Answered step by step

Verified Expert Solution

Question

1 Approved Answer

three parnter ships Tina and Jen are partners with Capital balances of $22,000 and $73,000, respectively. They share profits and losses in a 38:62 ratio.

three parnter ships

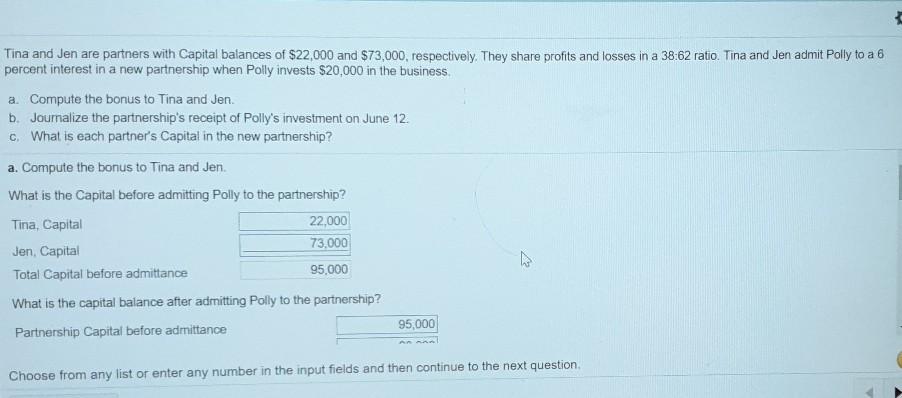

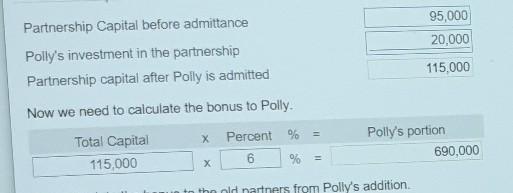

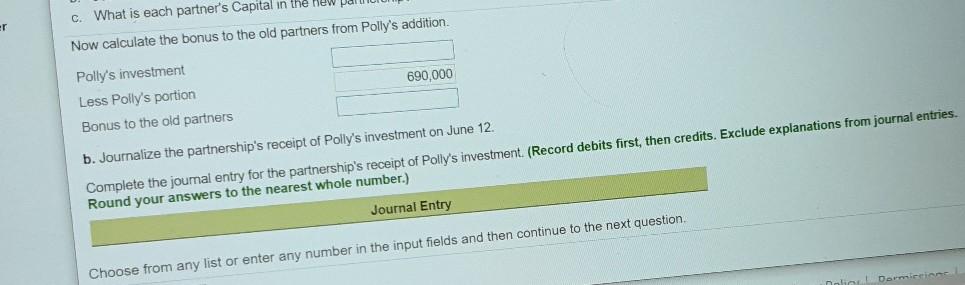

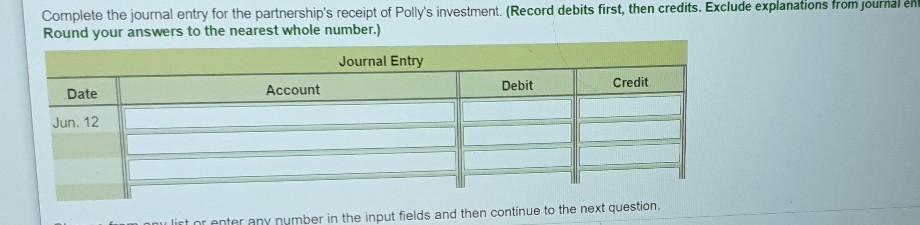

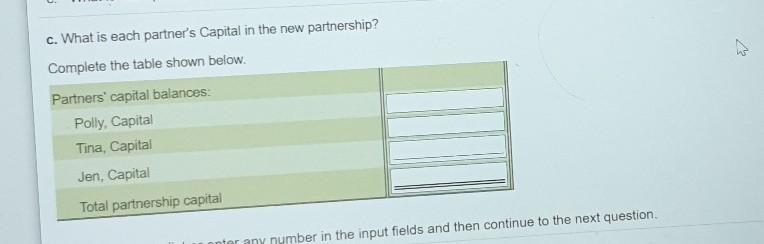

Tina and Jen are partners with Capital balances of $22,000 and $73,000, respectively. They share profits and losses in a 38:62 ratio. Tina and Jen admit Polly to a 6 percent interest in a new partnership when Polly invests $20,000 in the business a Compute the bonus to Tina and Jen. b. Journalize the partnership's receipt of Polly's investment on June 12. c. What is each partner's Capital in the new partnership? a. Compute the bonus to Tina and Jen What is the Capital before admitting Polly to the partnership? Tina, Capital 22,000 73.000 Jen, Capital Total Capital before admittance 95.000 What is the capital balance after admitting Polly to the partnership? 95,000 Partnership Capital before admittance 27 Choose from any list or enter any number in the input fields and then continue to the next question. 95,000 20,000 Partnership Capital before admittance Polly's investment in the partnership Partnership capital after Polly is admitted Now we need to calculate the bonus to Polly 115,000 Total Capital 115,000 Percent % = 6 % = Polly's portion 690,000 X to the old partners from Polly's addition c. What is each partner's Capital in the new Now calculate the bonus to the old partners from Polly's addition 690,000 Polly's investment Less Polly's portion Bonus to the old partners b. Journalize the partnership's receipt of Polly's investment on June 12. Complete the journal entry for the partnership's receipt of Polly's investment (Record debits first, then credits. Exclude explanations from journal entries Round your answers to the nearest whole number.) Journal Entry Choose from any list or enter any number in the input fields and then continue to the next question Complete the journal entry for the partnership's receipt of Polly's investment. (Record debits first, then credits. Exclude explanations from journal en Round your answers to the nearest whole number.) Journal Entry Date Account Debit Credit Jun. 12 list or enter any number in the input fields and then continue to the next question c. What is each partner's Capital in the new partnership? Complete the table shown below. Partners' capital balances: Polly, Capital Tina, Capital Jen, Capital Total partnership capital inter any number in the input fields and then continue to the next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started