Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Three questions Caradoc Machine Shop is considering a four-year project to improve its production efficiency. Buying a new machine press for $416,000 is estimated to

Three questions

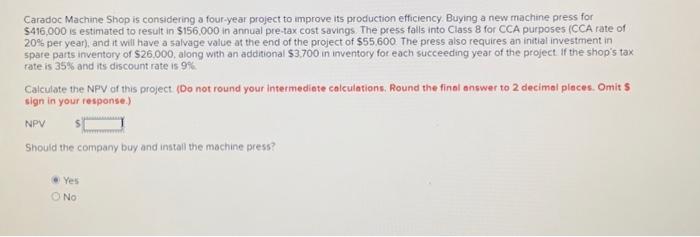

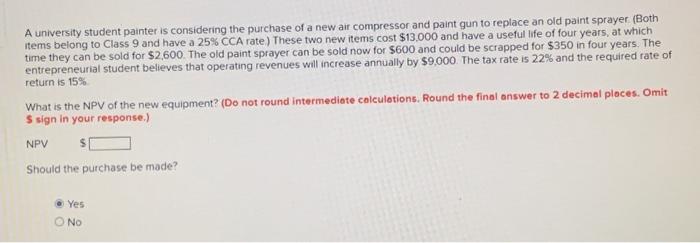

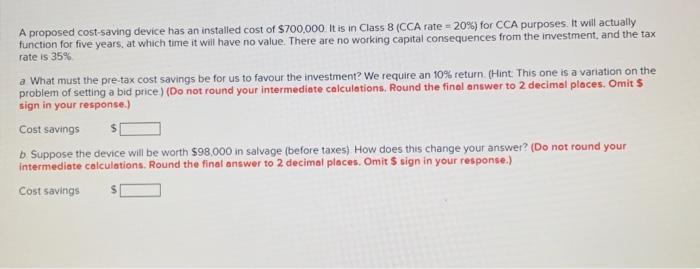

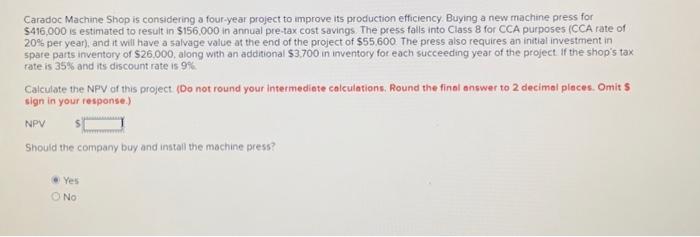

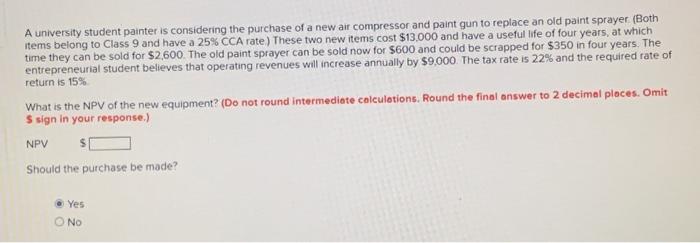

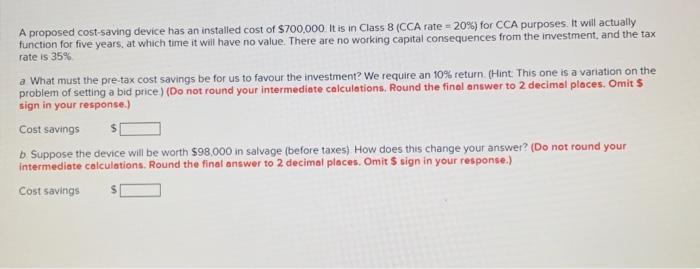

Caradoc Machine Shop is considering a four-year project to improve its production efficiency. Buying a new machine press for $416,000 is estimated to result in $156,000 in annual pre-tax cost savings. The press falls into Class 8 for CCA purposes (CCA rate of 20% per year), and it will have a salvage value at the end of the project of $55.600. The press also requires an initial investment in spare parts inventory of $26,000, along with an additional $3,700 in inventory foc each succeeding year of the project. If the shop's tax rate is 35% and its discount rate is 9% Calculate the NPV of this project. (Do not round your intermediate calculations. Round the final answer to 2 decimal places. Omit S sign in your response.) NPV Should the company buy and install the machine press? Yes No A university student painter is considering the purchase of a new air compressor and paint gun to replace an old paint sprayer (Both items belong to Class 9 and have a 25\% CCA rate) These two new items cost $13.000 and have a useful ife of four years, at which time they can be sold for $2,600. The old paint sprayer can be sold now for $600 and could be scrapped for $350 in four years. The entrepreneurial student believes that operating revenues will increase annually by $9,000. The tax rate is 22% and the required rate of return is 15% What is the NPV of the new equipment? (Do not round intermediate calculotions. Round the final answer to 2 decimal ploces. Omit S sign in your response.) NPV Should the purchase be made? Yes No A proposed cost-saving device has an installed cost of $700,000 It is in Class 8 (CCA rate =20% ) for CCA purposes. it will actually function for five years, at which time it will have no value. There are no working capital consequences from the investment, and the tax rate is 35% a What must the pre-tax cost savings be for us to favour the investment? We require an 10% return. (Hint: This one is a variation on the problem of setting a bid price) (Do not round your intermediate calculations. Round the finol answer to 2 decimal places. Omit $ sign in your response.) Cost savings b Suppose the device will be worth $98,000 in salvage (before taxes). How does this change your answer? (Do not round your intermediate colculations. Round the final onswer to 2 decimal places. Omit $ sign in your response.) Cost savings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started