Question

Three You are a graduate from one of the reputable universities in Ghana with BSc Accounting degree working with one of the finance houses in

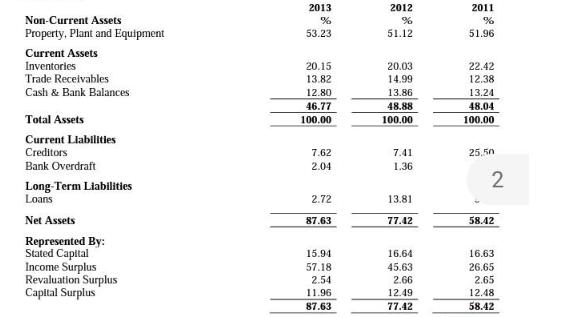

Three You are a graduate from one of the reputable universities in Ghana with BSc Accounting degree working with one of the finance houses in Accra that specializes in provision of project capital support to medium to large firms. Your institution recently received an application for project financing from Gbadago Enterprise Limited. This application has been assigned to your team for initial evaluation and analysis. Enclosed with the application package is Gbadago Enterprise Limited's Common Size Statement of Financial Position for the years ended 31st December as set out below:

Required:

a) As the team head, you are required to present a project report that set out your evaluation of the financial performance of Gbadago Enterprise Limited for the relevant years. You are to ensure that, your evaluation report covers profitability, liquidity and gearing analysis as well as your recommendations (if any) and basis of the recommendations.

b) Enumerate at least four (4) limitations of financial ratios. (4 marks)

c) Explain why Gbadago Enterprise Limited seeks for external sources of finance despite its high amount of retained earnings?

2013 2012 2011 Non-Current Assets % Property, Plant and Equipment 53.23 51.12 51.96 Current Assets Inventories 20.15 20.03 22.42 Trade Receivables 13.82 14.99 12.38 Cash & Bank Balances 12.80 13.86 13.24 46.77 48.88 48.04 Total Assets 100.00 100.00 100.00 Current Llabilities Creditors 7.62 7.41 25,50 Bank Overdraft 2.04 1.36 Long-Term Liabilities Loans 2.72 13.81 Net Assets 87.63 77.42 58.42 Represented By: Stated Capital Income Surplus Revaluation Surplus Capiltal Surplus 15.94 16.64 16.63 57.18 45.63 26.65 2.54 2.66 2.65 11.96 12.49 12.48 87.63 77.42 58.42

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Profitability ratios Return on Assets Net Income Total assets Return on Equity Net Income Equity Liquidity ratios Current ratio Current Assets Curre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started