Answered step by step

Verified Expert Solution

Question

1 Approved Answer

threshold rate is 15.2 percentage and can you get me the answe for 2nd page. Using the Threshold Rate you computed from above compute the

threshold rate is 15.2 percentage and can you get me the answe for 2nd page.

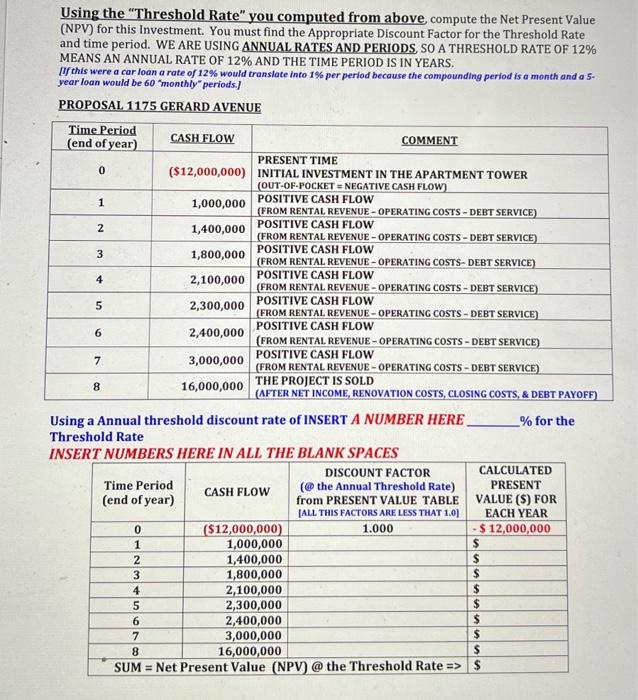

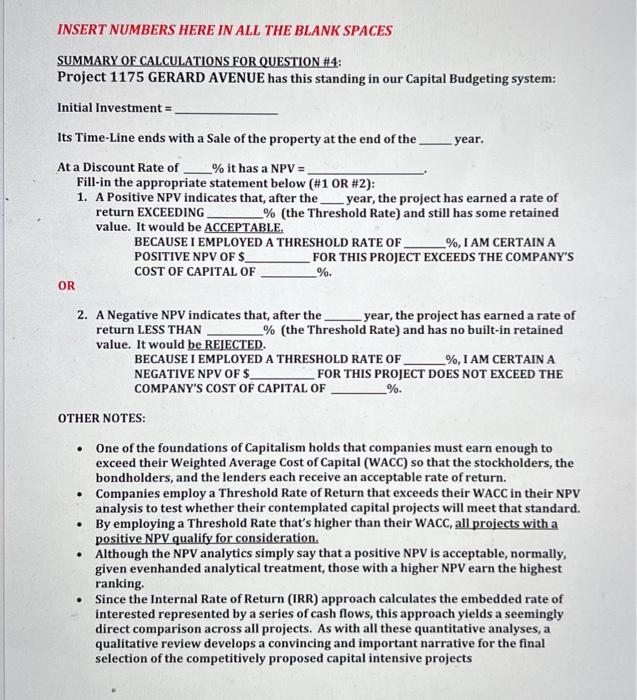

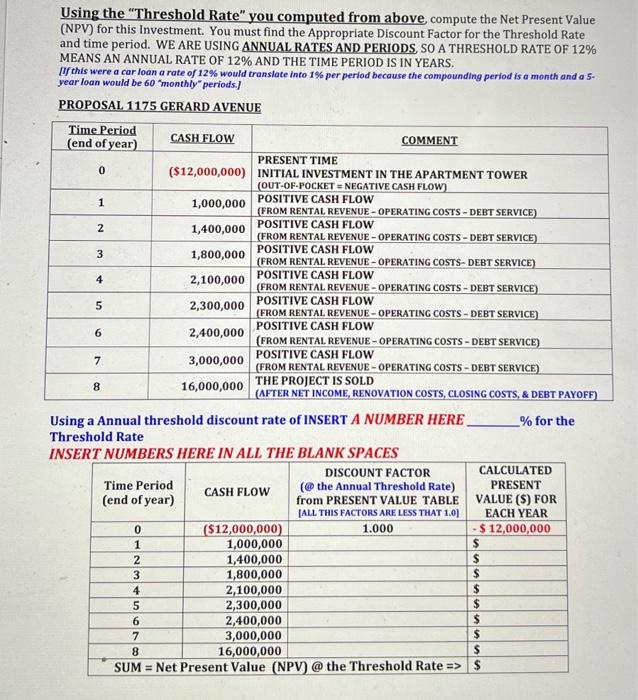

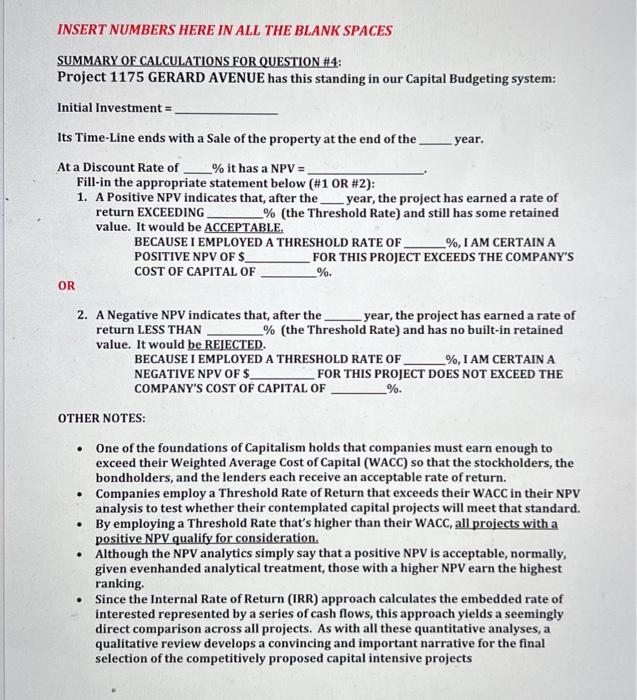

Using the "Threshold Rate" you computed from above compute the Net Present Value (NPV) for this Investment. You must find the Appropriate Discount Factor for the Threshold Rate and time period. WE ARE USING ANNUAL RATES AND PERIODS. SO A THRESHOLD RATE OF 12% MEANS AN ANNUAL RATE OF 12% AND THE TIME PERIOD IS IN YEARS. [If this were a car loan a rate of 12% would translate into 1% per period because the compounding period is a month and a 5 . year loan would be 60 "monthly" periods.] PROPOSAL 1175 GERARD AVENUE Using a Annual threshold discount rate of INSERT A NUMBER HERE % for the Threshold Rate INSFDT NIIMRERS HERE IN AI.I. THE RI.ANK SPACFS SUMMARY OF CALCULATIONS FOR QUESTION #4: Project 1175 GERARD AVENUE has this standing in our Capital Budgeting system: Initial Investment = Its Time-Line ends with a Sale of the property at the end of the year. At a Discount Rate of % it has a NPV = Fill-in the appropriate statement below (\#1 OR #2): 1. A Positive NPV indicates that, after the __year, the project has earned a rate of return EXCEEDING % (the Threshold Rate) and still has some retained value. It would be ACCEPTABL. BECAUSE I EMPLOYED A THRESHOLD RATE OF %, I AM CERTAIN A POSITIVE NPV OF $ FOR THIS PROJECT EXCEEDS THE COMPANY'S COST OF CAPITAL OF %. 