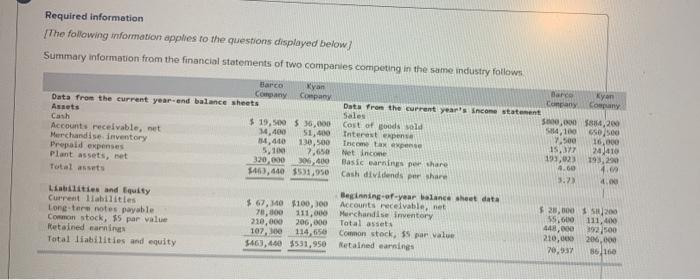

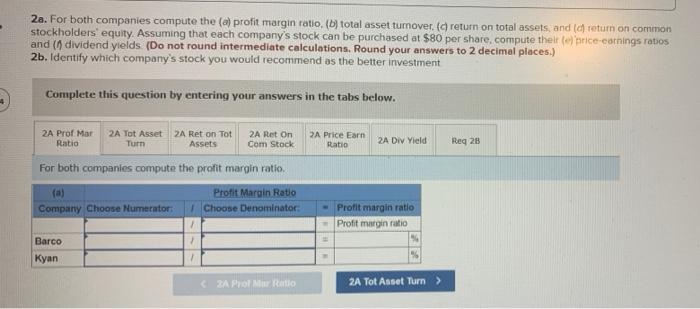

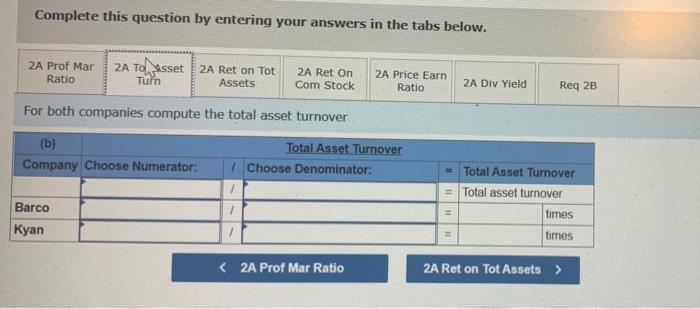

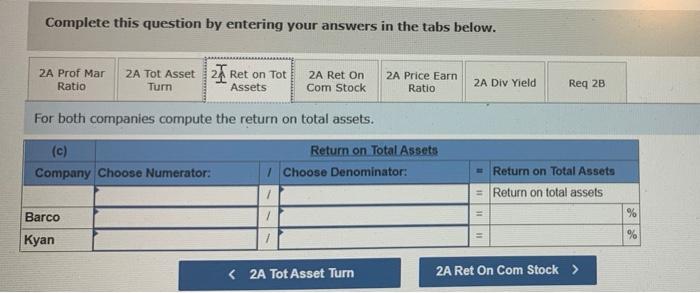

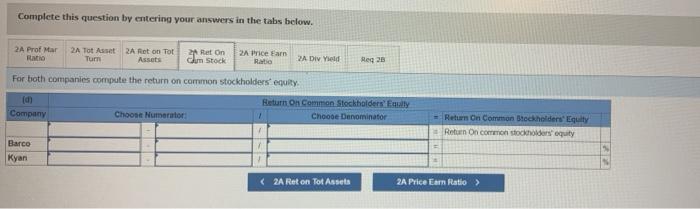

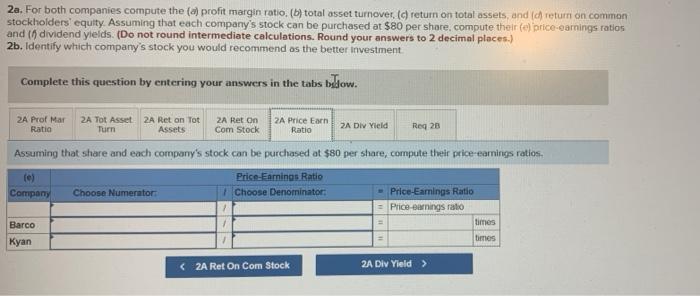

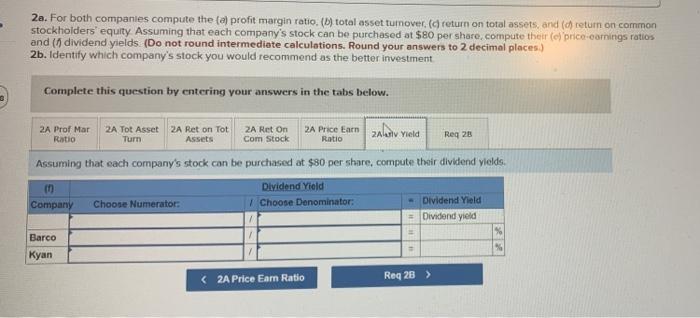

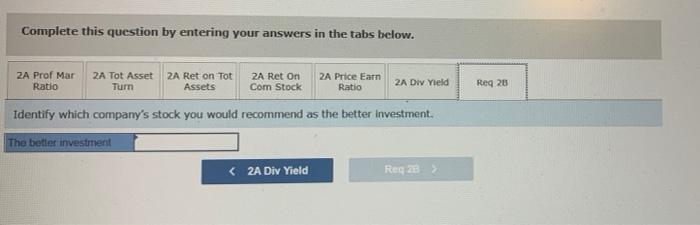

Required information The following information applies to the questions displayed below) Summary information from the financial statements of two companies competing in the same industry follows Company Barco Nyan Barce Company Com Company Data from the current year, and balance sheets Data from the current year's income statement Assets Sales S600,000 $814,200 Cash $ 19,500 5 35,000 Cost of goods sold 54,100 6,50 Accounts receivable, net 14.400 51,400 Interest expense 7.500 16,000 Merchandise. Inventory 34,410 130,500 Income tax pense 15,377 24410 Prepaid expenses 5,10 7.650 Het income 199,023 193,20 plant assets, net 320.000 6,400 Basse warning po share 4.60 4.60 Total assets 5463,440 3531,950 Cash dividends per share 3.2) . Liabilities and Equity Current abilities Lone tere notes payable Common stock, $5 par value Retained earning Total liabilities and equity Beginning-of-year balance sheet data $ 67,0 $100,100 Accounts receivable, net 70,000 111,000 Merchandise inventory 210,000 206,000 Total assets 1070 114,650 Common stock, 35 par value 5463,450 $631,950 Retained earnings $ 20,000 200 55,600 111,400 448,000 392500 210,000 206,000 70,93 36100 2a. For both companies compute the (a) profit margin ratio. (b) total asset turnover (a return on total assets, and (ch return on common stockholders equity. Assuming that each company's stock can be purchased at $80 per share, compute thelle rice-carnings ratios and ( dividend yields (Do not round intermediate calculations. Round your answers to 2 decimal places.) 2b. Identify which company's stock you would recommend as the better investment Complete this question by entering your answers in the tabs below. 2A Price Earn Ratio 2A Div Yield Req 28 2A Prof Mar 2A Tot Asset 2 Ret on Tot 2A Ret On Ratio Turn Assets Com Stock For both companies compute the profit margin ratio. (a) Profit Margin Ratio Company Choose Numerator Choose Denominator Profit margin ratio Profit margin ratio Barco Kyan ZA POMERO 2A Tot Asset Turn > Complete this question by entering your answers in the tabs below. ZA Prof Mar Ratio ZA To asset 2A Ret on Tot Turn Assets 2A Ret On Com Stock 2A Price Earn Ratio 2A Div Yield Req 2B For both companies compute the total asset turnover (b) Company Choose Numerator: Total Asset Turnover Choose Denominator: - Total Asset Turnover = Total asset turnover / Barco / 11 times Kyan / times Complete this question by entering your answers in the tabs below. 