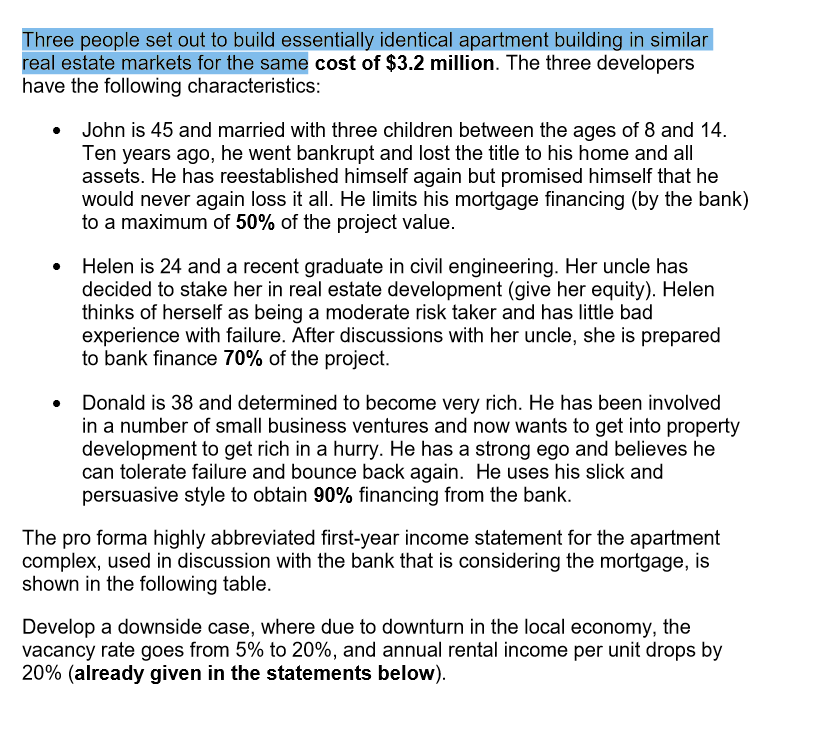

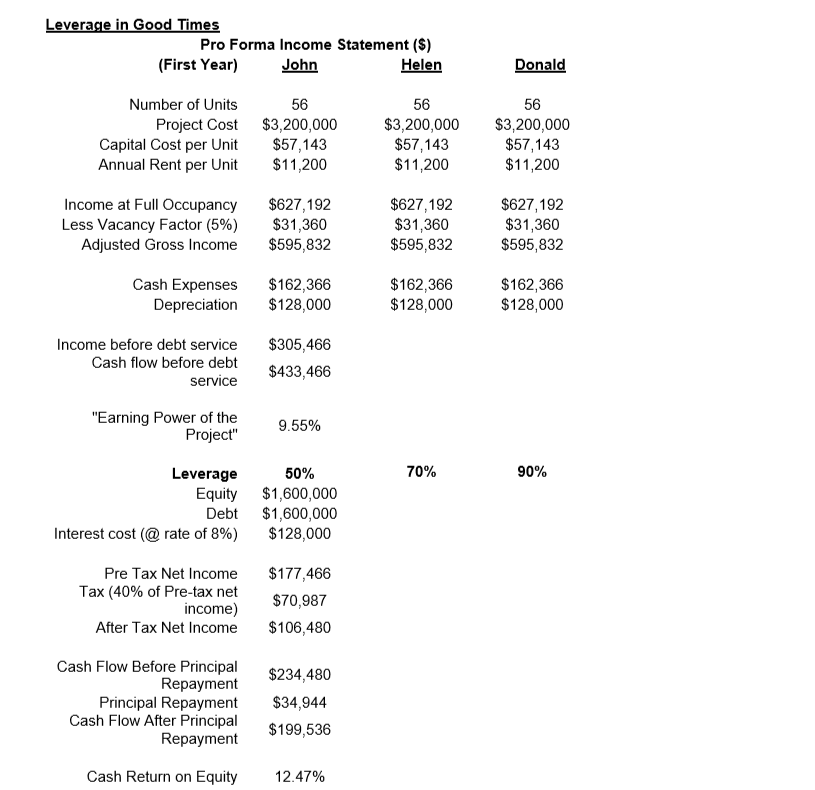

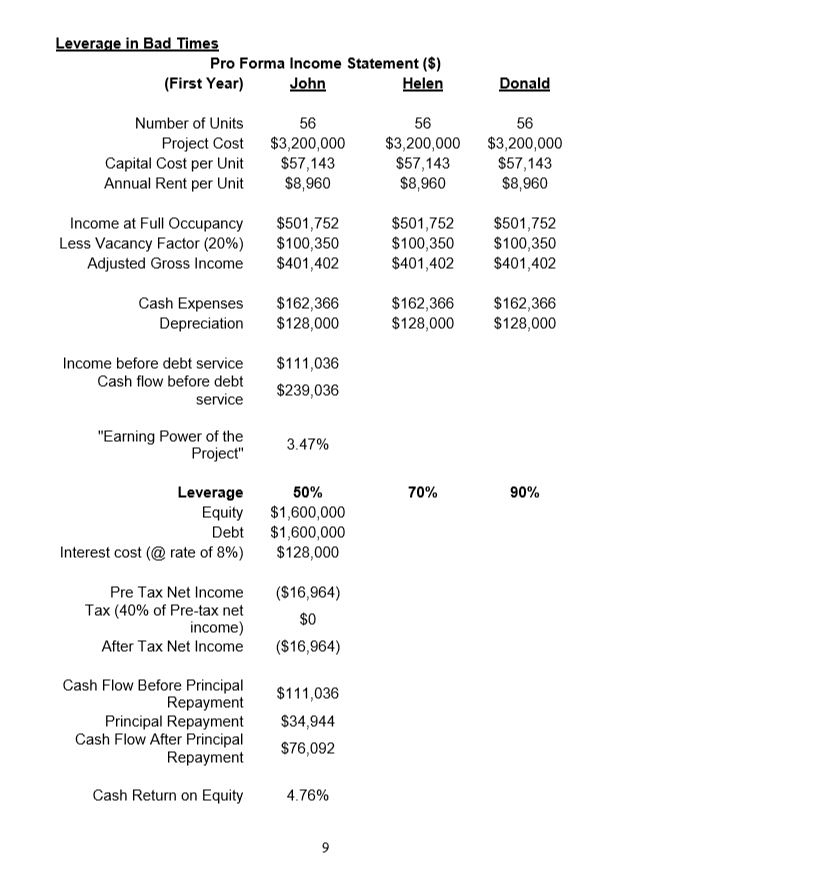

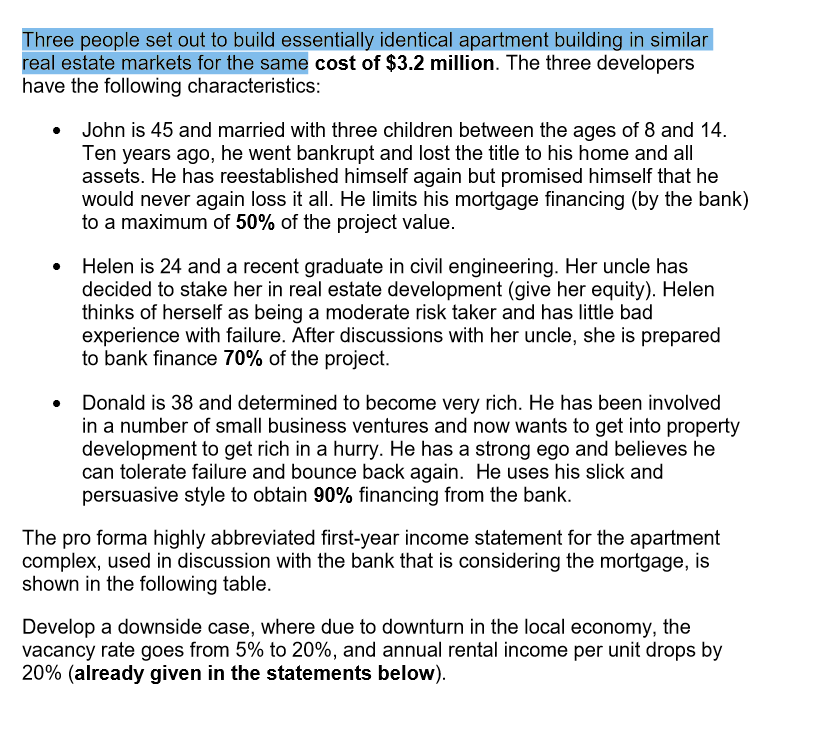

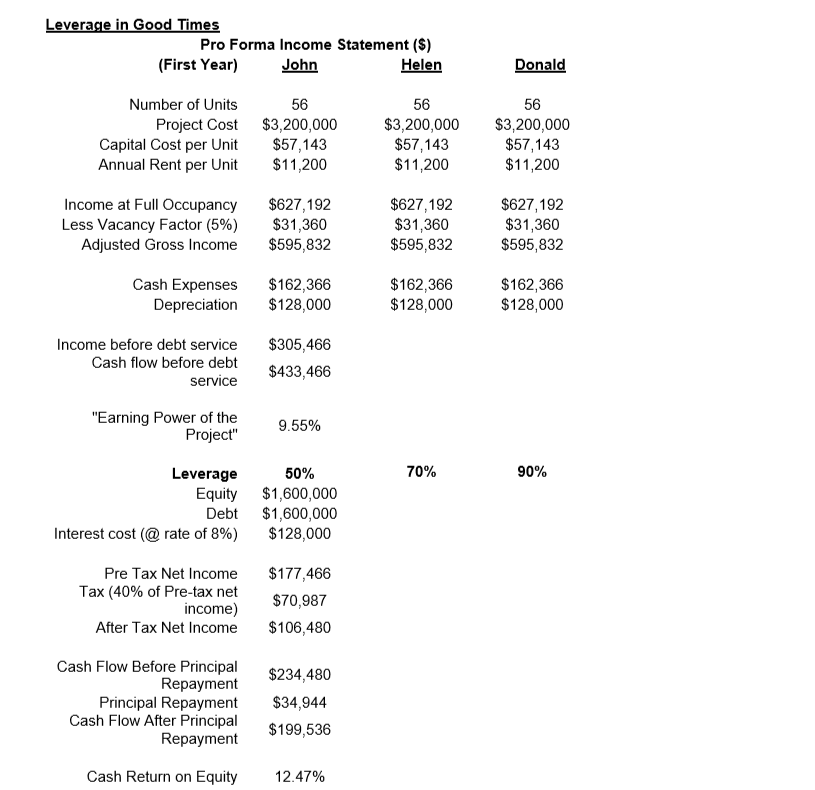

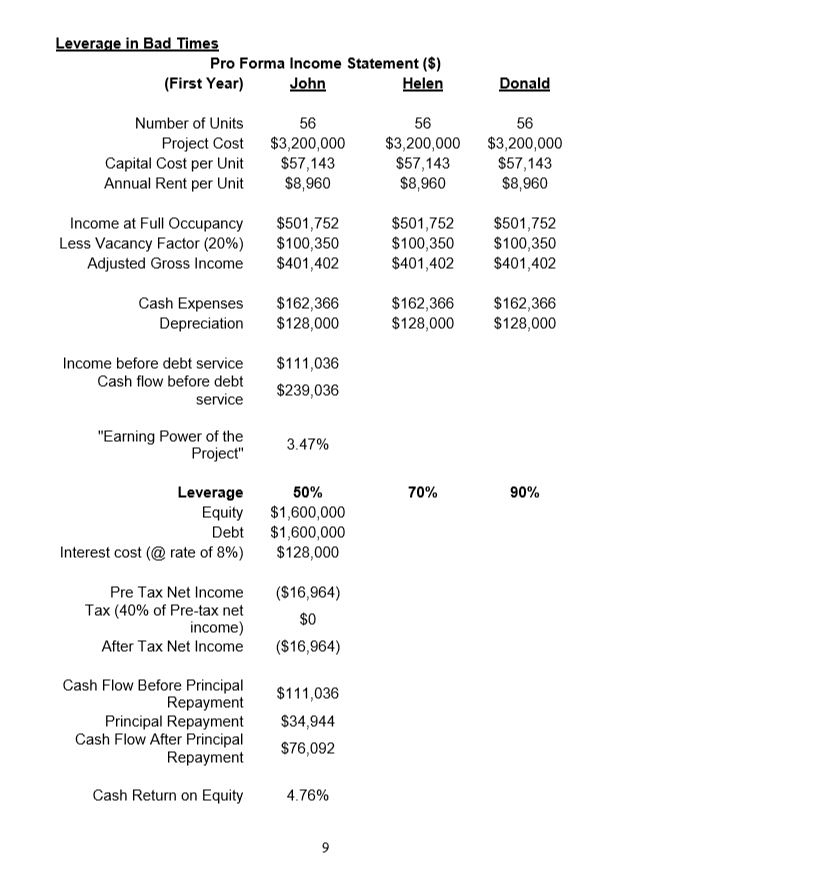

Three people set out to build essentially identical apartment building in similar real estate markets for the same cost of $3.2 million. The three developers have the following characteristics: John is 45 and married with three children between the ages of 8 and 14 Ten years ago, he went bankrupt and lost the title to his home and all assets. He has reestablished himself again but promised himself that he would never again loss it all. He limits his mortgage financing (by the bank) to a maximum of 50% of the project value. Helen is 24 and a recent graduate in civil engineering. Her uncle has decided to stake her in real estate development (give her equity). Helen thinks of herself as being a moderate risk taker and has little bad experience with failure. After discussions with her uncle, she is prepared to bank finance 70% of the project. Donald is 38 and determined to become very rich. He has been involved in a number of small business ventures and now wants to get into property development to get rich in a hurry. He has a strong ego and believes he can tolerate failure and bounce back again. He uses his slick and persuasive style to obtain 90% financing from the bank. The pro forma highly abbreviated first-year income statement for the apartment complex, used in discussion with the bank that is considering the mortgage, is shown in the following table. Develop a downside case, where due to downturn in the local economy, the vacancy rate goes from 5% to 20%, and annual rental income per unit drops by 20% (already given in the statements below) Leverage in Good Times Pro Forma Income Statement ($) John Donald (First Year) Helen