Answered step by step

Verified Expert Solution

Question

1 Approved Answer

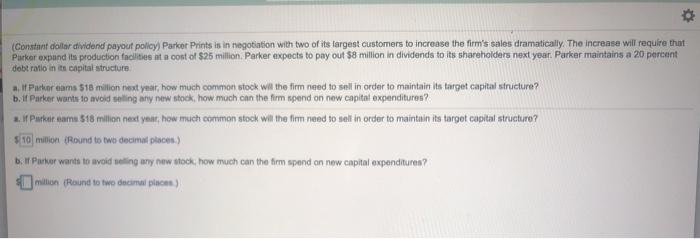

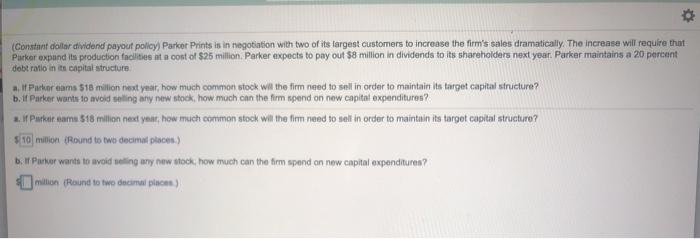

THUMBS UP FOR CORRECT ANSWERS! THANK YOU!!! (Constant dollar dividend payout policy) Parker Prints is in negotiation with two of its largest customers to increase

THUMBS UP FOR CORRECT ANSWERS! THANK YOU!!!

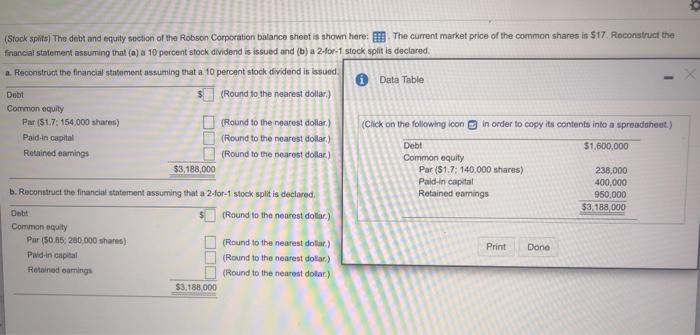

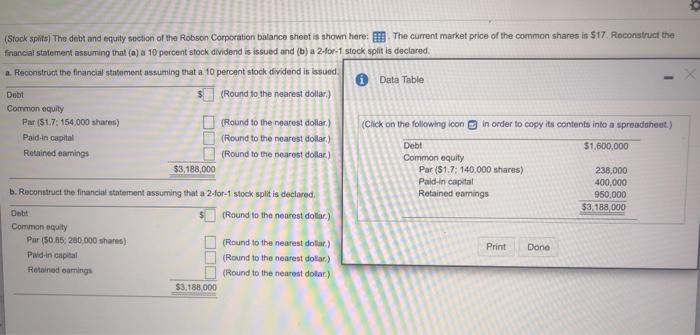

(Constant dollar dividend payout policy) Parker Prints is in negotiation with two of its largest customers to increase the firm's sales dramatically. The increase will require that Parker expand its production facilities at a cost of $25 million. Parker expects to pay out $8 million in dividends to its shareholders next year. Parker maintains a 20 percent debt ratio in its capital structure a. If Parker cams $16 milion next year, how much common stock win the firm need to sell in order to maintain its target capital structure? b.if Parker wants to avoid selling any new stock, how much can the firm spend on new capital expenditures? 2. Pirkdams 518 million next year, how much common stock win the firm need to sel in order to maintain its target capital structuro? 310 milion (Round to two decimal places) b. Parter wants to avoid seting any new stock, how much can the firm spend on new capital expendituren? $0 million (Round to two decimal places) (Stock splits) The debt and equity section of the Robson Corporation balance sheof is shown here: The current market price of the common shares is $17. Reconstruct the financial statement assuming that (a) a 10 percent stock dividend is issued and (b) a 2-for-1 stock split is declared 0 Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) $1,600,000 a. Reconstruct the financial statement assuming that a 10 percent stock dividend is issued Debt $(Round to the nearest dollar) Common equity Par ($1.7: 154,000 shares) (Round to the nearest dollar) Paid in capital (Round to the nearest dollar) Retained earings (Round to the nearest dollar) $3,188,000 b. Reconstruct the financial statement assuming that a 2-for-1 stock split is declared, Dett (Round to the nearest dollar) Common equity Par (50 25: 280,000 shares) (Round to the nearest dollar) Pud-in capital (Round to the nearest dollar) Retained earings (Round to the nearest dolar) $3,188,000 Debt Common equity Par($1.7: 140,000 shares) Paid.in capital Retained earnings 238,000 400,000 950.000 $3,188,000 Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started