2A Price Earn Ratio 2A Div Yield 2A Prof Mar ZA Tot Asset Ret on Tot 2A Ret On Ratio Turn Assets Com Stock For both companies compute the return on total assets. Req 28 (c) Company Choose Numerator: Return on Total Assets Choose Denominator: Return on Total Assets = Return on total assets 1 Barco % 1111 Kyan 7 Complete this question by entering your answers in the tabs below. 2A Prof Mar 24 Tot Asset 2A Reton Tot Ret On 2 Price Earn Ratio Turn Assets chum Stock Ratio 2A Div Yield Reg 28 For both companies compute the return on common stockholders equity (oh Return On Common Stockholders' Fully Company Choon Numarator Choose Denominator - Return On Common Beckholders' Equity Return On common stockholders equity Barco Kyan (2A Reton Tot Assets 2A Price Earn Ratio > 2a. For both companies compute the (a) profit margin ratio. (b) total asset turnover (c) return on total assets, and (ch return on common stockholders' equity Assuming that each company's stock can be purchased at $80 per share, compute their price-earnings ratios and ( dividend yields. (Do not round intermediate calculations. Round your answers to 2 decimal places.) 2b. Identify which company's stock you would recommend as the better investment Complete this question by entering your answers in the tabs budow. 2A Prof Mar Ratio 2A Tot Asset 2A Ret on Tot Turn Assets 2A Ret On Com Stock 2A Price Earn Ratio 2A Div Yield Reg 28 Assuming that share and each company's stock can be purchased at $80 per share, compute their price-earnings ratios. le) Price Earnings Ratio Company Choose Numerator: Choose Denominator - Price-Earnings Ratio = Price earnings rato 1 times Kyan times Barco 2a. For both companies compute the profit margin ratio. (b) total asset tumover. (return on total assets, and (d) return on common stockholders' equity Assuming that each company's stock can be purchased at $80 per share.compute their le price earnings ratios and (1) dividend yields (Do not round intermediate calculations. Round your answers to 2 decimal places.) 2b. Identify which company's stock you would recommend as the better investment Complete this question by entering your answers in the tabs below. Reg 2 2A Prof Mar 2A Tot Asset 2A Reton Tot 2A Ret On 2A Price Earn Aktiv Yield ZA Ratio Turn Assets Com Stock Ratio Assuming that each company's stock can be purchased at $30 per share, compute their dividend yields. Dividend Yield Company - Dividend Yield Choose Numerator: Choose Denominator: = Dividend yield Barco Kyan 2A Price Earn Ratio Reg 28 > Complete this question by entering your answers in the tabs below. ZA Prof Mar Ratio 2A Tot Asset 2A Ret on Tot Turn Assets 2A Ret On Com Stock 2A Price Earn Ratio 2A Div Yield Reg 28 Identify which company's stock you would recommend as the better investment. The better investment Complete this question by entering your answers in the tabs below. ZA Prof Mar Ratio ZA To asset 2A Ret on Tot Turn Assets 2A Ret On Com Stock 2A Price Earn Ratio 2A Div Yield Req 2B For both companies compute the total asset turnover (b) Company Choose Numerator: Total Asset Turnover Choose Denominator: - Total Asset Turnover = Total asset turnover / Barco / 11 times Kyan / times Complete this question by entering your answers in the tabs below. 