Answered step by step

Verified Expert Solution

Question

1 Approved Answer

THUMBS UP FOR CORRECT ANSWERS! THANK YOU!!! (Forecasting net income) in November of each year, the CFO of Barker Electronics begins the financial forecasting process

THUMBS UP FOR CORRECT ANSWERS! THANK YOU!!!

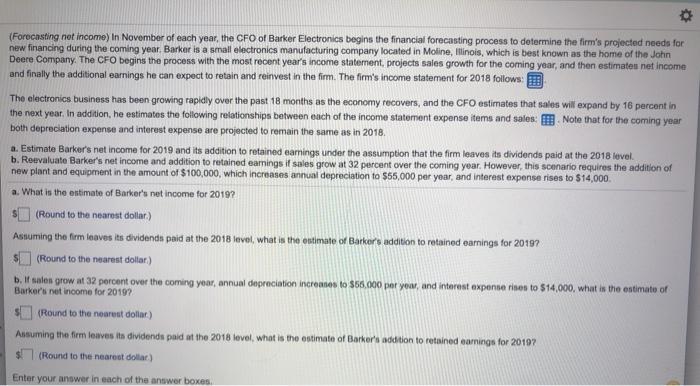

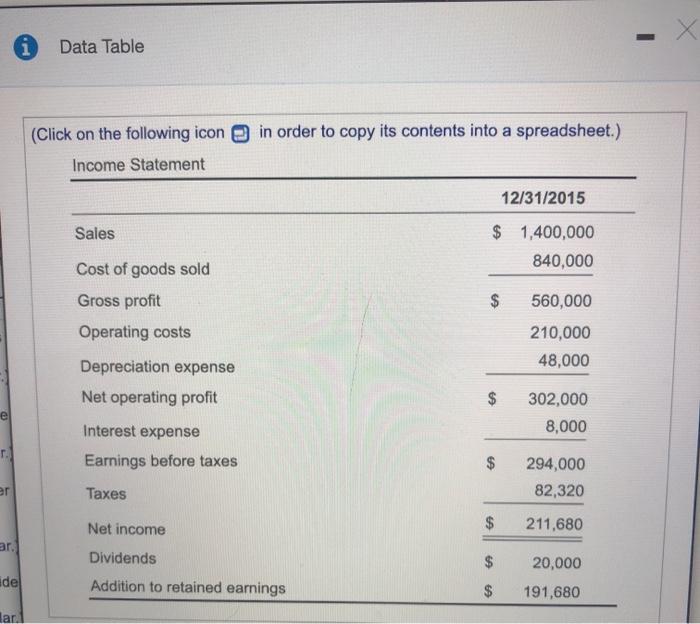

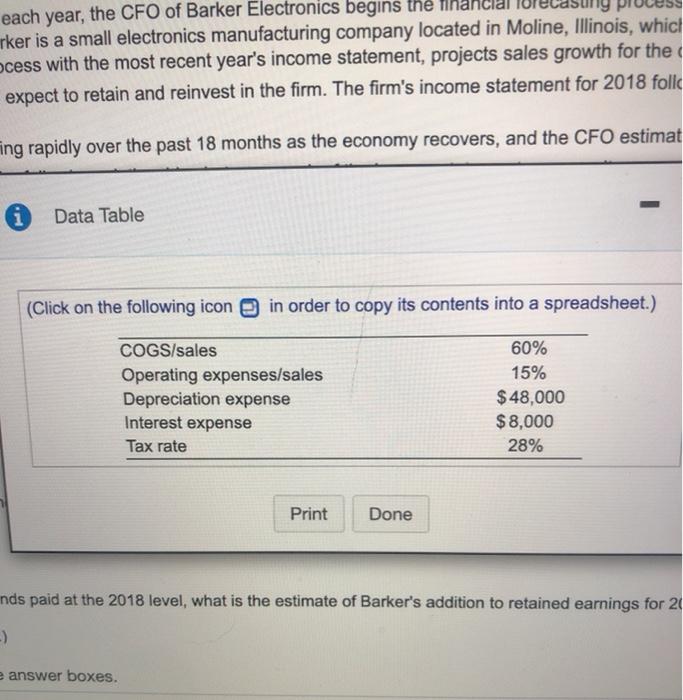

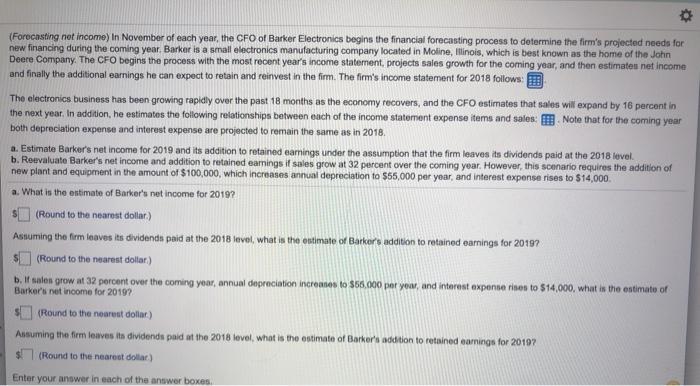

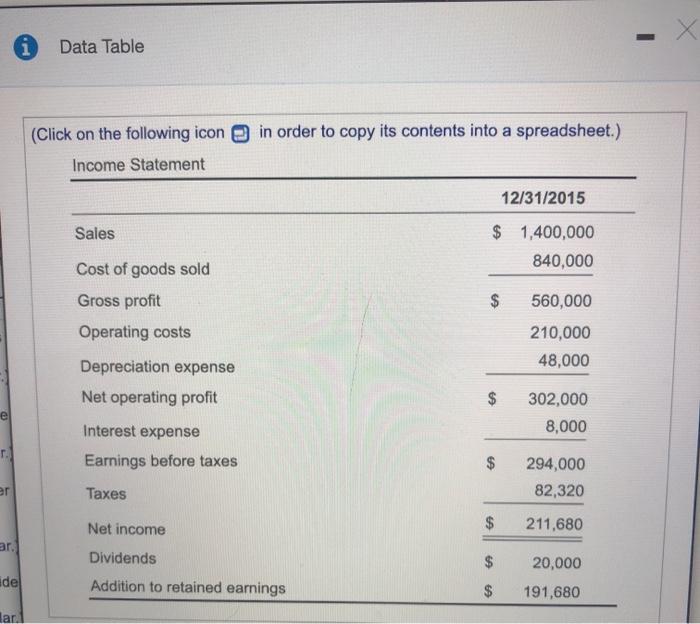

(Forecasting net income) in November of each year, the CFO of Barker Electronics begins the financial forecasting process to determine the firm's projected needs for new financing during the coming year. Barker is a small electronics manufacturing company located in Moline, Illinois, which is best known as the home of the John Deere Company. The CFO begins the process with the most recent year's income statement, projects sales growth for the coming year, and then estimates net income and finally the additional earnings he can expect to retain and reinvest in the firm. The firm's income statement for 2018 follows: The electronics business has been growing rapidly over the past 18 months as the economy recovers, and the CFO estimates that sales will expand by 16 percent in the next year. In addition, he estimates the following relationships between each of the income statement expense items and sales: Note that for the coming year both depreciation expense and interest expense are projected to remain the same as in 2018 a. Estimate Barker's net income for 2019 and its addition to retained earnings under the assumption that the firm leaves its dividends paid at the 2018 level b. Roevaluate Barker's net income and addition to retained earnings it sales grow at 32 percent over the coming year. However, this scenario requires the addition of new plant and equipment in the amount of $100,000, which increases annual