Number of Units 56 56 56 Project Cost Capital Cost per Unit Annual Rent per Unit $3,200,000 $57,143 $11,200 $3,200,000 $57,143 $11,200 $3,200,000 $57,143 $11,200 Income at Full Occupancy Less Vacancy Factor (5%) Adjusted Gross Income $627,192 $31,360 $595,832 $627,192 $31,360 $595,832 $627,192 $31,360 $595,832 Cash Expenses Depreciation $162,366 $128,000 $162,366 $128,000 $162,366 $128,000 $305,466 Income before debt service Cash flow before debt $433,466 service "Earning Power of the Project" 9.55% 70% 90% Leverage Equity 50% $1,600,000 $1,600,000 $128,000 Debt Interest cost (@rate of 8%) Pre Tax Net Income $177,466 Tax (40% of Pre-tax net income) After Tax Net Income $70,987 $106,480 Cash Flow Before Principal Repayment Principal Repayment Cash Flow After Principal Repayment $234,480 $34,944 $199,536 Cash Return on Equity 12.47% Leverage in Bad Times Pro Forma Income Statement ($) John Helen (First Year) Donald Number of Units 56 56 56 Project Cost Capital Cost per Unit Annual Rent per Unit $3,200,000 $57,143 $8,960 $3,200,000 $57,143 $8,960 $3,200,000 $57,143 $8,960 $501,752 $100,350 $401,402 Income at Full Occupancy Less Vacancy Factor (20%) Adjusted Gross Income $501,752 $100,350 $401,402 $501,752 $100,350 $401,402 $162,366 $128,000 $162,366 $128,000 $162,366 $128,000 Cash Expenses Depreciation $111,036 Income before debt service Cash flow before debt $239,036 service "Earning Power of the Project" 3.47% Leverage Equity 50% 70% 90% $1,600,000 $1,600,000 $128,000 Debt Interest cost (@ rate of 8%) Pre Tax Net Income ($16,964) Tax (40% of Pre-tax net income) After Tax Net Income $0 ($16,964) Cash Flow Before Principal Repayment Principal Repayment Cash Flow After Principal Repayment $111,036 $34,944 $76,092 Cash Return on Equity 4.76% For each of the three developers, complete the projections in the income statements (20 points) by calculating first-year pro forma