Thumbs up if solved :)

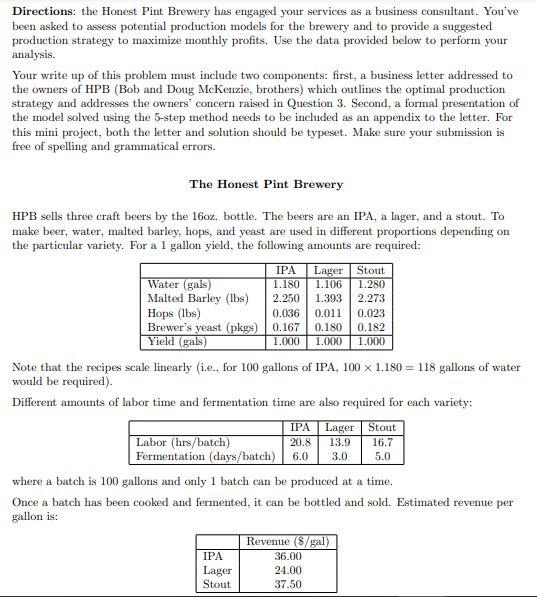

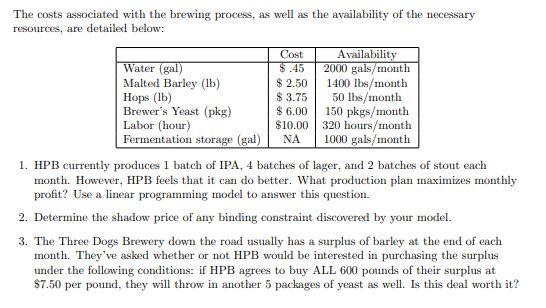

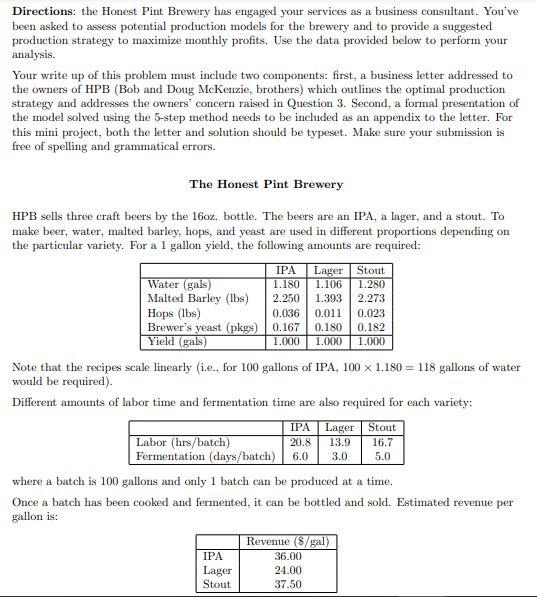

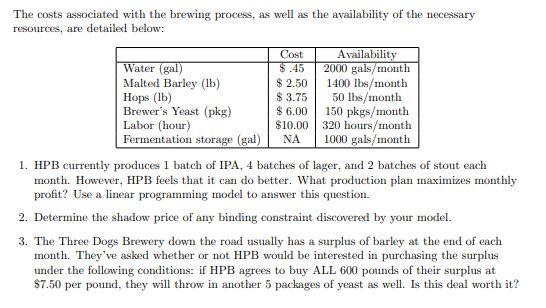

Directions: the Honest Pint Brewery has engaged your services as a business consultant. You've been asked to assess potential production models for the brewery and to provide a suggested production strategy to maximize monthly profits. Use the data provided below to perform your analysis. Your write up of this problem must include two components: first, a business letter addressed to the owners of HPB (Bob and Doug McKenzie, brothers) which outlines the optimal production strategy and addresses the owners' concern raised in Question 3. Second, a formal presentation of the model solved using the 5-step inethod needs to be included as an appendix to the letter. For this mini project, both the letter and solution should be typeset. Make sure your submission is free of spelling and grammatical errors. 1.280 0.011 0.182 1.000 The Honest Pint Brewery HPB sells three craft beers by the 1607. bottle. The beers are an IPA, a lager, and a stout. To peer, water, malted barley, hops, yeast are used in different proportions depending on the particular variety. For a l gallon yield, the following amounts are required: IPA Lager Stout Water (gals) 1.180 1.106 Malted Barley (lbs) 2.250 1.393 2.273 Hops (lbs) 0.036 0.023 Brewer's yeast (pkgs) 0.167 0.180 Yield (gal) 1.000 1.000 Note that the recipes scale linearly (i.e., for 100 gallons of IPA, 100 X 1.180 = 118 gallons of water would be required). Different amounts of labor time and fermentation time are also required for each variety: IPA Lager Stout Labor (hrs/batch) Fermentation (days/batch) 5.0 where a batch is 100 gallons and only 1 batch can be produced at a time. Once a batch has been cooked and fermented, it can be bottled and sold. Estimated revenue per gallon is: Revenue (/gal) IPA 36.00 Lager 24.00 Stout 37.50 16.7 20.8 6.0 13.9 3.0 Cost The costs associated with the brewing process, as well as the availability of the necessary resources, are detailed below: Availability Water (gal) $.45 2000 gals/month Malted Barley (lb) $ 2.50 1400 lbs/month Hops (lb) $ 3.75 50 lbs/month Brewer's Yeast (pkg) $ 6.00 150 pkgs/month Labor (hour) $10.00 320 hours/month Fermentation storage (gal) NA 1000 gals/month 1. HPB currently produces 1 batch of IPA, 4 batches of lager, and 2 batches of stout each month. However, HPB feels that it can do better. What production plan maximizes monthly profit? Use a linear programming model to answer this question. 2. Determine the shadow price of any binding constraint discovered by your model. 