Answered step by step

Verified Expert Solution

Question

1 Approved Answer

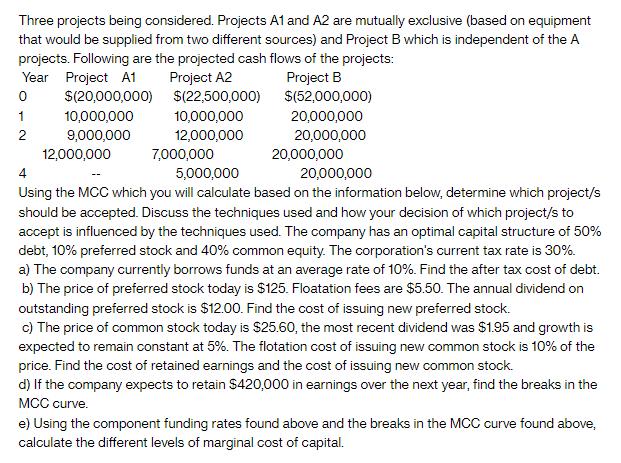

Three projects being considered. Projects A1 and A2 are mutually exclusive (based on equipment that would be supplied from two different sources) and Project

Three projects being considered. Projects A1 and A2 are mutually exclusive (based on equipment that would be supplied from two different sources) and Project B which is independent of the A projects. Following are the projected cash flows of the projects: Year Project A1 Project B $(52,000,000) 0 20,000,000 20,000,000 1 2 $(20,000,000) 10,000,000 9,000,000 12,000,000 Project A2 $(22,500,000) 10,000,000 12,000,000 7,000,000 20,000,000 4 5,000,000 20,000,000 Using the MCC which you will calculate based on the information below, determine which project/s should be accepted. Discuss the techniques used and how your decision of which project/s to accept is influenced by the techniques used. The company has an optimal capital structure of 50% debt, 10% preferred stock and 40% common equity. The corporation's current tax rate is 30%. a) The company currently borrows funds at an average rate of 10%. Find the after tax cost of debt. b) The price of preferred stock today is $125. Floatation fees are $5.50. The annual dividend on outstanding preferred stock is $12.00. Find the cost of issuing new preferred stock. c) The price of common stock today is $25.60, the most recent dividend was $1.95 and growth is expected to remain constant at 5%. The flotation cost of issuing new common stock is 10% of the price. Find the cost of retained earnings and the cost of issuing new common stock. d) If the company expects to retain $420,000 in earnings over the next year, find the breaks in the MCC curve. e) Using the component funding rates found above and the breaks in the MCC curve found above, calculate the different levels of marginal cost of capital.

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To determine which projects should be accepted we will calculate the cost of each source of financing and then calculate the weighted average cost of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started