Answered step by step

Verified Expert Solution

Question

1 Approved Answer

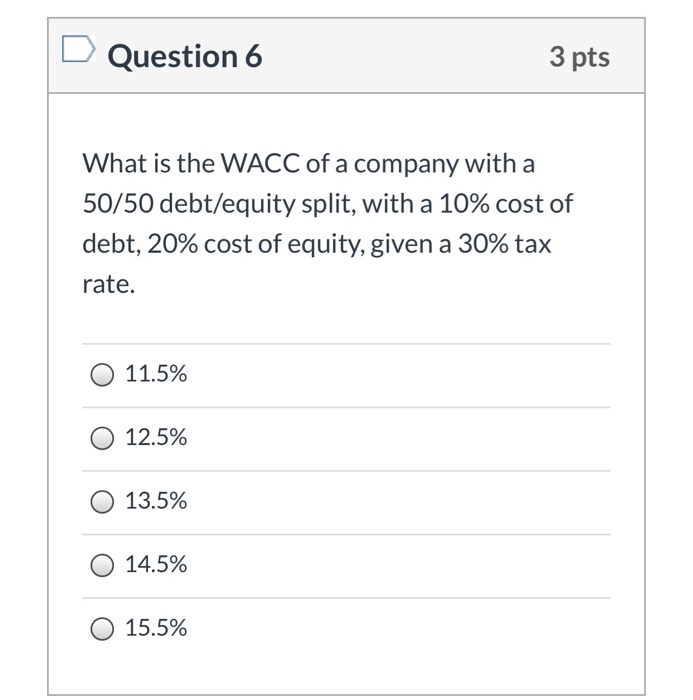

three wuestins olease answer all three questions and please indicate which question you're answering D Question 6 3 pts What is the WACC of a

three wuestins olease

answer all three questions and please indicate which question you're answering

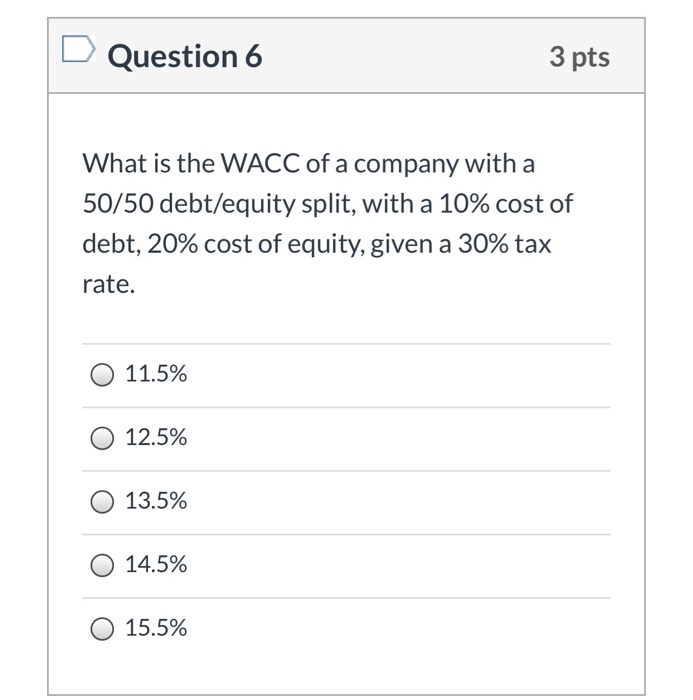

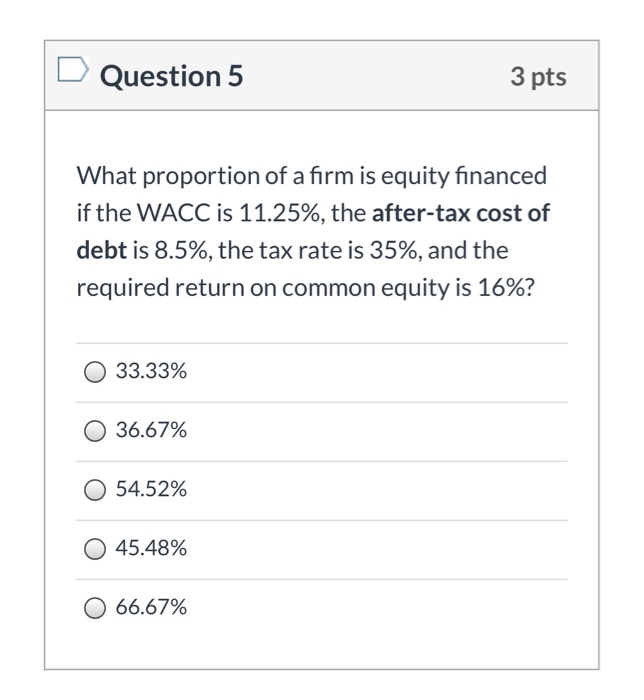

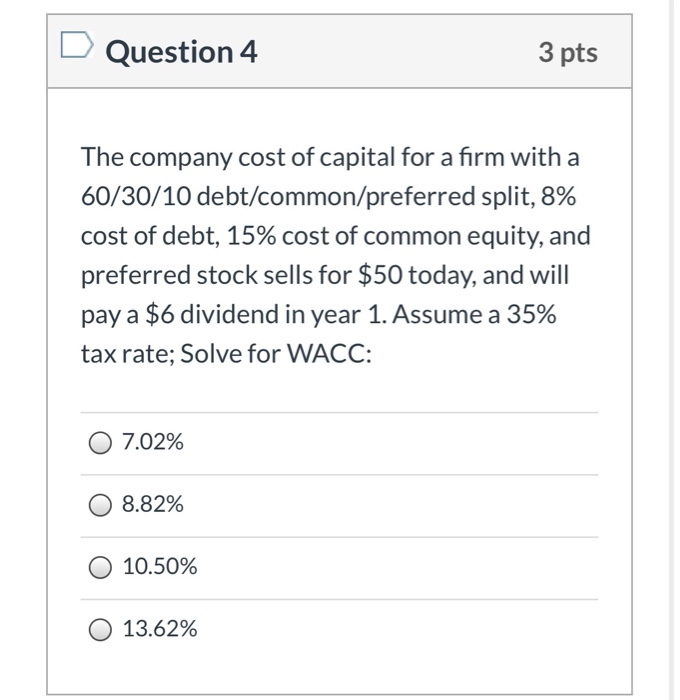

D Question 6 3 pts What is the WACC of a company with a 50/50 debt/equity split, with a 10% cost of debt, 20% cost of equity, given a 30% tax rate. O 11.5% O 12.5% O 13.5% O 14.5% 0 15.5% Question 5 3 pts What proportion of a firm is equity financed if the WACC is 11.25%, the after-tax cost of debt is 8.5%, the tax rate is 35%, and the required return on common equity is 16%? O 33.33% 0 36.67% O 54.52% O 45.48% 0 66.67% Question 4 3 pts The company cost of capital for a firm with a 60/30/10 debt/common/preferred split, 8% cost of debt, 15% cost of common equity, and preferred stock sells for $50 today, and will pay a $6 dividend in year 1. Assume a 35% tax rate; Solve for WACC: O 7.02% O 8.82% 0 10.50% O 13.62% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started