Ths is a three-part question

Ths is a three-part question

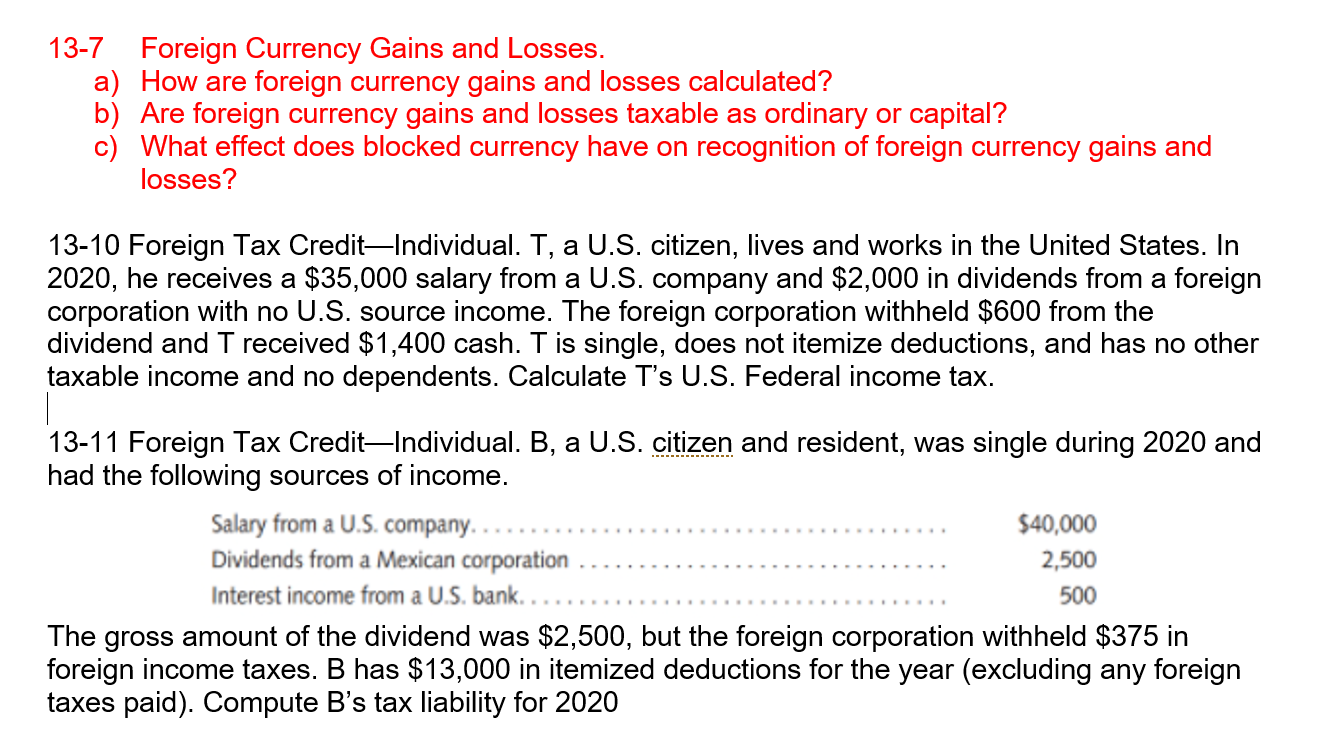

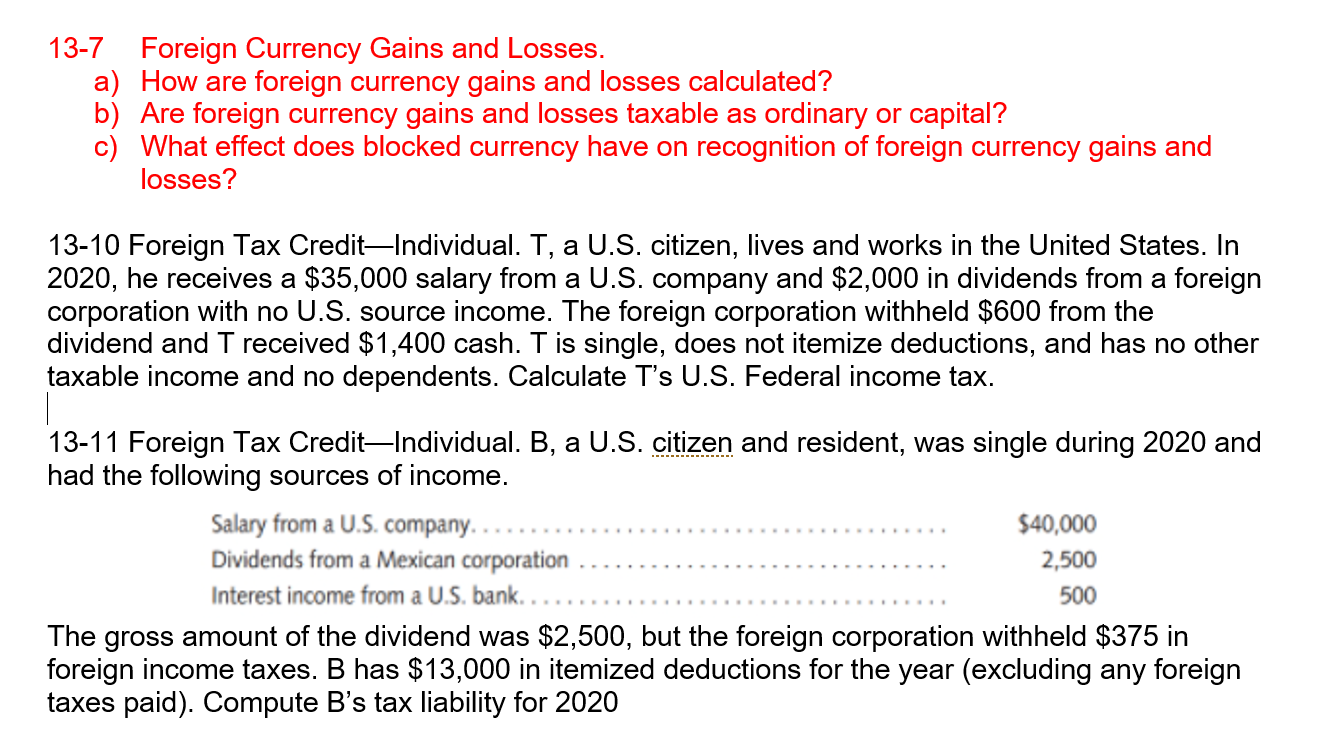

13-7 Foreign Currency Gains and Losses. a) How are foreign currency gains and losses calculated? b) Are foreign currency gains and losses taxable as ordinary or capital? c) What effect does blocked currency have on recognition of foreign currency gains and losses? 13-10 Foreign Tax Credit Individual. T, a U.S. citizen, lives and works in the United States. In 2020, he receives a $35,000 salary from a U.S. company and $2,000 in dividends from a foreign corporation with no U.S. source income. The foreign corporation withheld $600 from the dividend and I received $1,400 cash. T is single, does not itemize deductions, and has no other taxable income and no dependents. Calculate T's U.S. Federal income tax. 13-11 Foreign Tax CreditIndividual. B, a U.S. citizen and resident, was single during 2020 and had the following sources of income. Salary from a U.S. company. $40,000 Dividends from a Mexican corporation 2,500 Interest income from a U.S. bank. 500 The gross amount of the dividend was $2,500, but the foreign corporation withheld $375 in foreign income taxes. B has $13,000 in itemized deductions for the year (excluding any foreign taxes paid). Compute B's tax liability for 2020 13-7 Foreign Currency Gains and Losses. a) How are foreign currency gains and losses calculated? b) Are foreign currency gains and losses taxable as ordinary or capital? c) What effect does blocked currency have on recognition of foreign currency gains and losses? 13-10 Foreign Tax Credit Individual. T, a U.S. citizen, lives and works in the United States. In 2020, he receives a $35,000 salary from a U.S. company and $2,000 in dividends from a foreign corporation with no U.S. source income. The foreign corporation withheld $600 from the dividend and I received $1,400 cash. T is single, does not itemize deductions, and has no other taxable income and no dependents. Calculate T's U.S. Federal income tax. 13-11 Foreign Tax CreditIndividual. B, a U.S. citizen and resident, was single during 2020 and had the following sources of income. Salary from a U.S. company. $40,000 Dividends from a Mexican corporation 2,500 Interest income from a U.S. bank. 500 The gross amount of the dividend was $2,500, but the foreign corporation withheld $375 in foreign income taxes. B has $13,000 in itemized deductions for the year (excluding any foreign taxes paid). Compute B's tax liability for 2020

Ths is a three-part question

Ths is a three-part question