after-tax net income, cash flow and return on equity based on cash flow after principal repayment a. Does each developer have enough cash to make the principal repayment in year 1? (10 points) b. For the pro forma case, approximately how many years would it take for each developer to recover his or her equity? (10 points) For each of the three developers, calculate the same figures given in the income statement. Check if any developer has negative cash flow, and answer question a and b NOTES: Pro forma means the company calculates financial results based on certain projections or presumptions. Interest cost 8% of Debt Pre-tax net income Income before debt service minus Interest cost Tax 40% of Pre-tax net income After tax net income Pre-tax net income minus Tax Cash flow before principal repayment = After tax net income plus Depreciation Principal repayment (0.10184 multiplied by Debt) minus Interest Cash flow after principal repayment Cash flow before principal minus principal repayment Cash return on equity Cash flow after principal repayment divided by Equity Three people set out to build essentially identical apartment building in similar real estate markets for the same cost of $3.2 million. The three developers have the following characteristics: John is 45 and married with three children between the ages of 8 and 14 Ten years ago, he went bankrupt and lost the title to his home and all assets. He has reestablished himself again but promised himself that he would never again loss it all. He limits his mortgage financing (by the bank) to a maximum of 50% of the project value. Helen is 24 and a recent graduate in civil engineering. Her uncle has decided to stake her in real estate development (give her equity). Helen thinks of herself as being a moderate risk taker and has little bad experience with failure. After discussions with her uncle, she is prepared to bank