3. The Three Dogs Brewery down the road usually has a surplus of barley at the end of each month. They've asked whether or not HPB would be interested in purchasing the surplus under the following conditions: if HPB agrees to buy ALL 600 pounds of their surplus at $7.50 per pound, they will throw in another 5 packages of yeast as well. Is this deal worth it? Directions: the Honest Pint Brewery has engaged your services as a business consultant. You've been asked to assess potential production models for the brewery and to provide a suggested production strategy to maximize monthly profits. Use the data provided below to perform your analysis. Your write up of this problem must include two components: first, a business letter addressed to the owners of HPB (Bob and Doug McKenzie, brothers) which outlines the optimal production strategy and addresses the owners' concern raised in Question 3. Second, a formal presentation of the model solved using the 5-step inethod needs to be included as an appendix to the letter. For this mini project, both the letter and solution should be typeset. Make sure your submission is free of spelling and grammatical errors. 1.280 0.011 0.182 1.000 The Honest Pint Brewery HPB sells three craft beers by the 1607. bottle. The beers are an IPA, a lager, and a stout. To peer, water, malted barley, hops, yeast are used in different proportions depending on the particular variety. For a l gallon yield, the following amounts are required: IPA Lager Stout Water (gals) 1.180 1.106 Malted Barley (lbs) 2.250 1.393 2.273 Hops (lbs) 0.036 0.023 Brewer's yeast (pkgs) 0.167 0.180 Yield (gal) 1.000 1.000 Note that the recipes scale linearly (i.e., for 100 gallons of IPA, 100 X 1.180 = 118 gallons of water would be required). Different amounts of labor time and fermentation time are also required for each variety: IPA Lager Stout Labor (hrs/batch) Fermentation (days/batch) 5.0 where a batch is 100 gallons and only 1 batch can be produced at a time. Once a batch has been cooked and fermented, it can be bottled and sold. Estimated revenue per gallon is: Revenue (/gal) IPA 36.00 Lager 24.00 Stout 37.50 16.7 20.8 6.0 13.9 3.0 Cost The costs associated with the brewing process, as well as the availability of the necessary resources, are detailed below: Availability Water (gal) $.45 2000 gals/month Malted Barley (lb) $ 2.50 1400 lbs/month Hops (lb) $ 3.75 50 lbs/month Brewer's Yeast (pkg) $ 6.00 150 pkgs/month Labor (hour) $10.00 320 hours/month Fermentation storage (gal) NA 1000 gals/month 1. HPB currently produces 1 batch of IPA, 4 batches of lager, and 2 batches of stout each month. However, HPB feels that it can do better. What production plan maximizes monthly profit? Use a linear programming model to answer this question. 2. Determine the shadow price of any binding constraint discovered by your model. 3. The Three Dogs Brewery down the road usually has a surplus of barley at the end of each month. They've asked whether or not HPB would be interested in purchasing the surplus under the following conditions: if HPB agrees to buy ALL 600 pounds of their surplus at $7.50 per pound, they will throw in another 5 packages of yeast as well. Is this deal worth it