2A Price Earn Ratio 2A Div Yield 2A Prof Mar ZA Tot Asset Ret on Tot 2A Ret On Ratio Turn Assets Com Stock For both companies compute the return on total assets. Req 28 (c) Company Choose Numerator: Return on Total Assets Choose Denominator: Return on Total Assets = Return on total assets 1 Barco % 1111 Kyan 7 Complete this question by entering your answers in the tabs below. 2A Prof Mar 24 Tot Asset 2A Reton Tot Ret On 2 Price Earn Ratio Turn Assets chum Stock Ratio 2A Div Yield Reg 28 For both companies compute the return on common stockholders equity (oh Return On Common Stockholders' Fully Company Choon Numarator Choose Denominator - Return On Common Beckholders' Equity Return On common stockholders equity Barco Kyan (2A Reton Tot Assets 2A Price Earn Ratio > 2a. For both companies compute the (a) profit margin ratio. (b) total asset turnover (c) return on total assets, and (ch return on common stockholders' equity Assuming that each company's stock can be purchased at $80 per share, compute their price-earnings ratios and ( dividend yields. (Do not round intermediate calculations. Round your answers to 2 decimal places.) 2b. Identify which company's stock you would recommend as the better investment Complete this question by entering your answers in the tabs budow. 2A Prof Mar Ratio 2A Tot Asset 2A Ret on Tot Turn Assets 2A Ret On Com Stock 2A Price Earn Ratio 2A Div Yield Reg 28 Assuming that share and each company's stock can be purchased at $80 per share, compute their price-earnings ratios. le) Price Earnings Ratio Company Choose Numerator: Choose Denominator - Price-Earnings Ratio = Price earnings rato 1 times Kyan times Barco 2a. For both companies compute the profit margin ratio. (b) total asset tumover. (return on total assets, and (d) return on common stockholders' equity Assuming that each company's stock can be purchased at $80 per share.compute their le price earnings ratios and (1) dividend yields (Do not round intermediate calculations. Round your answers to 2 decimal places.) 2b. Identify which company's stock you would recommend as the better investment Complete this question by entering your answers in the tabs below. Reg 2 2A Prof Mar 2A Tot Asset 2A Reton Tot 2A Ret On 2A Price Earn Aktiv Yield ZA Ratio Turn Assets Com Stock Ratio Assuming that each company's stock can be purchased at $30 per share, compute their dividend yields. Dividend Yield Company - Dividend Yield Choose Numerator: Choose Denominator: = Dividend yield Barco Kyan 2A Price Earn Ratio Reg 28 > Complete this question by entering your answers in the tabs below. ZA Prof Mar Ratio 2A Tot Asset 2A Ret on Tot Turn Assets 2A Ret On Com Stock 2A Price Earn Ratio 2A Div Yield Reg 28 Identify which company's stock you would recommend as the better investment. The better investment