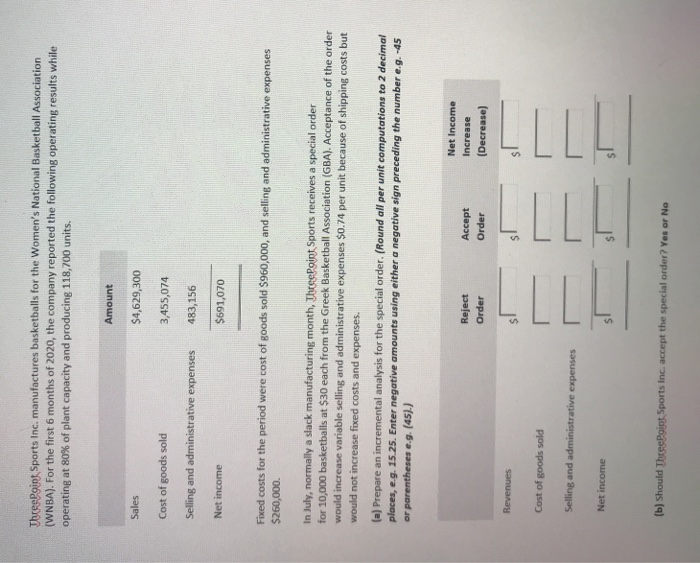

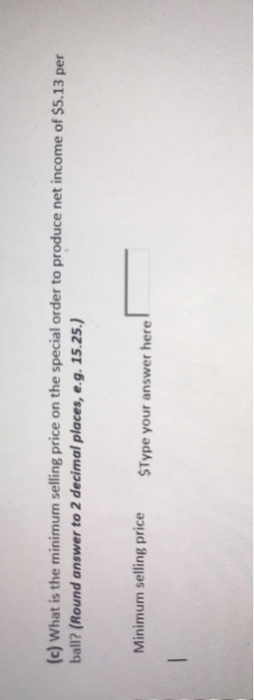

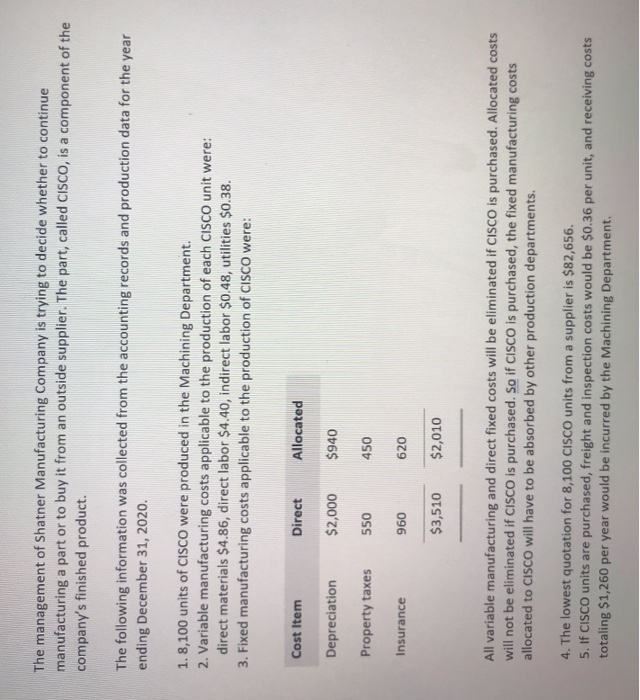

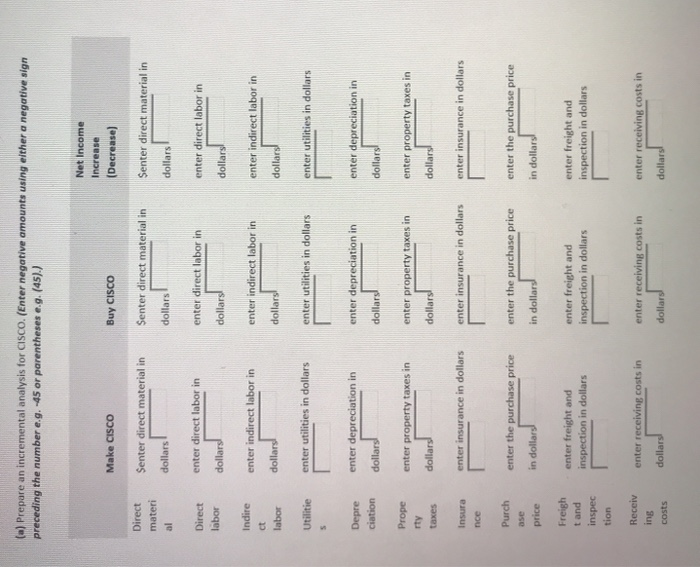

ThreePoint Sports Inc. manufactures basketballs for the Women's National Basketball Association (WNBA). For the first 6 months of 2020, the company reported the following operating results while operating at 80% of plant capacity and producing 118,700 units. Amount Sales $4,629,300 Cost of goods sold 3,455,074 Selling and administrative expenses 483,156 Net income $691,070 Fixed costs for the period were cost of goods sold S960,000, and selling and administrative expenses $260,000. In July, normally a slack manufacturing month, ThreePoint Sports receives a special order for 10,000 basketballs at $30 each from the Greek Basketball Association (GBA). Acceptance of the order would increase variable selling and administrative expenses $0.74 per unit because of shipping costs but would not increase fixed costs and expenses. (a) Prepare an incremental analysis for the special order. (Round all per unit computations to 2 decimal places, e.g. 15.25. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Reject Order Accept Order Net Income Increase (Decrease) Revenues Cost of goods sold LLLL Selling and administrative expenses Net income (b) Should Thres Point Sports Inc. accept the special order? Yes or No (c) What is the minimum selling price on the special order to produce net income of $5.13 per ball? (Round answer to 2 decimal places, e.g. 15.25.) Minimum selling price SType your answer here 1 The management of Shatner Manufacturing Company is trying to decide whether to continue manufacturing a part or to buy it from an outside supplier. The part, called CISCO, is a component of the company's finished product. The following information was collected from the accounting records and production data for the year ending December 31, 2020. 1. 8,100 units of CISCO were produced in the Machining Department. 2. Variable manufacturing costs applicable to the production of each CISCO unit were: direct materials $4.86, direct labor $4.40, indirect labor $0.48, utilities $0.38. 