Answered step by step

Verified Expert Solution

Question

1 Approved Answer

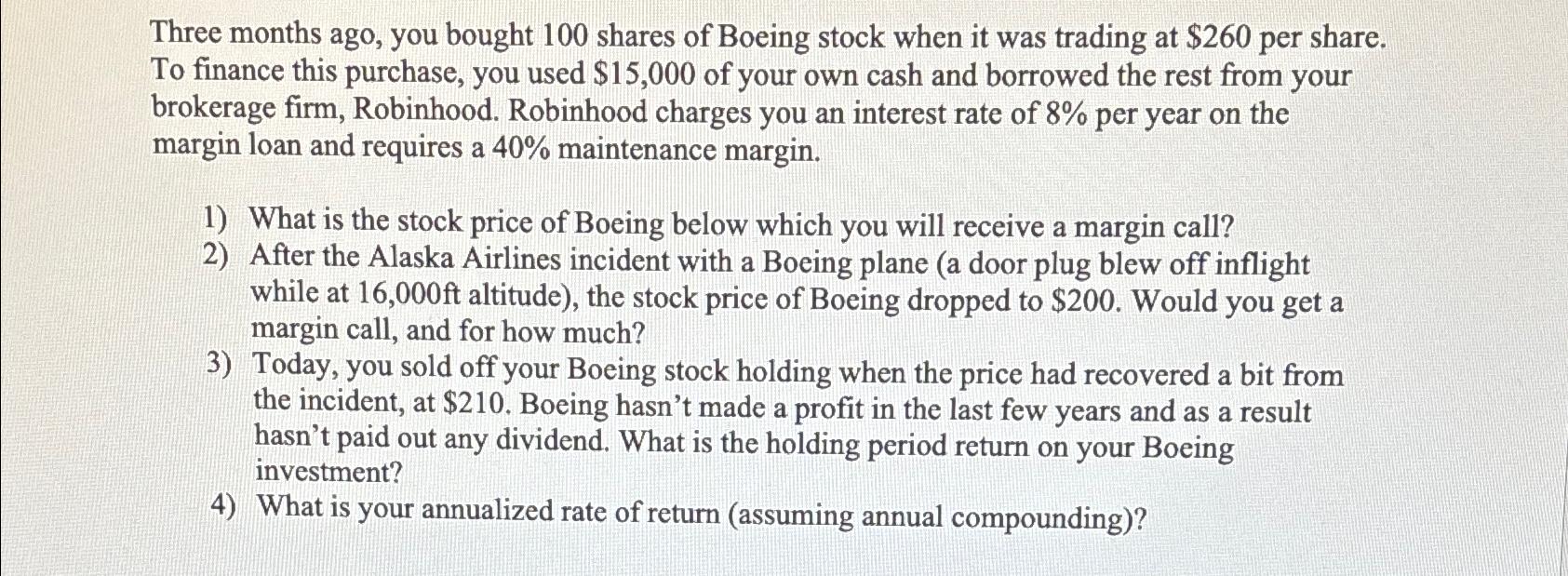

Three months ago, you bought 1 0 0 shares of Boeing stock when it was trading at $ 2 6 0 per share. To finance

Three months ago, you bought shares of Boeing stock when it was trading at $ per share. To finance this purchase, you used $ of your own cash and borrowed the rest from your brokerage firm, Robinhood. Robinhood charges you an interest rate of per year on the margin loan and requires a maintenance margin.

What is the stock price of Boeing below which you will receive a margin call?

After the Alaska Airlines incident with a Boeing plane a door plug blew off inflight while at altitude the stock price of Boeing dropped to $ Would you get a margin call, and for how much?

Today, you sold off your Boeing stock holding when the price had recovered a bit from the incident, at $ Boeing hasn't made a profit in the last few years and as a result hasn't paid out any dividend. What is the holding period return on your Boeing investment?

What is your annualized rate of return assuming annual compounding

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started