finance 70% of the project. Donald is 38 and determined to become very rich. He has been involved in a number of small business ventures and now wants to get into property development to get rich in a hurry. He has a strong ego and believes he can tolerate failure and bounce back again. He uses his slick and persuasive style to obtain 90% financing from the bank. The pro forma highly abbreviated first-year income statement for the apartment complex, used in discussion with the bank that is considering the mortgage, is shown in the following table. Develop a downside case, where due to downturn in the local economy, the vacancy rate goes from 5% to 20%, and annual rental income per unit drops by 20% (already given in the statements below) Leverage in Good Times Pro Forma Income Statement ($) John Donald (First Year) Helen Number of Units 56 56 56 Project Cost Capital Cost per Unit Annual Rent per Unit $3,200,000 $57,143 $11,200 $3,200,000 $57,143 $11,200 $3,200,000 $57,143 $11,200 Income at Full Occupancy Less Vacancy Factor (5%) Adjusted Gross Income $627,192 $31,360 $595,832 $627,192 $31,360 $595,832 $627,192 $31,360 $595,832 Cash Expenses Depreciation $162,366 $128,000 $162,366 $128,000 $162,366 $128,000 $305,466 Income before debt service Cash flow before debt $433,466 service "Earning Power of the Project" 9.55% 70% 90% Leverage Equity 50% $1,600,000 $1,600,000 $128,000 Debt Interest cost (@rate of 8%) Pre Tax Net Income $177,466 Tax (40% of Pre-tax net income) After Tax Net Income $70,987 $106,480 Cash Flow Before Principal Repayment Principal Repayment Cash Flow After Principal Repayment $234,480 $34,944 $199,536 Cash Return on Equity 12.47% Leverage in Bad Times Pro Forma Income Statement ($) John Helen (First Year) Donald Number of Units 56 56 56 Project Cost Capital Cost per Unit Annual Rent per Unit $3,200,000 $57,143 $8,960 $3,200,000 $57,143 $8,960 $3,200,000 $57,143 $8,960 $501,752 $100,350 $401,402 Income at Full Occupancy Less Vacancy Factor (20%) Adjusted Gross Income $501,752 $100,350 $401,402 $501,752 $100,350 $401,402 $162,366 $128,000 $162,366 $128,000 $162,366 $128,000 Cash Expenses Depreciation $111,036 Income before debt service Cash flow before debt $239,036 service "Earning Power of the Project" 3.47% Leverage Equity 50% 70% 90% $1,600,000 $1,600,000 $128,000 Debt Interest cost (@ rate of 8%) Pre Tax Net Income ($16,964) Tax (40% of Pre-tax net income) After Tax Net Income $0 ($16,964) Cash Flow Before Principal Repayment Principal Repayment Cash Flow After Principal Repayment $111,036 $34,944 $76,092 Cash Return on Equity 4.76% For each of the three developers, complete the projections in the income statements (20 points) by calculating first-year pro forma after-tax net income, cash flow and return on equity based on cash flow after principal repayment a. Does each developer have enough cash to make the principal repayment in year 1? (10 points) b. For the pro forma case, approximately how many years would it take for each developer to recover his or her equity? (10 points) For each of the three developers, calculate the same figures given in the income statement. Check if any developer has negative cash flow, and answer question a and b NOTES: Pro forma means the company calculates financial results based on certain projections or presumptions. Interest cost 8% of Debt Pre-tax net income Income before debt service minus Interest cost Tax 40% of Pre-tax net income After tax net income Pre-tax net income minus Tax Cash flow before principal repayment = After tax net income plus Depreciation Principal repayment (0.10184 multiplied by Debt) minus Interest Cash flow after principal repayment Cash flow before principal minus principal repayment Cash return on equity Cash flow after principal repayment divided by Equity