed capital, or $2,000M in cash (=4 x $500M). The $2,000 is before deducting any carried interest, so the amount that will get distributed to investors is less than $2,000M. Note that the fund managers were able to achieve $2,000 in payoffs on only $400M in investments because the fund cannot invest the full $500M since $100M is deducted for the management fee (in this case, $100M). Questions: 1. How much would the general partners collectively have earned in management fees and carried interest by the end of the 10th year, both before-tax and after tax? 2. Assume that general partners are able to fund their entire capital contribution ($15M) using a portion of the annual management they otherwise would have received, thereby converting management fees into an additional share of the net profits (carried interest): Ignore the time value of money. (i) (11) (111) How much better off would the general partners be in the first year on a pure cash flow basis? How much better off will the general partners be in the 5th year on a pure cash flow basis? [Note: This question only asks about the 5th year] In total, how much better off will the general partners be as of the end of the 10th year on a pure cash flow basis? [Note: This question asks about the entire 10 year period] 3. Assume that Congress and the president changed the law on carried interest, and required that it all be taxed as ordinary income. (i) Assume that the general partners cannot fund their capital contribution using the annual management fees. Under the new tax regime, how much would the general partners collectively have earned in management fees and carried interest by the end of the 10th year, both before-tax and after tax? How much worse off would the general partners be relative to current law?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started