3. Fixed manufacturing costs applicable to the production of CISCO were: Cost Item Direct Allocated Depreciation $2,000 $940 Property taxes 550 450 Insurance 960 620 $3,510 $2,010 All variable manufacturing and direct fixed costs will be eliminated if CISCO is purchased. Allocated costs will not be eliminated if CISCO is purchased. So if CISCO is purchased, the fixed manufacturing costs allocated to CISCO will have to be absorbed by other production departments. 4. The lowest quotation for 8,100 CISCO units from a supplier is $82,656. 5. If CISCO units are purchased, freight and inspection costs would be $0.36 per unit, and receiving costs totaling $1,260 per year would be incurred by the Machining Department. (a) Prepare an incremental analysis for CISCO. (Enter negative amounts using either a negative sign preceding the number e.g.-45 or parentheses e... (45).) Net Income Increase (Decrease) Make CISCO Buy CISCO Senter direct material in Senter direct material in Senter direct material in Direct materi al dollars dollars dollars enter direct labor in enter direct labor in enter direct labor in Direct labor dollars dollars dollars Indire enter indirect labor in enter indirect labor in enter indirect labor in labor dollars dollars dollars Utilitie enter utilities in dollars enter utilities in dollars enter utilities in dollars 5 enter depreciation in enter depreciation in enter depreciation in Depre ciation dollars dollars dollars enter property taxes in enter property taxes in enter property taxes in Prope rty taxes dollars dollars dollars Insura enter insurance in dollars enter insurance in dollars enter insurance in dollars nice Purch enter the purchase price enter the purchase price in dollars) enter the purchase price ase price in dollars in dollars! Freigh t and inspec tion enter freight and inspection in dollars enter freight and inspection in dollars enter freight and inspection in dollars Receiv ing enter receiving costs in enter receiving costs in enter receiving costs in costs dollars dollars dollars Total Senter total annual cost Senter total annual cost Senter total annual cost annua I cost in dollars in dollars in dollars (b) Based on your analysis, what decision should management make? The company should select between make and buy (c) Would the decision be different if Shatner Company has the opportunity to produce $3,000 of net income with the facilities currently being used to manufacture CISCO? select between Yes and No