Answered step by step

Verified Expert Solution

Question

1 Approved Answer

through May 31, 2021, the Company has a business loss of $91,000. shares are acquired by an unrelated corporation. For the period January 1,

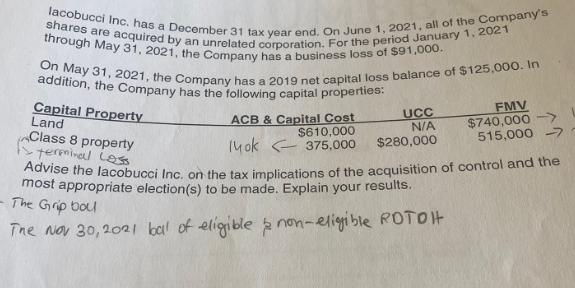

through May 31, 2021, the Company has a business loss of $91,000. shares are acquired by an unrelated corporation. For the period January 1, 2021 lacobucci Inc. has a December 31 tax year end. On June 1, 2021, all of the Company's addition, the Company has the following capital properties: On May 31, 2021, the Company has a 2019 net capital loss balance of $125,000. In Capital Property Land Class 8 property ACB & Capital Cost $610,000 UCC N/A FMV $740,000-> 515,000 -> 375,000 $280,000 14ok terminal Loss Advise the lacobucci Inc. on the tax implications of the acquisition of control and the most appropriate election(s) to be made. Explain your results. The Grip bol The Nov 30, 2021 bal of eligible & non-eligible ROTOH

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

The acquisition of control of a corporation by an unrelated corporation can have significant tax implications for both the buyer and the seller In thi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started