thumbs up guarenteed

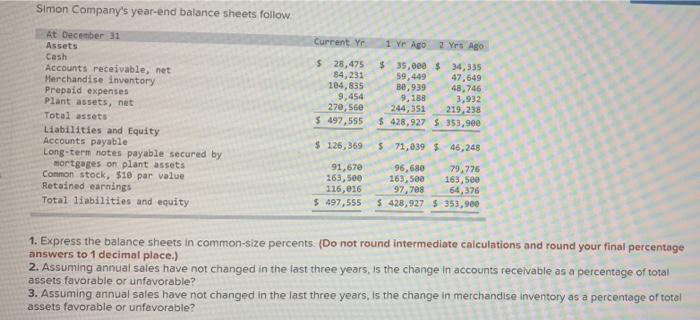

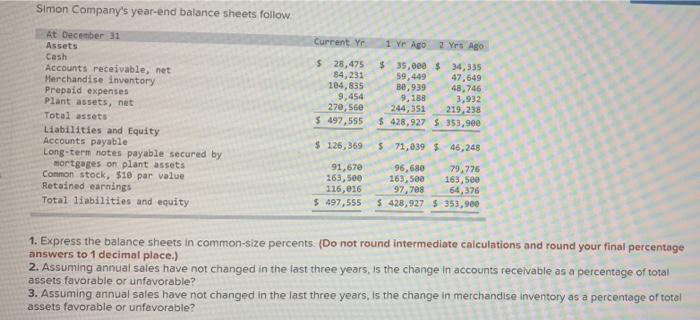

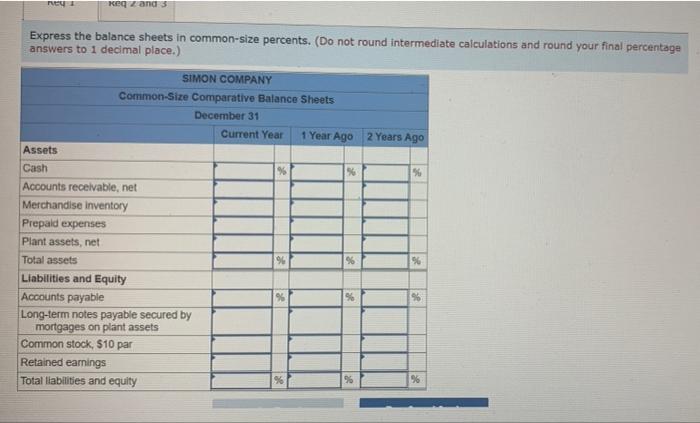

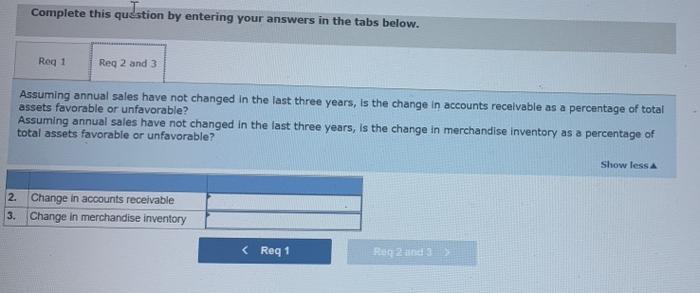

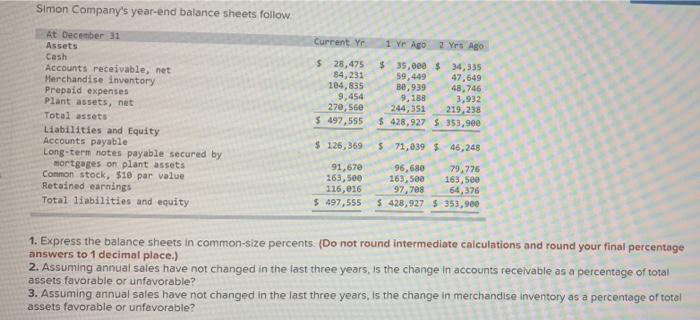

Simon Company's year-end balance sheets follow Current Yr 1 yr Ago 2 yrs Ago At December 31 Assets Cash Accounts receivable, net Merchandise Inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Conmon stock, $10 par value Retained earnings Total liabilities and equity $ 28,475 84,231 104,835 9,454 270,56e $ 497,555 $ 35,000$ 34,335 59,449 47,649 30,939 48,746 9,188 3,932 244,351 219,238 $ 428,927 S 353,900 $ 126,369 $ 71,039 $ 46,248 91,670 263,500 116,016 $ 497,555 96,68 79,776 163,500 163,5ee 97,708 64,376 $ 428,927 $ 353,900 1. Express the balance sheets in common-size percents. (Do not round intermediate calculations and round your final percentage answers to 1 decimal place.) 2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable? 3. Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total assets favorable or unfavorable? Reg zand 3 Express the balance sheets in common-size percents. (Do not round intermediate calculations and round your final percentage answers to 1 decimal place.) SIMON COMPANY Common-Size Comparative Balance Sheets December 31 Current Year 1 Year Ago 2 Years Ago Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets 94 % % Liabilities and Equity Accounts payable % % 96 Long-term notes payable secured by mortgages on plant assets Common stock, $10 par Retained earnings Total liabilities and equity % % % Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 and 3 Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable? Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total assets favorable or unfavorable? Show less 2. Change in accounts receivable 3. Change in merchandise inventory