depreciation to $55,000 per year, and interest expense rises to $14,000 a. What is the estimate of Barker'u net income for 2019? (Round to the nearest dollar) Assuming the firm leaves its dividends paid at the 2018 level, what is the estimate of Barker's addition to retained earnings for 20197 (Round to the nearest dollar) b. Il santon grow at 32 percent over the coming year, annual depreciation increases to $68,000 per year, and interest expense rises to $14,000, what is the estimate of Barker's net income for 2019? (Round to the nearest dollar) Assuming the firm leaves its dividends paid at the 2018 level, what is the estimate of Barker's addition to retained earnings for 2019? (Round to the nearest dollar) Enter your answer in each of the answer boxes 1 Data Table in order to copy its contents into a spreadsheet.) (Click on the following icon Income Statement 12/31/2015 Sales $ 1,400,000 840,000 Cost of goods sold Gross profit Operating costs $ 560,000 210,000 48,000 Depreciation expense Net operating profit e 302,000 8,000 Interest expense r. Earnings before taxes 294,000 82,320 er Taxes Net income 211.680 ar. Dividends $ $ $ de Addition to retained earnings 20,000 191,680 $ lar. each year, the CFO of Barker Electronics begins the rker is a small electronics manufacturing company located in Moline, Illinois, which ocess with the most recent year's income statement, projects sales growth for the expect to retain and reinvest in the firm. The firm's income statement for 2018 folie ing rapidly over the past 18 months as the economy recovers, and the CFO estimat Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) COGS/sales Operating expenses/sales Depreciation expense Interest expense Tax rate 60% 15% $ 48,000 $8,000 28% Print Done inds paid at the 2018 level, what is the estimate of Barker's addition to retained earnings for 2 e answer boxes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started