Question

Thrillville has $40.2 million in bonds payable. One of the contractual agreements in the bond is that the debt to equity ratio cannot exceed 2.0.

Thrillville has $40.2 million in bonds payable. One of the contractual agreements in the bond is that the debt to equity ratio cannot exceed 2.0. Thrillvilles total assets are $80.2 million, and its liabilities other than the bonds payable are $10.2 million. The company is considering some additional financing through leasing.

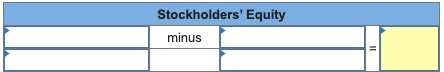

Required: 1. Calculate total stockholders' equity using the balance sheet equation. (Enter your answer in millions rounded to 1 decimal place (i.e., $5,500,000 should be entered as 5.5).)

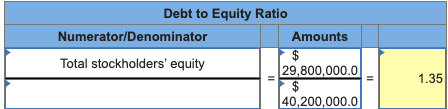

2. Calculate the debt to equity ratio. (Enter your answers in millions (i.e., $5,500,000 should be entered as 5.5). Round ratio answer to 2 decimal places. Do not round intermediate calculations.)

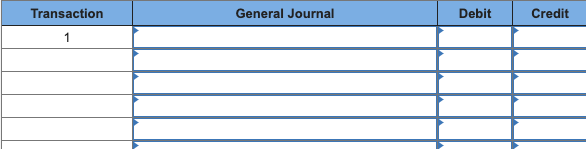

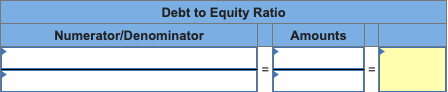

3. The company enters a lease agreement requiring lease payments with a present value of $15.2 million. Record the lease. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answer in millions (i.e., $5,500,000 should be entered as 5.5) rounded to 1 decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started