Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thrillville has $39 million in bonds payable. One of the contractual agreements in the bond is that the debt to equity ratio cannot exceed

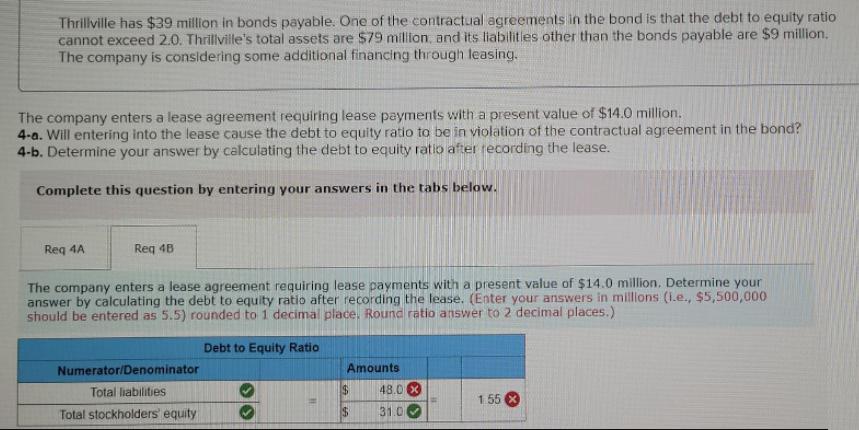

Thrillville has $39 million in bonds payable. One of the contractual agreements in the bond is that the debt to equity ratio cannot exceed 2.0. Thrillville's total assets are $79 million, and its liabilities other than the bonds payable are $9 million. The company is considering some additional financing through leasing. The company enters a lease agreement requiring lease payments with a present value of $14.0 million. 4-a. Will entering into the lease cause the debt to equity ratio to be in violation of the contractual agreement in the bond? 4-b. Determine your answer by calculating the debt to equity ratio after recording the lease. Complete this question by entering your answers in the tabs below. Req 4A Req 4B The company enters a lease agreement requiring lease payments with a present value of $14.0 million. Determine your answer by calculating the debt to equity ratio after recording the lease. (Enter your answers in millions (1.e., $5,500,000 should be entered as 5.5) rounded to 1 decimal place, Round ratio answer to 2 decimal places.) Debt to Equity Ratio Numerator/Denominator Amounts Total liabilities %24 48.0 1.55 Total stockholders' equity 31.0

Step by Step Solution

★★★★★

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Answer Yes 4b Total assets before the lease 79 million Total debt ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started