Answered step by step

Verified Expert Solution

Question

1 Approved Answer

through May 31, 2021, the Company has a business loss of $91,000. shares are acquired by an unrelated corporation. For the period January 1,

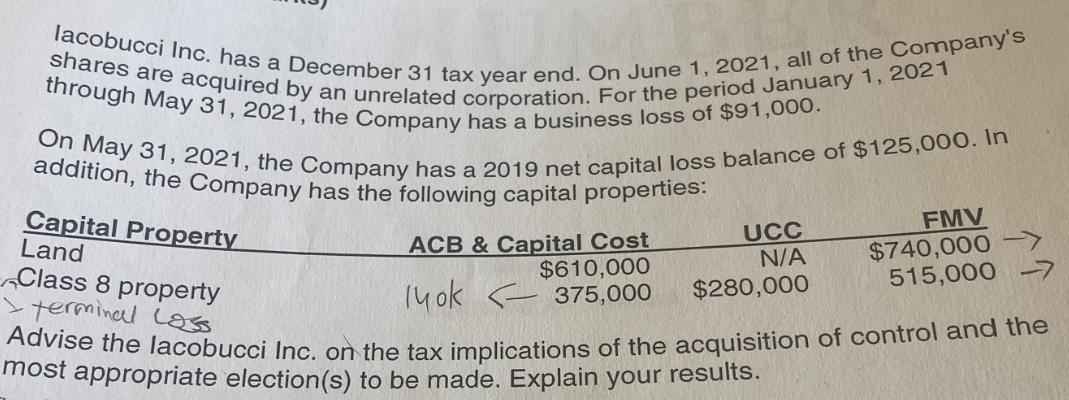

through May 31, 2021, the Company has a business loss of $91,000. shares are acquired by an unrelated corporation. For the period January 1, 2021 lacobucci Inc. has a December 31 tax year end. On June 1, 2021, all of the Company's On May 31, 2021, the Company has a 2019 net capital loss balance of $125,000. In addition, the Company has the following capital properties: Capital Property Land Class 8 property terminal Loss UCC ACB & Capital Cost $610,000 N/A $280,000 lyok 375,000 FMV $740,000 515,000 7 Advise the lacobucci Inc. on the tax implications of the acquisition of control and the most appropriate election(s) to be made. Explain your results.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Tax Implications of Shoobucci Incs Acquisition and Election Options Acquisition of Control Th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started