Answered step by step

Verified Expert Solution

Question

1 Approved Answer

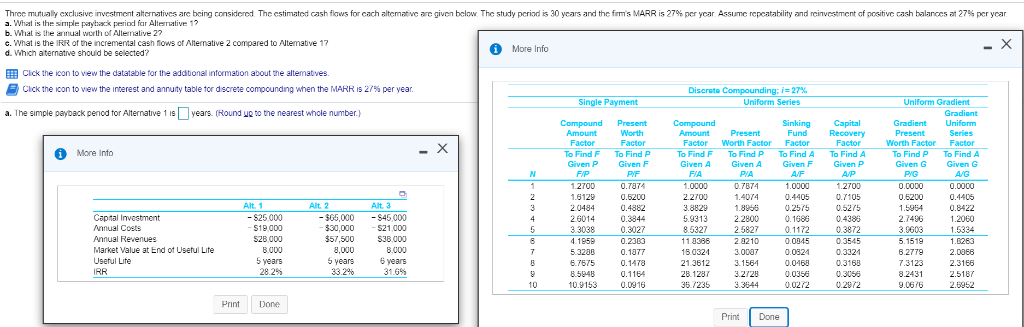

Three mutually exclusive investment alternatives are being considered. The estimated cash flows for each alternative are given below. The study period is 30 years and

Three mutually exclusive investment alternatives are being considered. The estimated cash flows for each alternative are given below. The study period is 30 years and the firm's MARR is 27% per year. Assume repeatability and reinvestment of positive cash balances at 27% per year.

Three mutually exclusive investment alternatives are being considered. The estimated cash flows for each alternative are given below. The study period is 30 years and the firm's MARR is 27% per year. Assume repeatability and reinvestment of positive cash balances at 27% per year.

(a) what is the simple payback period for alternative 1?

(b) what is the annual worth of alternative 2?

(c) what is the IRR of the incremental cash flows of alternative 2 compared to alternative 1?

(d) which alternative should be selected?

Threc mu u aly cxclusive im e ment alternativ are being considen d e stimated cash flows or each altema we are given clow The study pen s 30 yea and the r ms MARR s 279 per year Assum ep atability and en ves ment cash ba an es a 27% per year po .what is the simple payback period far Alternative 17 b. What 8 the !nual wurth of Allernative 2? c. What is the IRR ot the incremental cash lows of Altermative 2 compared to Altemative 1? d. Which aternatrve should be selected? More Info Clck the icon to view the datatable for the addtonal information about the altematves Cick the icon to view the interest and annuity table tor discrete comoounang when the NARRYS 21% per year Discrete Compounding; i 27% Uniform Series Uniform Gradient a. The simple payback penod tor Alternative 1 is years. (Round ue to the nearest whole number.) Compound SinkingCapital Factor Given F PresentUniform Factor To Find F Given P Factor To Find P Given F Factor To Find F Given A Worth Factor To Find P Given A Factor To Find A Given P Worth Factor Facto Mone Into To Find A To Find P To Find A Given G Given 0.7874 1.2700 0.7105 0.00 0.4406 16129 2.2700 1.4074 0.4405 S25.000 $19000 S28.000 8000 S45,000 $30,000 $21,000 57,500 3800 B000 6 years 31.6% 65,000 0.3844 0.3027 0.2303 0.1377 0.1478 0.1164 0.4386 0.3872 Annual Costs Annual Revenues Market Value at End ot Usetul Lite Usetul Lute 3.3038 2.5827 8,000 years 33.2% 5.320B 6.7675 8.5948 15 0321 21.3512 28 1287 35./2353.3644 3.0007 8.2779 2.0068 0.3056 8.2431 Print Done Print Done Threc mu u aly cxclusive im e ment alternativ are being considen d e stimated cash flows or each altema we are given clow The study pen s 30 yea and the r ms MARR s 279 per year Assum ep atability and en ves ment cash ba an es a 27% per year po .what is the simple payback period far Alternative 17 b. What 8 the !nual wurth of Allernative 2? c. What is the IRR ot the incremental cash lows of Altermative 2 compared to Altemative 1? d. Which aternatrve should be selected? More Info Clck the icon to view the datatable for the addtonal information about the altematves Cick the icon to view the interest and annuity table tor discrete comoounang when the NARRYS 21% per year Discrete Compounding; i 27% Uniform Series Uniform Gradient a. The simple payback penod tor Alternative 1 is years. (Round ue to the nearest whole number.) Compound SinkingCapital Factor Given F PresentUniform Factor To Find F Given P Factor To Find P Given F Factor To Find F Given A Worth Factor To Find P Given A Factor To Find A Given P Worth Factor Facto Mone Into To Find A To Find P To Find A Given G Given 0.7874 1.2700 0.7105 0.00 0.4406 16129 2.2700 1.4074 0.4405 S25.000 $19000 S28.000 8000 S45,000 $30,000 $21,000 57,500 3800 B000 6 years 31.6% 65,000 0.3844 0.3027 0.2303 0.1377 0.1478 0.1164 0.4386 0.3872 Annual Costs Annual Revenues Market Value at End ot Usetul Lite Usetul Lute 3.3038 2.5827 8,000 years 33.2% 5.320B 6.7675 8.5948 15 0321 21.3512 28 1287 35./2353.3644 3.0007 8.2779 2.0068 0.3056 8.2431 Print Done Print DoneStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started