2. A Negative NPV indicates that, after the year, the project has earned a rate of return LESS THAN % (the Threshold Rate) and has no built-in retained value. It would be REIECTED. BECAUSE I EMPLOYED A THRESHOLD RATE OF % I AM CERTAIN A NEGATIVE NPV OF $ FOR THIS PROJECT DOES NOT EXCEED THE COMPANY'S COST OF CAPITAL OF % OTHER NOTES: - One of the foundations of Capitalism holds that companies must earn enough to exceed their Weighted Average Cost of Capital (WACC) so that the stockholders, the bondholders, and the lenders each receive an acceptable rate of return. - Companies employ a Threshold Rate of Return that exceeds their WACC in their NPV analysis to test whether their contemplated capital projects will meet that standard. - By employing a Threshold Rate that's higher than their WACC, all projects with a positive NPV qualify for consideration. - Although the NPV analytics simply say that a positive NPV is acceptable, normally, given evenhanded analytical treatment, those with a higher NPV earn the highest ranking. - Since the Internal Rate of Return (IRR) approach calculates the embedded rate of interested represented by a series of cash flows, this approach yields a seemingly direct comparison across all projects. As with all these quantitative analyses, a qualitative review develops a convincing and important narrative for the final selection of the competitively proposed capital intensive projects

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started